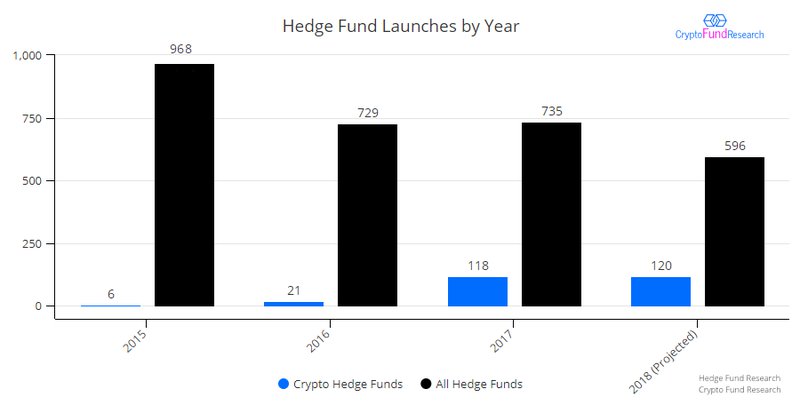

20% of Hedge Funds Launched in 2018 are Crypto-Focused

Nowadays, the financial market keeps growing and offering new opportunities to its customers to help them make money out of their investments.

It is estimated that the total number of hedge funds in 2018 will reach 600, out of which 120 will be cryptocurrency-focused. This fact shows that the awareness of cryptocurrency investors has grown a lot for the last two years and for the next years it will continue increasing in a rapid way.

According to Press Release shared with CryptoGlobe, the data given by Crypto Fund Research (CFR) shows that in the first three quarters of 2018, 90 cryptocurrency hedge funds have been launched and it will rise up to 120, which will comprise 20% of the estimated total number of hedge funds.

Crypto Hedge Funds Results in Previous Years

To compare with the previous years, in 2017 the percentage of crypto-focused funds was 16%, while it reached only 3% in 2016. Joshua Gnaizda, the founder of Crypto Fund Research, noted that the situation in the market did not discourage the launch of new funds, but they are not sure that the rate of a new launch will be sustainable for a long period. However, there are quite a few signs showing up-coming significant downwards.

It is obvious that despite the growth of crypto hedge funds, they still represent 3% (303) of over 9,000 currently operational hedge funds. While the global hedge fund industry manages over $3 trillion, crypto hedge funds are in the head of less than $4 billion assets. According to the research, half of all crypto funds launched this year are US-based, although countries like Australia, China, Malta, and the United Kingdom have seen a number of fund releasement.

Despite the less number of crypto-managed assets, investors are meant to continue putting their money on Bitcoin and Ethereum and probably, in the next few years 303 crypto hedge funds out of existing 9,000 will increase dramatically due to its transformative and attractive nature for the market dealers and traders.

What’s a hedge fund?

It is an investment pool, where the clients put their funds to make money despite the fluctuation of the market (it’s called ”hedging”). The hedge fund is operated by a professional manager, whose goal is to maximize returns and reduce risks as much as possible. It can be said that the manager acts like a trader because he/she invests in different securities and equities that match with the fund’s goals. One of the most important distinguishers of the hedge fund is its availability, which means that it is open only to qualified (”accredited”) investors.

Comments (0 comment(s))