EUR/USD outlook for the coming week

The EUR/USD is the most heavily traded pair and it will be very volatile this week with several major announcements about to be announced. So, let’s start with the current situation.

Current situation

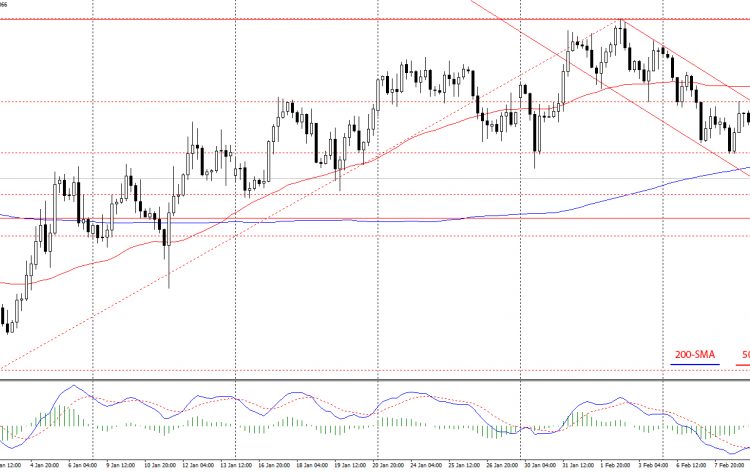

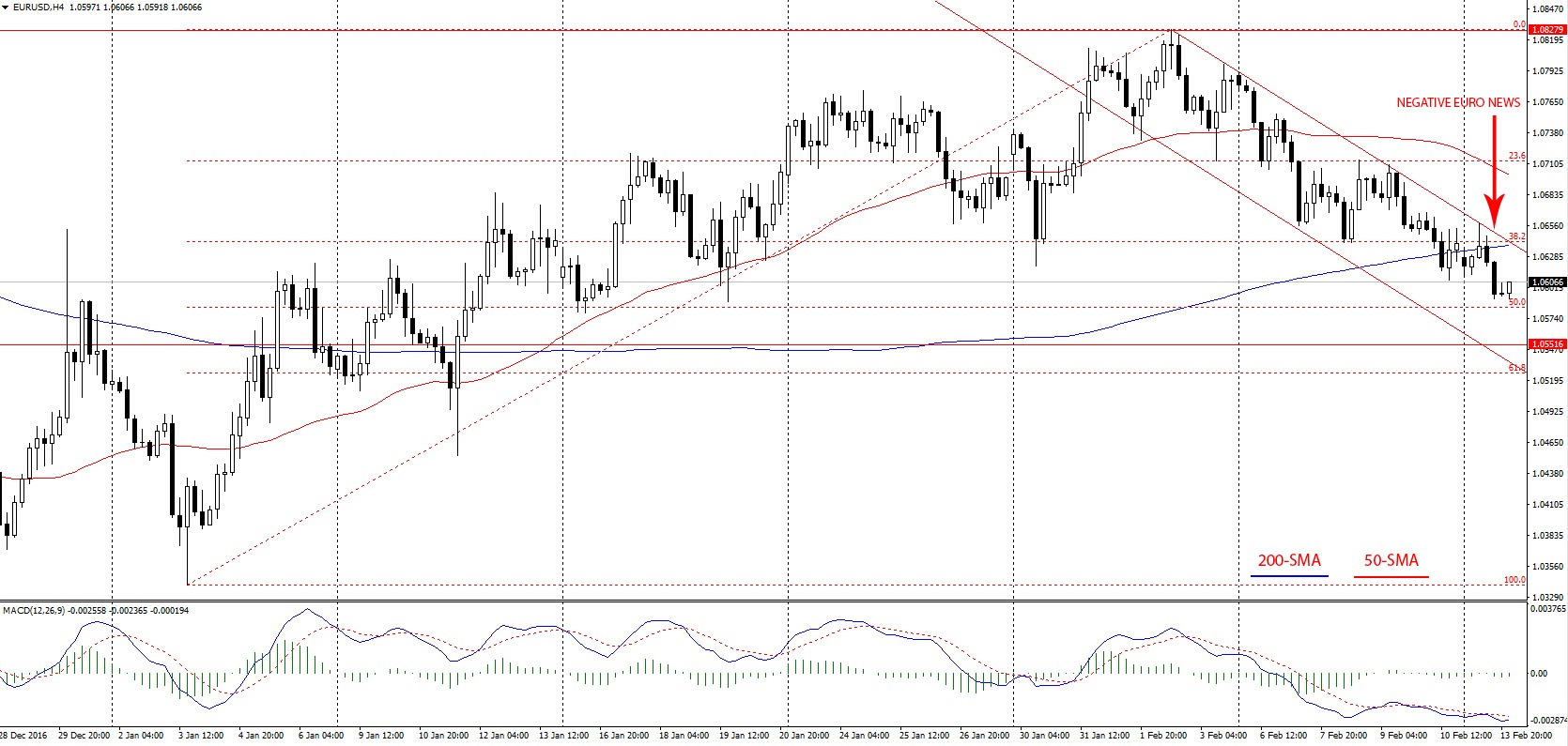

Last week, the EUR/USD was mainly bearish falling down below the 38.2% Fibonacci level. This week again started out on a negative tone for the euro. Earlier yesterday, ECB president Mario Draghi spoke on the EU economic forecasts. The quantitative easing measures in the region were raising inflation, but still being below the 2% target. Due to this, the statements by Draghi were dovish causing the euro to weaken.

Our hope of the ECB raising interest rates was dashed and this put a dent on the strength of the euro. In addition, data from Germany was also weak and being the largest economy in the region, the euro fell below 1.06. This euro weakness also made the pair of crossing below the 200 SMA (simple moving average) putting it in bearish territory.

This week’s predictions

If the bearish sentiment continues we expect the pair to drop down to the support level around 1.055. Of course, this would mean going below the 50% Fibonacci level, where we are already seeing some support building up, so the main push will come from the fundamental side.

For the rest of the week, the most impactful news will involve the US dollar, and that is going to affect the direction this pair takes. Later today and tomorrow, FED chair Yellen is expected to speak, and the FOMC report is also expected to be released. The FED made it clear that they intended to raise interest rates this year at least once, but we don’t expect this to happen today. US president Trump has shown intentions of weakening the dollar from its 14-year high, so the rates might not go up just yet.

If the interest rates remain at 0.75%, which we expect they will, the euro just might regain its strength and turn the downtrend around. Still from the US will be the crude oil inventories on Wednesday and the unemployment claims on Thursday. Both of these announcements tend to have a serious impact and they will surely affect the direction this pair takes.

However, we’re expecting some reports on Germany’s economic sentiment, with pundits expecting lower figures, so this is definitely something to keep an eye on. On the European side also, there will be reports on the Spanish 10-year bonds performance and more news from Germany and Italy.

So, now we have the pair trading at a bearish territory below the 200-SMA, the euro is showing signs of weakness which makes us believe it will continue to slide. On the other hand, the pair is approaching a critical support level around 1.055 and the MACD indicator showing an oversold market. The level to watch will be around the 1.0585 level which represents the 50% Fibonacci level from the January to February uptrend. If this level is crossed downwards, we could see the 1.055 support being tested this week, but if not, then the trend will reverse and rise up to the 1.064 level. Right now, we’re at a pivot point, with the pair just waiting for a push either way. The push will come from the US, which is where all the attention should be.

Comments (0 comment(s))