Gold rally has stopped due to Trump’s decision on Mexican tariffs

Even the possibility of reducing the rate of the Federal Reserve could not stop the fall in the price of gold, since the decision of President Donald Trump not to punish Mexico eventually had a greater impact.

The price of physical metal and gold futures fell from a 14-month high on Monday, ending the eight-day rally. The decision of the president not to continue to increase tariffs on Mexican imports has partially removed the negative sentiment on global macroeconomic markets. The fall in price also made it possible to buy cheap metal for those who want to make money on the longest rally of gold this year.

Spot gold, reflecting trading in bullion, was trading at $ 1,327.64 per ounce during the American session, down by $ 12.94, or 1%, per day. On Friday, the price reached a maximum in April 2018, reaching $ 1,348.34.

Gold futures with delivery in August, traded in the Comex division of the New York Mercantile Exchange, fell in price by $ 16.80, or by 1.25%, to 1,329.30 dollars per ounce. At the last session, he reached the February high of $ 1,352.55.

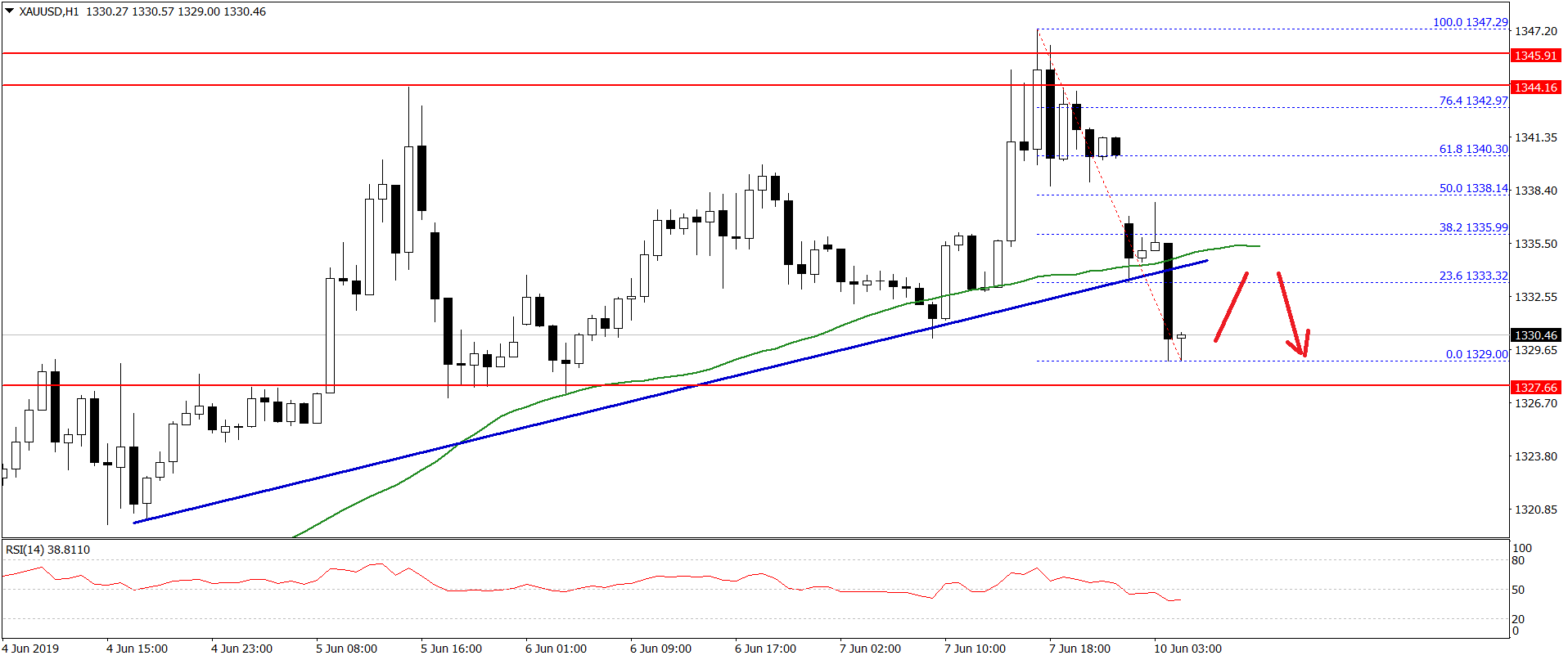

Gold Price Technical Analysis 10th June 2019

Gold price struggled to clear the $1,347 and $1,350 resistance levels against the US Dollar. The price started a fresh decline and broke the $1,340 support level to enter a short term bearish zone.

During the recent slide, the price even settled below the $1,335 support and 50 hourly simple moving average. Moreover, there was a break below a connecting bullish trend line with support at $1,335 on the hourly chart.

The price traded as low as $1,329 and it is currently consolidating losses. An initial resistance is near $1,333 and the 23.6% Fib retracement level of the last decline from the $1,347 high to $1,329 low.

The main resistance is near the broken trend line, the 50 hourly SMA, $1,335, and the 50% Fib retracement level of the last decline from the $1,347 high to $1,329 low. A clear close above $1,338 might start a decent upward move. If not, there could be more losses below $1,330.

Comments (0 comment(s))