AUD/USD outlook: the pair is clearly trading in a bearish zone

The AUD/USD pair holds a narrow range after the meeting of the Reserve Bank of Australia (RBA), but key events occurring in the Asia-Pacific region may affect the short-term forecast for the Australian Dollar, as the United States and China, Australia’s largest trading partner, is fighting for reaching a trade agreement.

AUD/USD extends the range of price action from the previous week, when the RBA interest rate decision changes little for the short-term forecast for the Australian Dollar, as the central bank stands aside on the eve of the May 18 Federal elections.

However, recent comments from the RBA suggest that the central bank will take additional steps to isolate the region, since ‘inflation data for the March quarter were noticeably lower than expected and suggest subdued inflationary pressures across much of the economy.’

In turn, Governor Philip Law and Co. can prepare Australian households and enterprises for a speedy reduction in rates, since ‘a further improvement in the labor market was likely to be needed for inflation to be consistent with the target,’ and the threat is lower — increasing the target price may push the RBA to resume its cycle easing, because ‘the ongoing subdued rate of inflation suggests that a lower rate of unemployment is achievable.’

Hence, updates in the employment report in Australia may affect the short-term forecast for AUD/USD, as the economy is expected to add 15.0K jobs in April, while the unemployment rate is expected to remain stable at 5.0% during the second month. Positive developments should support the Australian Dollar, as it weakens the rates for reducing the RBA rate, but a batch of lackluster data prints can drag on AUD/USD, as this boosts speculation at lower interest rates.

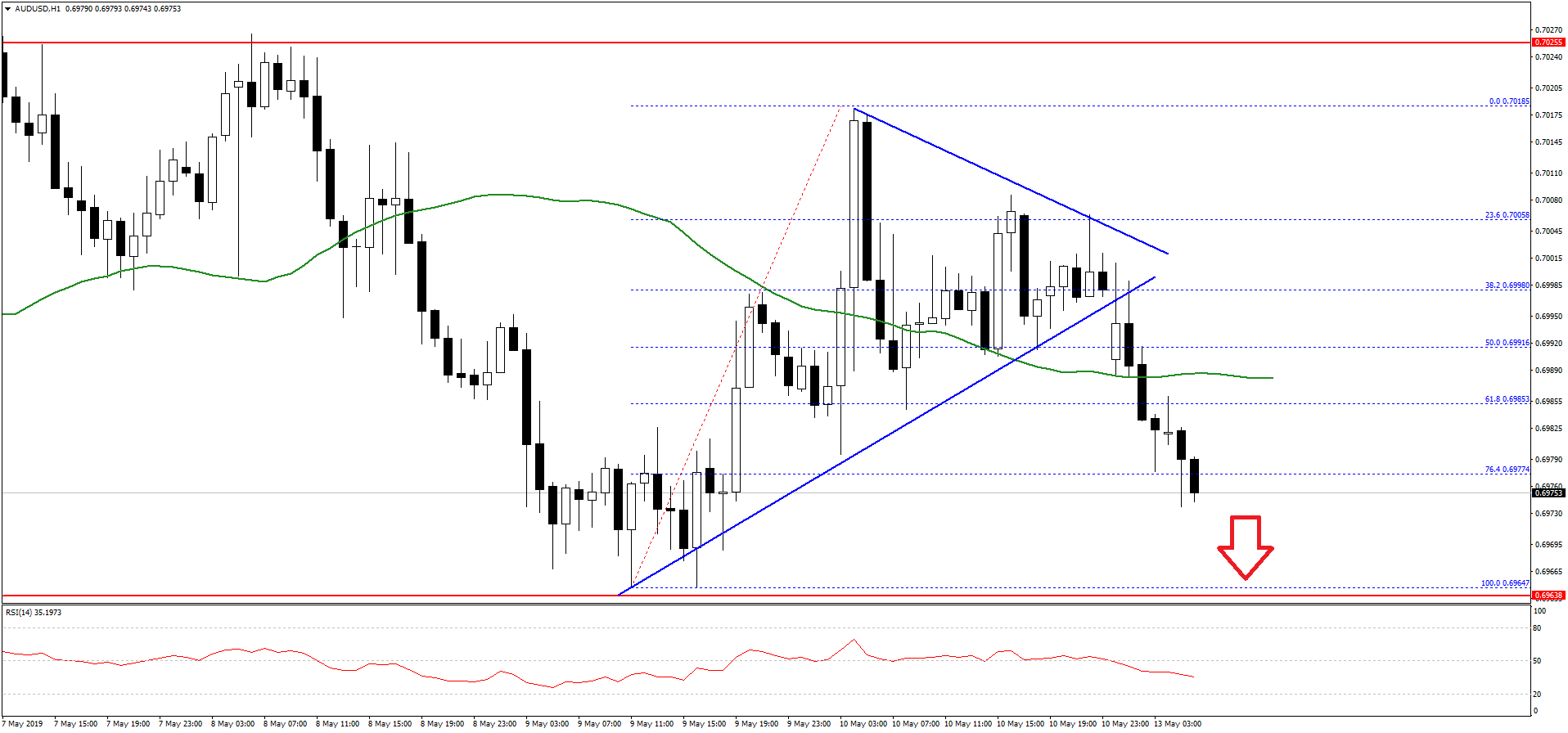

AUD/USD technical analysis

The Aussie dollar failed to surpass the 0.7025 and 0.7020 resistance levels against the US Dollar. The AUD/USD pair started a downward move and broke the key 0.7000 support area.

During the decline, the pair broke a major bullish trend line with support at 0.6998 on the hourly chart. Besides, there was a break below the 0.6990 support, the 50 hourly simple moving average, and the 61.8% Fib retracement level of the last wave from the 0.6964 low to 0.7018 high.

The pair is clearly trading in a bearish zone below 0.6980, and the 76.4% Fib retracement level of the last wave from the 0.6964 low to 0.7018 high.

Therefore, AUD/USD is likely to retest the 0.6964 swing low in the near term. The next key supports are near 0.6955 and 0.6940. On the upside, the 0.7000 level and the 50 hourly SMA might protect gains.

Comments (0 comment(s))