Topsteptrader funded account program review

Topsteptrader was established in 2010 in the United States and offers a new approach to futures trading. Topsteptrader offers funded accounts to those traders who will manage to prove their trading style and risk management to the company. For this, they need to trade with futures, follow the rules of the company and close 2-step program successfully. Some might find Topsteptrader program interesting, but we have found several important flaws in it that you need to be aware of before you apply for it. Read the detailed Topsteptrader review to see if the company is legit and if it is worth to enroll in the “Trading Combine” program.

www.topsteptrader.com review

Let us start with the www.topsteptrader.com review since the website is traders’ first touch point with the company. At first sight, the website seems to be very modern with its design and style. Generally, Topsteptrader brands itself as the company for modern traders and has “Trading reinvented” as a motto. However, the design is the only thing it can be prised for. The front page of the website is not very informative. It showcases the way Topsteptrader works for the traders but does not describe details fully. According to it, traders who want to join the program of funded futures trading should prove themselves to be eligible to join the program. For this, they need to show that they can manage risks and trade profitably. If they manage to do that, they will get funded account where they can trade with the money of the company and receive profits. Apart from it, the website presents the results of the traders and success of the program in numbers stating that 1020 accounts have been funded in 2018 for the traders from 161 countries. According to it, Topsteptrader is funding 90 accounts per month on avarage. However, it does not state the ratio of funding accounts.

Apart from this information, there is not much to see on the website. On the navigation bar, you can see the section for “Our program” which is redirecting visitors to the description of the program. There, the company is providing only limited, basic information about the program and rules. It certainly lowers the Topsteptrader rating. Moreover, the company does not display information about all commissions and charges. Generally, a lot of information is absent on the website, which makes it harder for the traders to grasp the concent of the Topsteptrader. Overall, the website of the broker did not leave us satisfied.

Trading conditions with Topsteptrader

Since information is very limited, it was hard even for us to get a full idea about the service. We had to research quite a lot to prepare this Topsteptrader review. The company offers traders to enroll in their program and get funded account for futures trading.

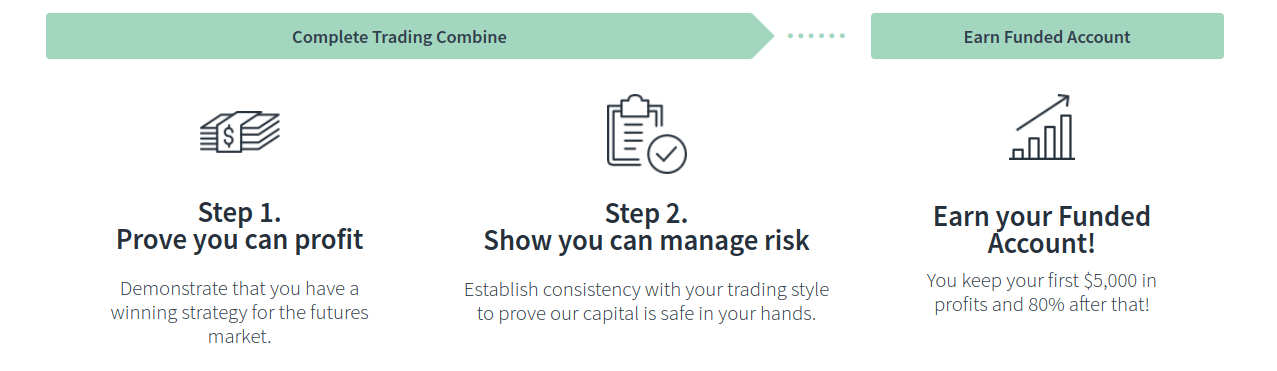

Traders who are accepted are getting their account funded by the Topsteptrader. Customers of the company are able to keep the 5000 USD from the first profit and 80 percent of the profits made by trading, 2o percent of it is kept by the company. To get accepted as a trader, one needs to prove his or her trading style and risk management, after which the person is getting funded account. Yet everything seems to be easy with this 3 stage program, however, it is not as easy as it seems from the beginning and the question can Topsteptrader be trusted? is still relevant.

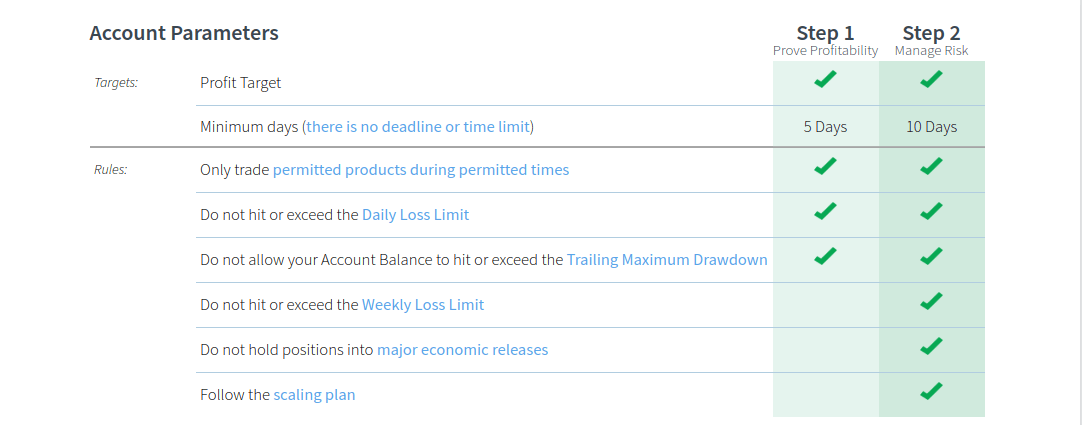

Let’s see how the program works. A person who decides to join the program needs to join “trading combine” and fulfill all criteria. The first step has the following requirements:

- A trader should trade with CME group futures during the allowed times only

- A trader should not hit daily loss limit which is minimum 500 USD

- A trader should not allow the balance to hit the trailing maximum drawdown. Traders should pay much attention to it as the requirement is very strict. For example, for 50 000 USD account the maximum drawdown is 2000 USD, meaning that the balance cannot drop below 48 000 USD. Which is very hard to maintain.

If the trader will meet these criteria, he or she will be transitioned to the next level – Step 2. On the second level traders need to meet the same criteria and some additional ones and should trade at least for 10 days.

- A trader should not hit the weekly loss limit

- A trader should not trade during the major economic releases

- A trader needs to follow scalping plan

As you can see, the rules are very strict and easy to violate. If one fails to meet any of these criteria at any point, she or he will have to either leave the idea of trading with Topsteptrader or reset the account which costs 99 USD each time. At the same time, taking step 1 and step 2 is not free as well. There are monthly subscription fees and other charges we will review in details below. One needs to take into the account that the rules still remain to be strict when one reaches the funding account and it might stop anytime you fail to follow them. It leaves an impression that the traders are set up to fail multiple times, which can make you think of Topsteptrader scam.

Topsteptrader account types

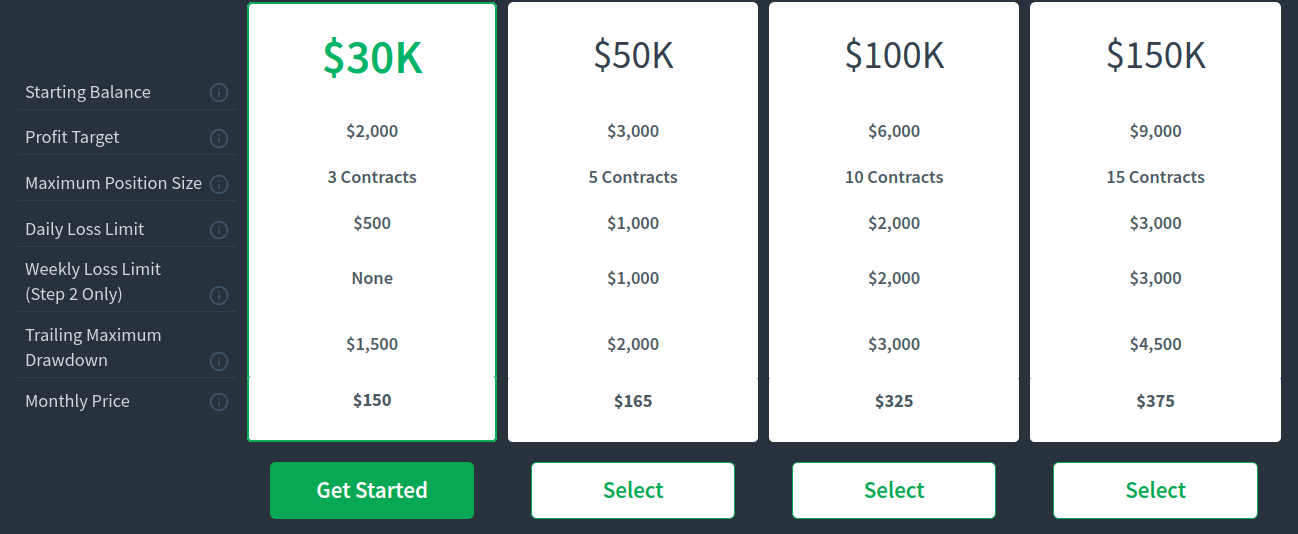

Topsteptrader offers four types of accounts. Each of them has different requirements. This is how the accounts work. You choose the account based on the amount of the money you want to be funded with once you close both of the steps successfully. The rules and requirements are the same for step 1, step 2 and when you are funded as well.

- If you want your account to be funded with 30 000 USD you have to pay a monthly subscription price of 150 USD.

- You need to meet the profit target of 2000 USD

- The maximum position size you can hold is 3 contracts

- Your daily loss limit is 500 USD

- You can lose the maximum 1,500 USD

You can check the requirements for the other accounts below. The main reason why there are so many negative Topsteptrader opinions is that traders don’t really get 30 000 USD or 50 000 USD funding. Instead of 30 000 USD, they receive the amount of money which is the maximum drawdown, in this case, 1500 USD. Since if you cannot lose more than that.

Topsteptrader fees

As mentioned above, the website does not show all the commissions and charges that you might have to pay when trading with Topsteptrader. First of all, you need to know that you can take 3, 6 and 12-month membership meaning that for the shortest membership you have to pay the minimum of 450 USD and the maximum of 1,125 USD. Also since the rules are very strict you will have to reset your account several times, which will cost you 99 USD each time.

There is an additional fee if you want to trade with the futures from other groups as well, CME, CBOT, NYMEX, and COMEX futures cost 105 USD each, EUREX costs 69 USD. There are commissions for a regulatory fee, platform fee, data fee, transaction fee, and exchange fee. Topsteptrader withdrawal is also charged with 50 USD if the money withdrawn is less than 500 USD. Last but not least, you need to take performance coaching before you get your account funded which will cost you another 195 USD per month.

Is Topsteptrader legit?

As you could see yourself the concept of Topsteptrader seems to be easy from the beginning but gets more and more complicated once you learn more about it. While the Topsteptrader scam might not be real, the program itself is not very appealing as it has a lot of flaws. It is clearly not for the beginner traders since the requirements are hard to be met by the professional traders leave alone those who have very small experience. At the same time, the Topsteptrader service is not appealing for the professional traders as well, since they can trade by themselves and have 100 percent of the profits and not pay hundreds of dollars and 20 percent of profits to the Topsteptrader. Moreover, you can see that the funding is not as much as the company showcases it. Overall, the broker’s service is not satisfactory and Topsteptrader is not in the list of the recommended broker.

Comments (0 comment(s))