UproFX review – are we dealing with a scam broker?

Contracts for Difference (CFDs) have long become one of the more popular trading assets on the market. People of various trading backgrounds enter the CFD markets quite easily and with simple orders get involved in this exchange.

One of the biggest advantages of CFD trading is that traders don’t need to own any asset in order to exchange them. Traders and their brokers make a contract about a certain price movement. If the price goes in the direction previously anticipated by the trader, the position will yield the profit, while the opposite direction will lead to the losses.

Unfortunately, this market also houses lots of fraudulent brokers. It’s quite easy for them to set up a brokerage and sell it as a credible entity. That’s why traders should be extremely careful when selecting a brokerage.

To make our contribution to that process, we have prepared the UproFX Forex broker review. In it, we’ll examine every little detail about the broker’s offerings and terms of conditions.

A quick round-up

UproFX is a CFD brokerage that is operating through Estonia. It is also important to mention that they are a child company of Yield Enterprise Currency Software. Having a parent company always adds a bit more trust to a Forex brokerage as we know that should the UproFX Forex broker be involved in something shady, their reputation will not be the only one at stake. Yet we cannot deem this detail as the savior of the broker’s reputation.

The company is quite remarkable in terms of its offerings in trading terms and conditions. Not being a subject of the ESMA regulatory system, the broker is able to offer much “beefier” numbers. With UproFX it is possible to utilize their high leverage of 1:100, miles above the restrictions to 1:30 on currency CFDs.

As for the minimum deposit requirement, the broker demands a 250 EUR deposit from its first customers. In Forex, this is a standard condition, however, the absence of one major detail makes it quite high for the beginner traders. We’ll find out what this missing detail is further down below.

So, does all of this information excuse the UproFX scam rumors? Not necessarily, we still deem the company untrustworthy due to the lack of a legitimate license.

UproFX review: first impressions

The first thing we noticed when entering the website was how complex its design was. There were various wallpapers and visual effects scattered across the interface which, in our opinion, isn’t very mature of a financial website. Sure, good-looking visuals are always compelling, but when it comes to the functionality of the website, it’s far more important for it to be easier to navigate and adapt. Yet, the complex design doesn’t allow that to happen.

As for the informative side of the website, we have to admit that the uprofx.com review left good impression on us. Thematic separation of the sections was spot-on with the most important information about the spreads, leverage, and withdrawals all laid bare in front of the visitor.

When we entered the website it immediately seemed quite welcoming. We always make a point of trying to find some sort of problems with the company’s website, but thanks to the immaculate state they managed to tick all of our boxes. This UproFX review could have gone a completely different route if the broker wasn’t transparent enough, however, all of the navigation involved in the website was up to date and fluid. The most important information about the spreads, leverage, and withdrawals were laid bare in front of us. Always a good sign.

However, even though the UproFX FX brokerage is transparent in disclosing its terms of information, the actual terms it offers are quite over-the-top and seem exaggerated when compared to their average counterparts. The majority of EU based brokers don’t have the ability to bypass ESMA regulations and still be in the green, and in this case, UproFX is no exception. We appreciate the honesty and transparency of the company, but that is no excuse for not having a regulation.

Leverage & Spreads

The leverage is quite a delicate topic these days as more and more Forex brokers in the EU keep reducing them, trying to either stretch the ESMA regulations or just completely be subdued by them. Nearly all of the best FX brokerages you will find in countries like the UK and Germany have already succumbed to the restricted leverage and trade benefits. The fact that UproFX broker is still able to offer leverage of 1:100 is what birthed all of the conspiracy theories of an UproFX scam.

And fairly enough, there are lots of dangers associated with such high leverage offerings. You see, leverage increases the position size controlled by a trader. This way, both profits and losses increase in size. That’s why it’s super important to have a reasonable multiplication offering on your website and why UproFX goes way over the line when offering a 1:100 leverage for its CFDs.

In terms of spreads, the company offers you a choice. On some accounts they have fixed spreads, some may come in as floating. This means that according to the market situation you can choose which account would be more profitable in the long run and always have a reassurance that the spread will remain the same no matter what. In this sense, we can say that the variable spreads partially balance out the negative impacts of the exaggerated leverage, yet the latter has a far larger effect than the former.

UproFX reviews of account types

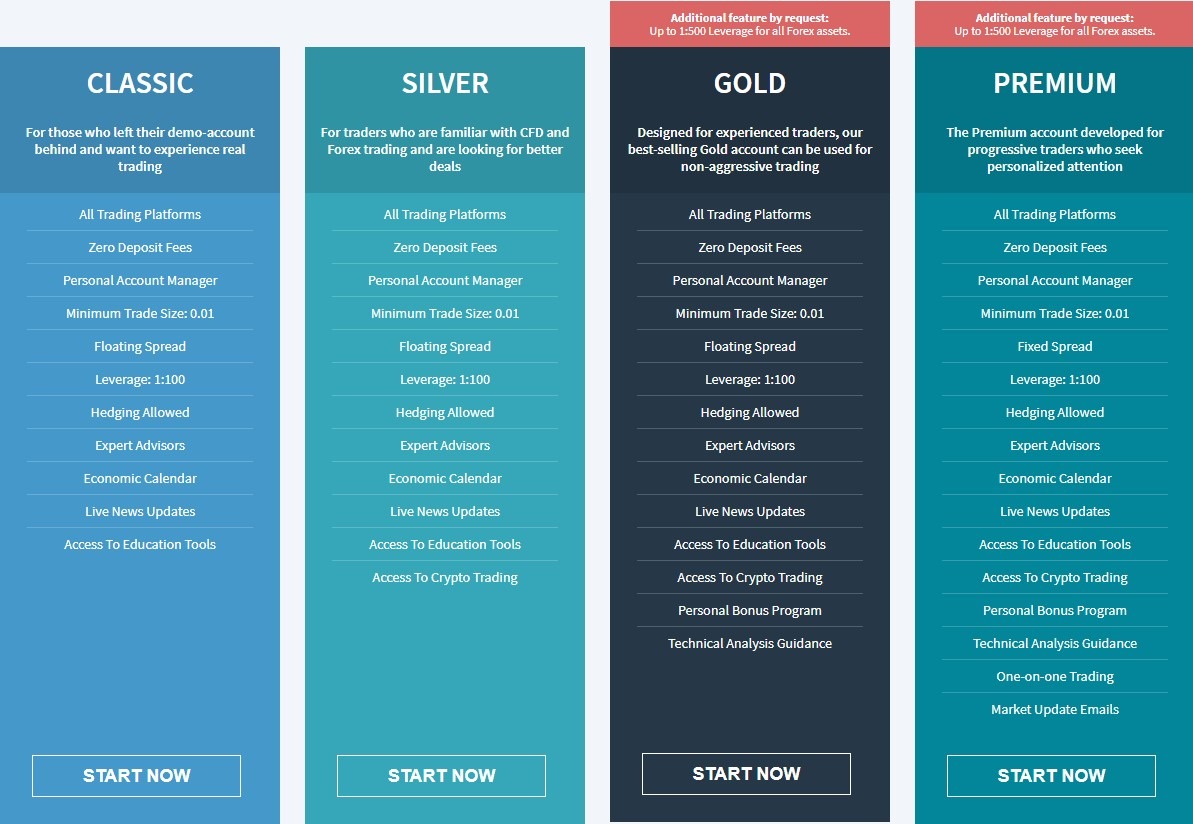

Although it is common to see about 3 types of accounts on a given website, in our process of the UproFX review, we found out that the company offers 4. Although it’s not recommended to burden your customers with too much choice, we believe that the amount is still acceptable.

With the two cheapest, Classic and Silver accounts you will be eligible for floating spreads and a leverage of 1:100. However, Gold and Premium accounts are able to offer additional perks. For example, you will have access to a personal bonus program and technical analysis guidance. On top of that, the Premium account holders also get access to one-on-one trading and market update emails.

While all of the above-mentioned differences are valuable in their own way, we still don’t think that they’re worth extra cash. If it were up to us, we’d go for the Classic account and use the most basic offerings for the least amount of minimum deposit requirement.

Withdrawals & Deposits

The withdrawals and deposits vary between payment methods. For example, the minimum deposit is EUR 250 for credit/debit cards isn’t necessarily the case for Wire transfer. For Wire transfer, the UproFX deposit and withdrawal policy sets the minimum deposit at EUR 500, which is a serious disadvantage for somebody forced to use Wire Transfer.

But no matter the deposits, withdrawals are the most important aspects of a Forex broker. So, can UproFX be trusted in this case? Can they provide a fluid withdrawal process? Well, check out for yourselves: whenever you want to withdraw funds from your account, you need to file an application for it. The time for your application to be processed and accepted can vary from several hours to days which, in itself, is a big disadvantage.

And we can see what the problem is here. The credit card/bank wire payment platforms are extremely slow and are associated with significant security breaches. It would’ve been so much better if the broker incorporated cryptocurrencies such as Bitcoin and Litecoin into its system. These digital coins would greatly increase transaction speeds and make payments much more secure.

Is UproFX legit?

A glance through what UproFX has to offer would immediately convince a beginner trader that they are trustworthy. However, once we look at it through an experienced eye, it leaves a very shady impression on us. For example, not having a regulation but posing enticing offers seems like a trap much like what we’ve seen with so many past experiences.

However, we are not necessarily calling this company fraudulent as there are some traders – not many, though – who say they’ve had a smooth experience. Therefore, we’d simply not recommend this broker in the first place rather than brand it a scam.

The 1:100 leverage is simply not worth the risk for any trader regardless of how much experience they have. This feature can greatly affect their financial stability and put them in a dire financial situation.

And perhaps the biggest bummer in this review is the fact that UproFX doesn’t have any license. This means that the question: “can UproFX be trusted?” cannot possibly be answered positively. Therefore, it’s best to completely avoid the broker and find someone else for your trading endeavors.

Comments (0 comment(s))