USD/CAD gained bullish momentum following USD pullback and WTI recovery

Although growing tensions between the US and China continue to spread pessimism across commodity-related currencies, the USD/CAD pair remained under the 50-day SMA, around 1.3410, while moving towards European open on Monday.

The reason may be the recent recovery in WTI against the backdrop of a likely increase in nuclear stocks by Iran and the expected expansion of supply cuts by the OPEC+ alliance.

Crude oil is Canada’s largest export commodity, and therefore, any price change in the energy benchmark is directly related to the Canadian Dollar.

The latest pullback of the US Dollar against the background of the formation of profit at the beginning of the week can also be considered as the reason for the rise of the pair.

The US New York Empire State manufacturing index, NAHB housing market index and comments from the Bank of Canada’s (BOC) Deputy Governor Lawrence Schembri can direct near-term trade sentiment.

The forecast assumes the absence of changes in the US housing market at the level of 66, while a slightly softer figure is indicated at 12.75 versus 17.80 before the production index. In addition, BOC’s Schembri will be watched closely to seek any more clues of monetary policy easing.

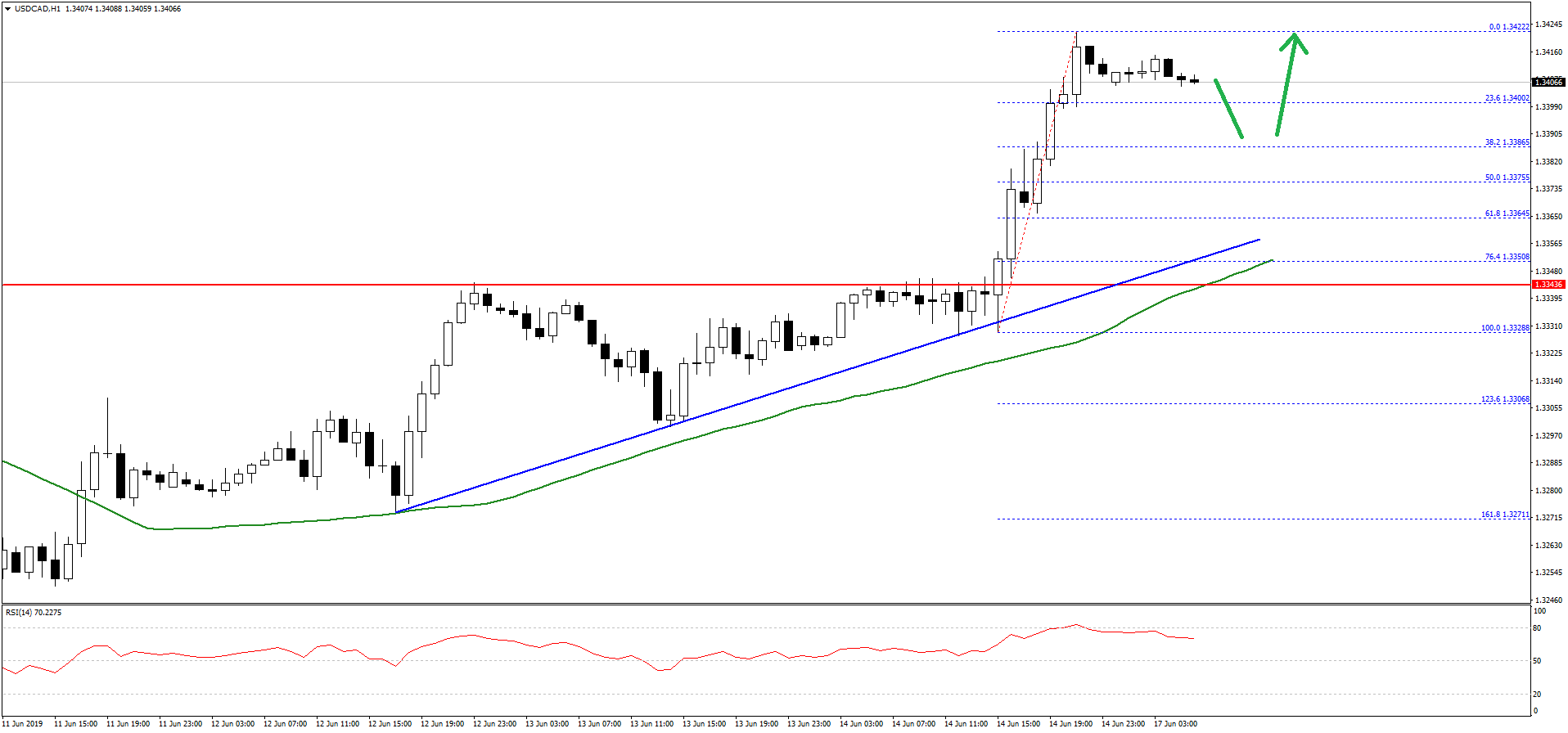

USD/CAD technical analysis

The US Dollar started a major upward move above the 1.3350 resistance zone against the Canadian Dollar. The USD/CAD pair gained bullish momentum above the 1.3400 level as well.

The pair traded as high as 1.3422 and it is currently trading well above the 50 hourly simple moving average. At the outset, the pair is consolidating gains above the 1.3400 level and the 23.6% Fib retracement level of the recent wave from the 1.3328 low to 1.3422 high.

However, there are many supports on the downside near the 1.3380 and 1.3360 levels. The main support is near the 1.3350 level and a connecting bullish trend line on the hourly chart.

On the upside, a break above the 1.3420 level is likely to set the pace for more gains above the 1.3440 level in the coming sessions.

Comments (0 comment(s))