In depth TradeMax review you should read before opening an account

TradeMax is a Forex and CFDs brokerage that is established in Australia. The broker offers trading currency pairs and CFDs on various trading assets. As long as the broker is regulated by the Australian Securities and Investment Commission (ASIC) many think that the TradeMax scam is impossible. However, there are some suggestions that the broker is leading some kind of scam scheme. The minimum deposit required for opening an account with the broker is as high as 1000 USD or AUD. Traders are allowed to use 1:400 leverage. TradeMAx offers one of the most popular trading platforms MT4, various payment methods and several types of accounts that will be discussed in details below. It is not easy to be a scam broker when you are under the authorization of ASIC, however, the number of complaints towards the brokerage is suspiciously high. Hence we decided to examine the broker closely and answer the question is TradeMax legit or a scam?!

Regulatory background

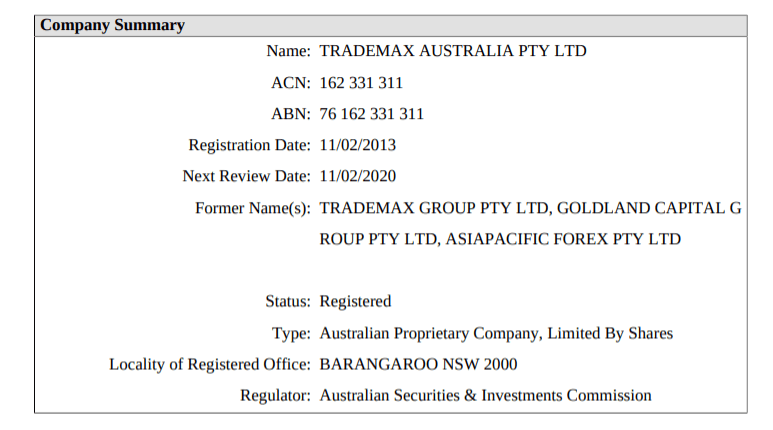

According to the website the brokerage was established in Australia in 2013 and has years of experience on the Foreign Exchange market. The broker suggests it is regulated by ASIC, which is one of the most reputable financial authorities in the world. The name of the company operating TradeMax FX brokerage is TradeMax Group Pty Ltd with the ASIC license number No.436416. the legitimacy of the license can be checked on the official website of ASIC, which states that the broker actually has a legit license.

After seeing a legit license from the ASIC many would assume that the broker is legit and there is no possibility of TradeMax fraud. ASIC requires licensed financial service providers to meet strict requirements of capital (1 million USD) to receive a license. In addition, it requires the company to implement certain internal procedures such as staff training, risk management, segregated funds, accounting, and audits. This gives high legitimacy to the ASIC regulated brokerages. However, I would advise continuing reading this review before opening an account with the broker as there are certain signs pointing out that everything is not quite right with TradeMax.

As the company summery from the ASIC website shows, the broker’s former names include TradeMax Group PTY LTD, AsiaPacific Forex PTY Ltd, and Goldland Capital Group PTY Ltd, which was operating the brands mentioned. The brands that were run by the same company other than TradeMax.com.au are FXUF.com; SuperTraderFX.com.au. There is also TradeMax capital that is the same company as TradeMax. The Facebook page of TradeMax capital suggests the website of TradeMax.

There are no TradeMax reviews made by the customers, however, there are a lot of reviews made and opinions stated about TradeMax capital that states that the broker is a scam. The majority of the traders pointed out that the broker was involved in Chinese scam scheme, where they were contacted by the Chinese girls that were convincing and pushing them to start trading with TradeMax capital and asked for the proof – MT4 account ID. As they were getting commissions for adding new trader.

One more thing to consider with TradeMax – the broker states that the information is not intended to traders other than the residents of Australia, however, it also says that the broker is providing service to the residents of every country except the United States. TradeMax has accounts on Facebook and WeChat – Chinese social platform that emphesizes the links between the Chinese scam and TradeMax. Moreover, while the only available language on the website is English, there are some remarks in Chinese as well, such as online chat information.

What does the broker offer

As you can see the regulatory background does not create a very good TradeMax opinion, now let us review the features and the service of the broker. TradeMax offers to trade with three assets. It has more than 100 global currencies available for trading, CFDs on commodities such as metals, energy and agriculture, CFDs on Indices such as China A50, and other global indices. The broker offers MT4 trading platform that is compatible with windows and mobile.

Account types

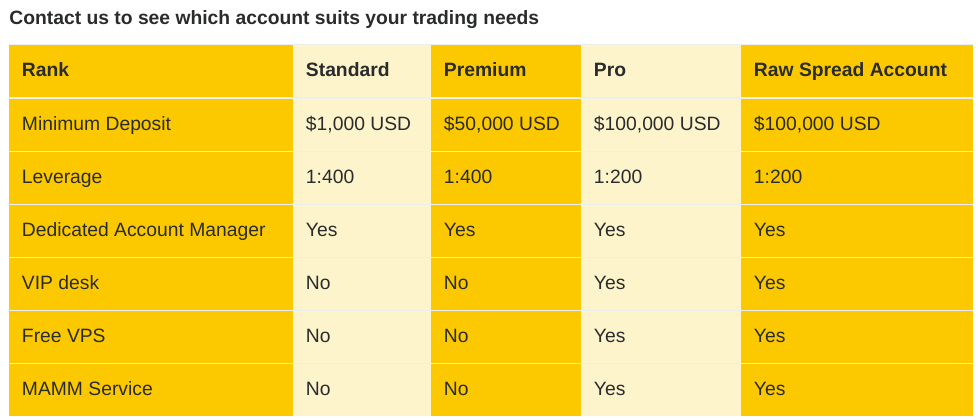

TradeMax offers four types of account – Standard, Premium, Pro, and Raw spread Account. The difference between standard and premium account is nothing more but a minimum deposit. The minimum deposit for the Standard account is 1000 USD, it has the leverage of 1:400, and comes with a dedicated account manager. The premium account has exactly the same features, but the deposit is 50,000 USD. It is not indicated what is the additional value that comes with an additional 49,000 USD. It can be the case that the broker simply wants to lure the customers into investing more with the fancy name.

The pro account and raw spread account are the same as well. The minimum deposit is the same for both – 100,000 USD, they both have the same leverage up to 1:200, have dedicated account manager, VIP desk, Free VPS, and MAMM service. Again, there is no indication of what is the difference between accounts which effects TradeMax rating negatively.

TradeMax withdrawal and other fees

The information about the withdrawal is not available on the website. Normally the brokers have a separate page dedicated to deposit and withdrawal. Information on how to withdraw your funds is available only in the legal documents. But unfortunately, the information about TradeMax withdrawal is very limited there. It mentioned that for the residents of Australia withdrawal is a fee, for the traders outside the country it costs 25 AUD.

Commissions are not indicated on the website as well, the only thing we were able to find about this matter was in the FAQ section. According to the broker, it is not charging any service fee but the spreads are different for the different account types as the broker is making money via spreads. For the raw account, spreads are from 0 hence there is a commission fee of 7 USD or 9AUD per lot traded.

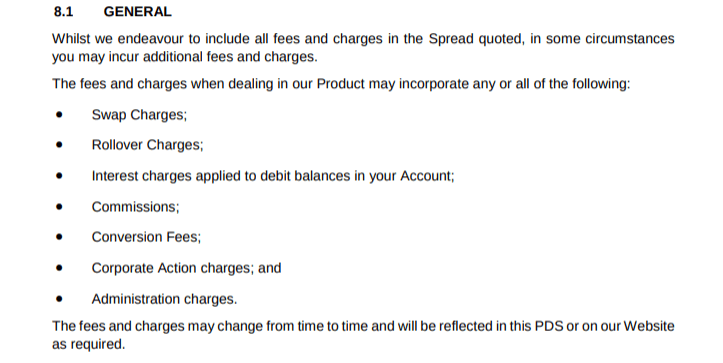

In the formal documents of the broker, which can be seen on the website TradeMax Forex broker suggests that there can be other charges as well, such as swap charges, rollover charges, interest charges, commissions, conversion fees, corporate action charges, and administration charges. However, it is not mentioned how much are these charges and why can some of them occur. This way, you might find out that some of your money has been taken from your account for any reason unknown to you.

Can TradeMax be trusted?

Let’s sum up TradeMax review – the broker seems to be regulated for one reason only – it has a license from ASIC. However, one living outside Australia needs to consider that the broker is only limited to its actions in Australia and it is not regulated outside of it. Meaning that if you are living in Europe you are not protected by the ASIC license at all, moreover, ASIC does not have investors compensation funds. The company that operates the broker has been operating several other brands that are accused of being a scam. It indicates that TradeMax scam is possible too. The website does not provide enough information about the brokerage or its services which is also suspicious as good brokers strive to provide full information in the most convenient way. With the information in our hands, we can confidently say that the broker is a scam and it cannot be trusted at all.

Comments (0 comment(s))