The EUR/USD pair consolidating with support near 1.1325

China offered to buy more American goods to balance the trade balance with the United States. US President Donald Trump will meet with Chinese Prime Minister Liu He at the end of the day, and the announcement of the meeting raised hopes. There were no reports of progress in structural changes, such as intellectual property.

The euro also has its own reasons for growth or at least stabilization. The euro zone’s purchasing managers index for February, published on Thursday, was mostly above expectations. According to forecasts, the German business climate IFO will remain stable in the new February report. European Central Bank President Mario Draghi will speak later in Bulgaria and may shed light on recent events.

The late report on orders for durable goods in the US for December was better than expected but fell on the most important non-defense air measures from -0.7%, which lowered growth forecasts. Existing home sales also fell short of forecasts, reaching 4.94 million annually, which again demonstrated the weakness of the housing sector.

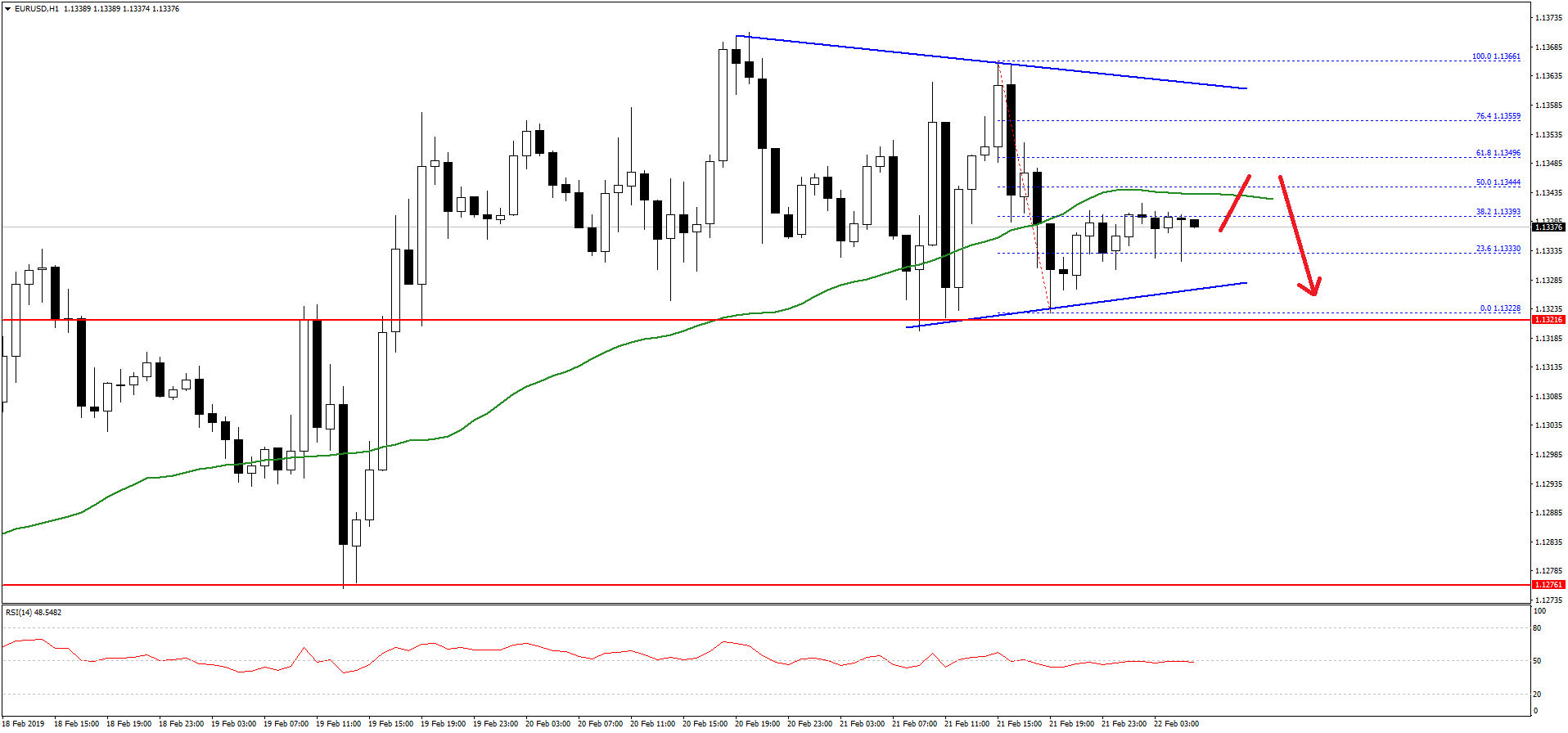

EUR/USD Technical Analysis 22nd Feb 2019

The Euro recovered recently after forming a decent support near the 1.1275 level against the US Dollar. The EUR/USD pair traded above the 1.1300 and 1.1320 resistance levels.

There was even a spike above the 1.1350 resistance and the 50 hourly simple moving average. However, the pair failed to break the 1.1360 zone and later declined below 1.1350 and the 50 hourly SMA.

The pair tested the 1.1320 support and it is currently consolidating in a contracting triangle with support near the 1.1325 on the hourly chart. On the upside, there are many hurdles near 1.1350 and the 50% Fib retracement level of the last drop from the 1.1366 high to 1.1322 low.

In the short term, there could be an upward move, but the pair is likely to struggle near 1.1350. On the downside, a break below the 1.1320 support could trigger losses towards the 1.1275 support.

Comments (0 comment(s))