AUD/USD outlook: the pair is currently correcting gains

Even after global growth risks and downside forecasts are still underlined, the expectations of the RBA head regarding a possible infrastructure increase in the interest of the Australian economy helped the AUD/USD pair, as it rises to a 12-day high of 0.6950 early Monday.

While the steady weakening of the US dollar helped the Aussie to maintain its former strength, the recent comments of the Governor of the Reserve Bank of Australia (RBA) Philip Lowe helped the further growth of quotations.

Lowe quoted negative risks for the global economic outlook but also said that macroeconomic growth is still reasonable. He also mentioned that markets set prices for rate cuts in major economies, but he refrains from any indication of further RBA policy steps, speaking at the Leadership Forum of the Australian National University in Canberra.

Investors are focusing on his comments that low rates elsewhere can help the government borrow at exotic lows, which in turn can create additional infrastructure investments that will benefit the Australian economy.

It should also be noted that Australian buyers paid little attention to trade conflicts between the United States and China and the threat-like headlines from Chinese daily newspapers.

Investors can now focus on political games surrounding world trade, along with sending the dollar to a new impulse due to a lack of basic data left for publication.

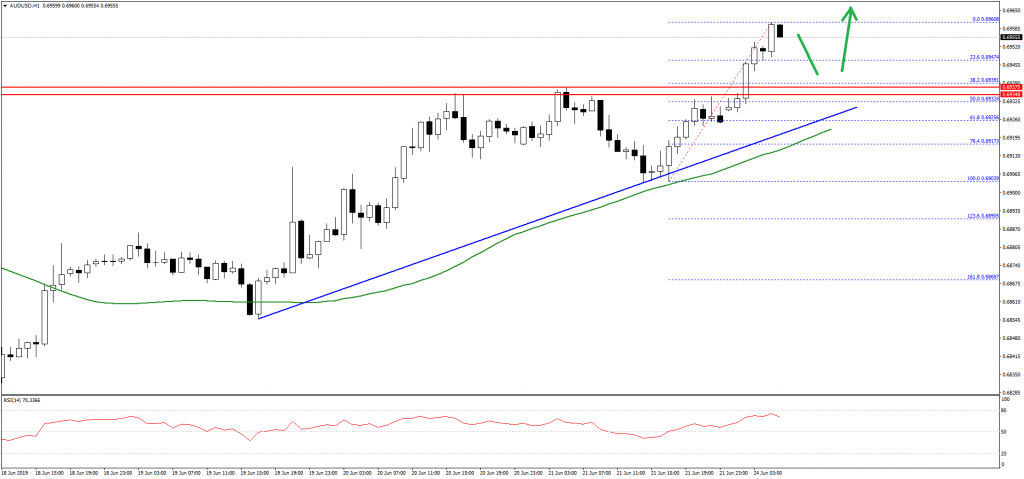

AUD/USD Technical Analysis

The Aussie dollar started a steady rise after a strong decline below 0.6850 against the US Dollar. The AUD/USD pair gained bullish momentum and broke the key 0.6900 resistance level.

The pair even climbed above the 0.6940 level and the 50 hourly simple moving average. It traded as high as 0.6960 and it is currently correcting gains.

On the downside, initial support is near the 0.6945 and the 23.6% Fib retracement level of the last wave from the 0.6903 low to 0.6960 high. There is also a major bullish trend line with support at 0.6930 on the hourly chart.

On the upside, an initial resistance is near the 0.6960 level, above which the pair could aim the 0.7000 resistance area, followed by the 0.7020 pivot level. An intermediate resistance is near the 0.6980 level.

Comments (0 comment(s))