Where is gold value heading?

Gold value had been going up since late last year, but now we’re starting to see a pullback that has got investors wondering what’s happening with gold. In a previous article on gold value, we had expected the price to go up, which it did temporarily before the current downtrend. Gold is an important commodity to look at because it has a butterfly effect on the markets, which is why gold value is something to consider.

Recent gold value trends

Since the US presidential elections late last year the value of gold has risen concurrently with US stocks and assets. The rise in gold value was spurred by the uncertainty of a new administration, plus the increasing uncertainty in the Eurozone.

In the week ended 13th April, there was a spike in gold prices following fears of increased tension between the US and North Korea that weakened the US dollar and US stocks. All of these factors helped push the price of gold to a high just below $1,300. During this time, gold had formed a nice upward trend that had experts predicting prices above $1,300.

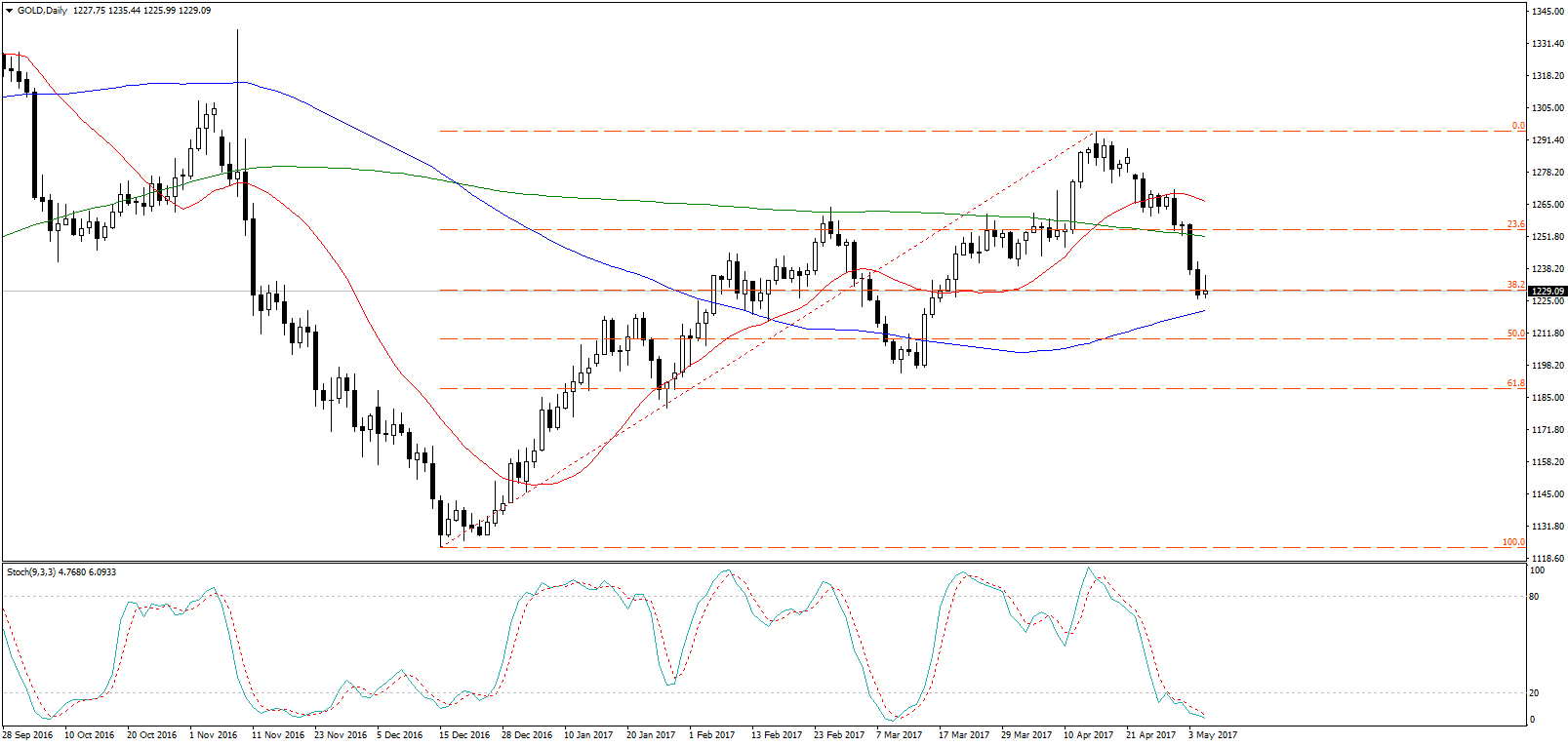

However, at this point, gold started to become overbought as seen from the stochastic oscillator. Furthermore, COT reports by the CFTC for the week ended 14th April showed that there were more net short positions than long. The bulls were covering their positions, and a downtrend imminent with a target at $1,277 area to act as a support.

The support level held for a while, up until the French elections. With Macron emerging top, a lot of uncertainty was eased, and gold shed a chunk of value, enough to break below the 18-day moving average. On the Fibonacci retracement, the value of gold was propped up by the 23.6% Fibonacci level, but this too was broken by the FED announcement to postpone a rate hike. The announcement was able to pull gold value below the 200-day moving average and down to the 38.2% Fibonacci level where it has closed this week.

What’s causing the slump in gold value?

A number of fundamentals have caused the value of gold to decrease by almost 5% in less than a month. So far, none of these issues have been resolved, leaving gold stuck in limbo. The most pressing issue right now will be the weekend’s French elections, which will determine the future direction of gold.

How might gold value change in the weeks to come?

Despite decreasing value, there has still not been established a clear downtrend, which gives some hope of the previous uptrend resuming. The coming week’s trend will be established by the result of Sunday’s presidential elections in France.

Should Macron win, which the polls predict, gold value might go down lower and target the 61.8% Fibonacci level below $1,200. On the other hand, Le Pen would cause the value of gold to rise exponentially, both in the long and short terms. The former seems likely.

Technical analysis supports the continuation of the previous uptrend. Stochastic oscillators show gold in oversold conditions, and an inverted hammer also indicates a possible reversal of the downtrend. Plus, this may just be a correction in the markets. The fundamentals are mixed, though, and will depend on the French elections outcome. Some experts have also attributed the recent decline in gold value to decreased demand by central banks and consumers for jewellery due to the high prices. With the decrease in price, the demand might pick up once more and drive prices higher.

For the moment, gold isn’t predictable, and it would be better to wait a few days. If the recent downtrend continues, the first target should be at $1,200 which is both a technical and psychological support level. Further slumps would pull value down to the 61.8% Fibonacci level at $1,185. Further downtrends below this point would be difficult in the short term. If an uptrend were to form, target $1,250 where the 200-day moving average is trending. Further uptrends may just take us back to the $1,300 level.

Comments (0 comment(s))