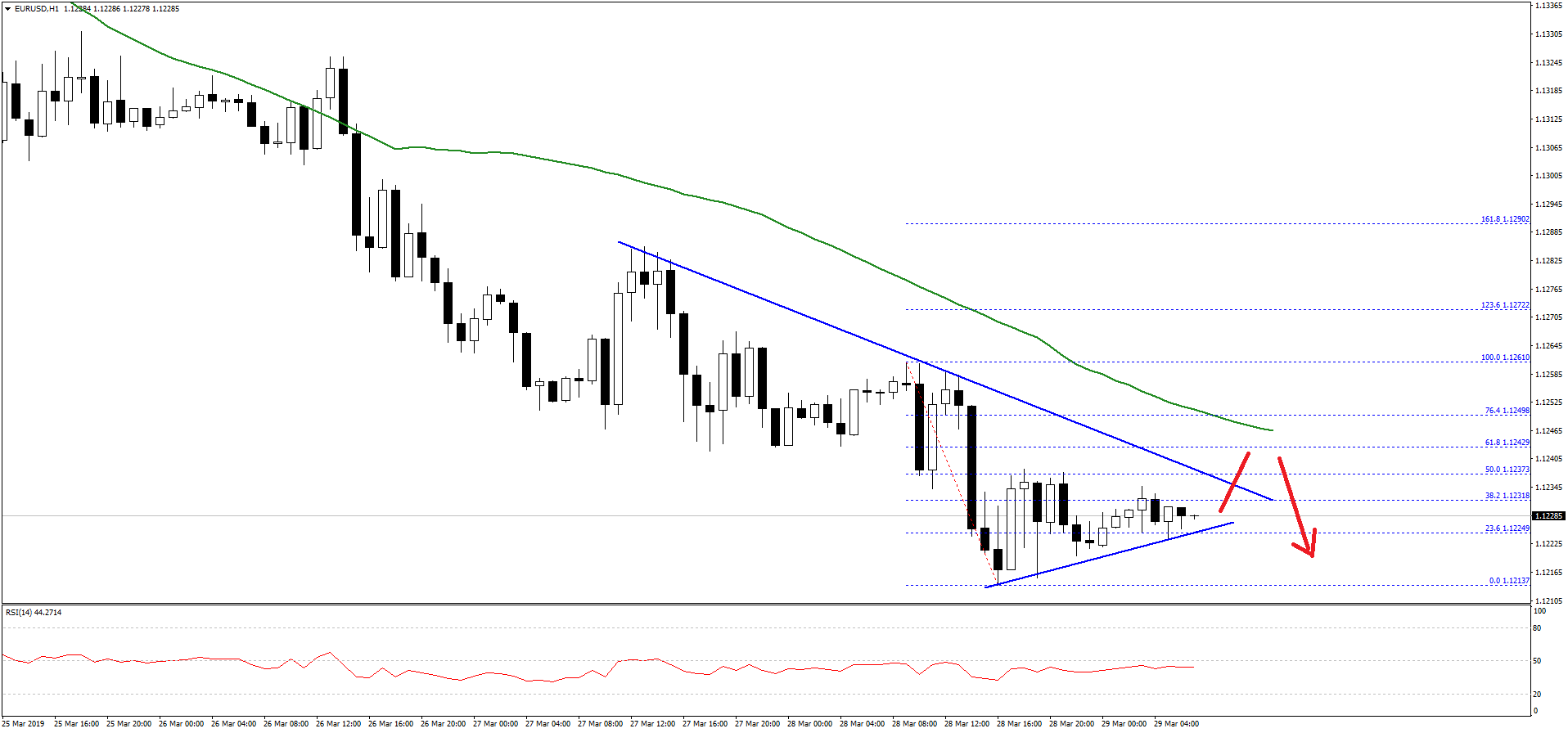

EUR/USD outlook: a new downward channel has been formed

Yesterday, the Euro tried to go higher, but fell from 1.1260 to test the lowest rate of almost three weeks. The pair continued to fall as the US dollar benefited from the lack of risk sentiment. Most central banks in the world are softly positioned due to weak prospects for global growth. It is also worth noting that the yield on German ten-year bonds fell even more, which gives another bearish signal of sentiment in Europe.

EUR/USD technical analysis

The Euro declined steadily after it failed to break the 1.1340 resistance level against the US Dollar. The EUR/USD pair traded below the 1.1300 level to move into a bearish zone.

There was even a close below the 1.1260 support and the 50 hourly simple moving average. It traded as low as 1.1213 and it is currently correcting higher. However, there are many hurdles on the upside near the 1.1235-1.1240 zone.

There is also a major bearish trend line in place with resistance near 1.1235 on the hourly chart, positioned with the 50% Fib retracement level of the last drop from the 1.1261 high to 1.1213 low.

Therefore, the pair is likely to struggle near the 1.1235-1.1240 resistance area. On the downside, the main support is at 1.1210, below which there is a risk of more losses below 1.1200.

Comments (0 comment(s))