ICO funding surpasses VC funding for blockchain startups

All startups face one major problem – funding. Typically, a startup would expect to raise capital after gaining interest from a venture capital (VC) firm, but perhaps now there’s a better way. Instead of appealing to corporate investors, why not the masses? This was the idea behind the growth of ICO funding, and the total amount raised this far now supersedes that gained from VC funding.

Amounts raised through ICO funding and VC funding

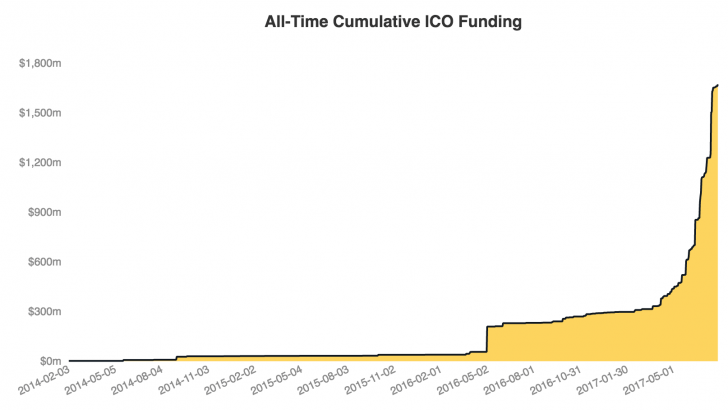

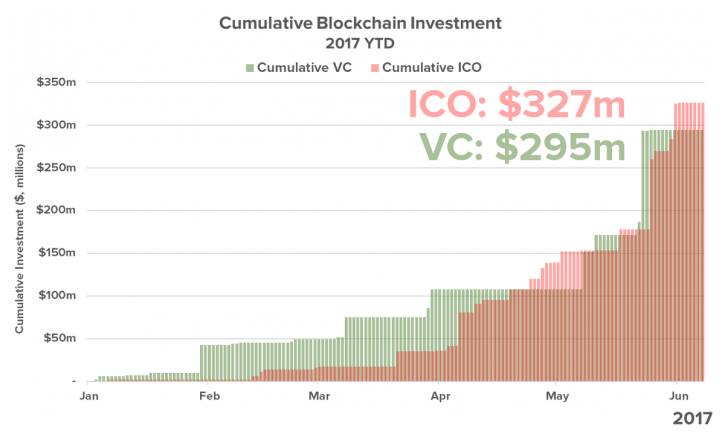

VC funding has always been the preferred method of getting capital, so it would make sense that it has always been the dominant force. Data reported by Coindesk shows that, since 2012, venture capital has infused more than $1.8 billion into blockchain start-ups. In 2016, the total amount raised by VC funding totaled just over $600 million. As for ICO funding, the total investment was about $300 million, but that was last year.

This year, there have been a lot more startups focused on blockchain technologies. Yet, as of August, investment has only reached about $350 million from VC funding. Meanwhile, total ICO funding has finally reached $1.8 billion in August as reported by Forbes magazine. Out of that figure, this year’s investment alone was more than $1.5 billion, just from ICO funding.

There was a huge jump in ICO funding over the past few months on the back of some very successful ICOs like Filecoin, Tezos, and EOS. Filecoin, for example, managed to raise more than $250 million in August, within an hour! In July alone, more than $540 million was poured into blockchain companies, but only $6.12 million came from traditional VC firms. The rest was the result of ICO funding from individual investors. Compared to a month earlier, May, VC funding had reached $107 million mainly due to the investment in R3 that would connect various major banking institutions. A drop from $107 million to $6.12 million clearly shows how sharply VC funding has declined in the blockchain industry.

All in all, total funding in Q2 of this year was about $800 million, but only $241.3 million can be attributed to VC funding.

Why is ICO funding becoming more popular than VC funding?

Individual investors and speculators are responsible for the increasing growth of ICO funding in the blockchain. Cryptocurrencies have become very lucrative this year, and many have become interested in participating. The triumph of ICO funding over conventional VC funding also proves that a large populace can beat the need for corporate investors. However, it doesn’t mean that this is the end for VC firms, not at all. These firms could just participate in the ICOs themselves if that’s what it takes. For now, though, the people seem to prefer ICOs over traditional fundraising tactics.

Comments (0 comment(s))