USD/RUB up 1% after months of downtrend

On Friday, the Russian ruble opened down on a moderately negative external background. After Friday, the ruble continued to lose its positions. This happened while the situation on world markets improved rapidly. Experts claim that one of the major reasons for it is the increasing scares for sanctions against Russia.

The increase of the USD can also be a result of the new decision of US lawmakers, saying that an agreement was reached to provide $900 billion in aid aiming at supporting American citizens and businesses amid the negative impact of the pandemic.

The recent movements in the market indicate that the price of the USD/RUB is up about 1%, selling at about 73.5875. There are many things that have had an impact on the increase of the USD. Recently, the Bank of Russia, CBR, decided to leave the door open for a little more easing.

The statement of the Governor once again implies that the bank will continue having a cautious approach and the key rate will remain on hold at 4.25%. A new set of sanctions is one of the main risks in 2021, and some of the experts are claiming that next year, the price of the ruble will go back to around 60.8833.

Before making any decisions on your positions, however, make sure to use technical and fundamental indicators for the best outcome.

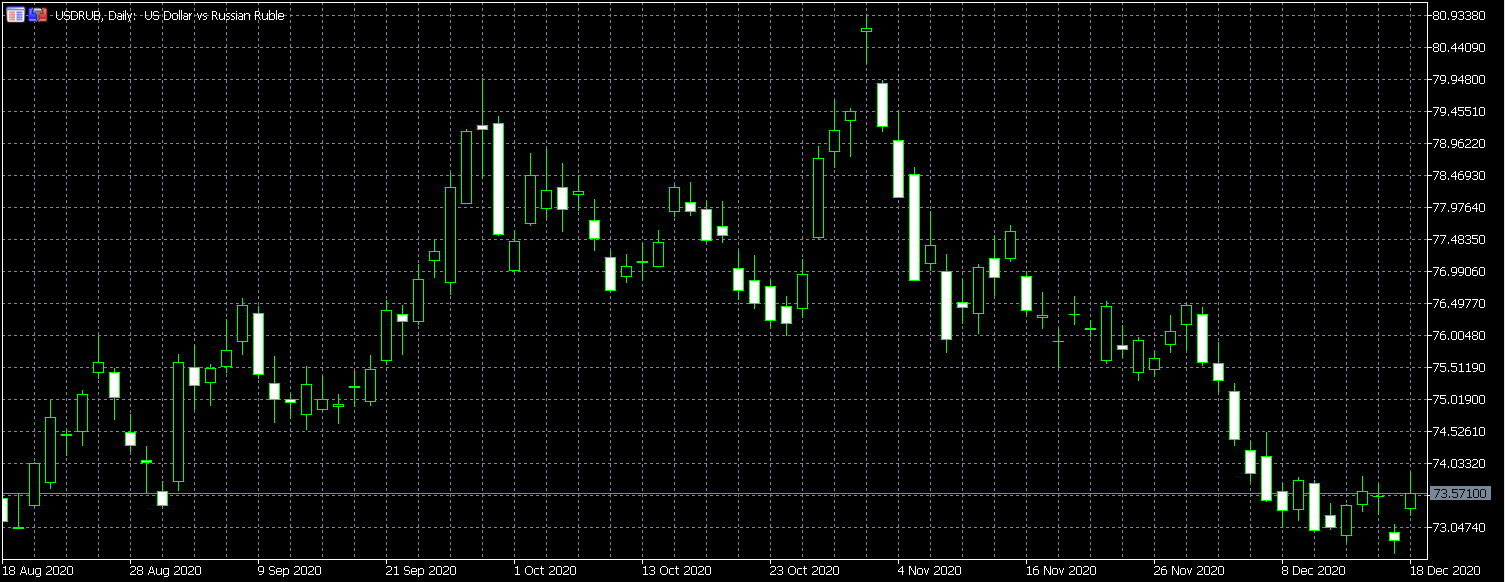

Price movements of USD/RUB

The candlestick chart shown above indicates the price changes of currency pair USD/RUB starting from August 18 to today. As you can see from the chart above, the price of the currency pair has started increasing around August 18, after which, it hit hights around August 25.

After this, the prices started going down again. At the beginning of September, it increased again, before decreasing around September 12. Around September 20, the prices started increasing again and had an uptrend for several days. For much of October, the price was very much unstable.

It changed several times, before going up at the end of the month. One of the major reasons for it was the US presidential elections, which had a huge impact on the prices in November. A new president was elected in the United States, Joe Biden. Because of the situation in the USA, USD started dropping in many pairs.

It included USD/RUB as well, and as you can see, the prices were very much decreasing until recently. Today, the price of the currency pair started increasing once again. The increase was as much as 1%. The ruble has been on a good run for some time now. However, it has fallen quickly.

During the trading day, other emerging currencies were actively declining as well. However, some of them switched to rapid corrective growth, unlike ruble. One of the major supporters of the increase of other emerging currencies was the situation on the world markets. Recently, the Russian debt market has also returned to a downward trend.

The ruble is predicted to stay under pressure by leading experts in the market. This is true at least in short term. The decision of the Bank of Russia will leave a key rate unchanged at a record low level of 4.25%. Also, the central bank has toughened the rhetoric and the regulatory body will assess the feasibility of further cutting the key rate.

In addition, the Bank of Russia has also confirmed the termination of the phase of easing monetary policy, taking a pause for an indefinite period. Although it could support the ruble in the long term, the short term effect of it is negative for the Russian currency. The main reason for it is that the government bond market has lost its driver of lower yield on expectations of a lower-key rate.

However, because of the political and economical uncertainty, it is very hard to predict anything. The number of Covid-19 cases is increasing very fast around the world, creating further problems. As of now, many countries have already adopted restrictions on mobility for the second time. Some even said that the third wave of the Covid-19 has begun, for example, in Poland.

But, there is some positive news as well. One of them is the increasing hopes for the Covid-19 vaccine, which was already used in the United States and in the United Kingdom. Most of the countries are planning to start vaccinating around the end of the year or earlier next year.

This could help the current situation of the financial markets, however, at this point, everything is a lot harder to predict.

Comments (0 comment(s))