EUR/GBP analysis for the week 12

The EUR/GBP pair will be an interesting one to watch this week as both the Eurozone and UK are at a political crossroads. In the UK, Article 50 was passed by parliament and approved by the queen, now it’s just waiting for the trigger by Prime Minister May. Over in the Eurozone, elections in France and Germany are still pending, with the Dutch elections having been completed.

Technical analysis of the EUR/GBP pair

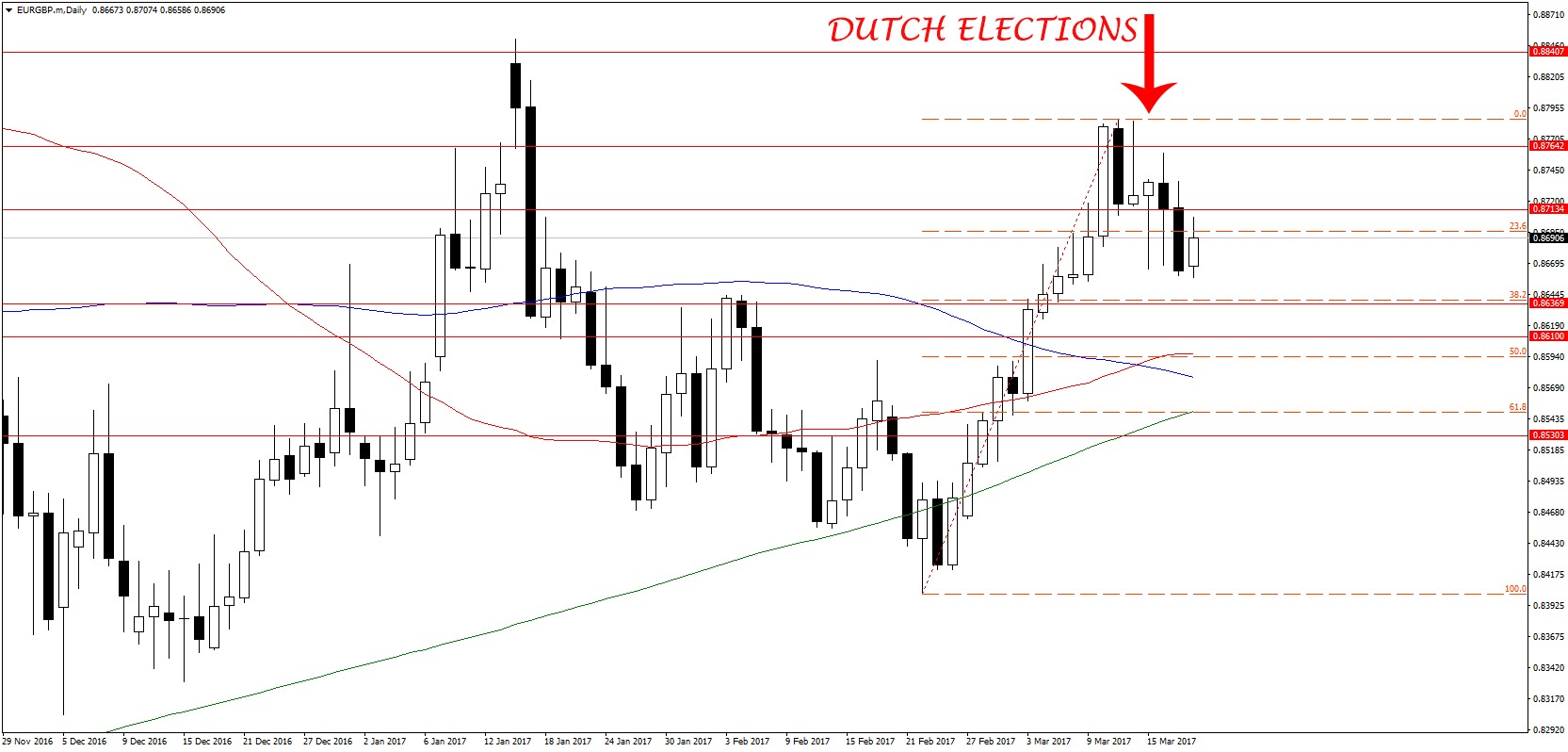

After a strong rally for the past few weeks, the EUR/GBP pair hit a snag at the resistance level around 0.876. it closed above this point but was unable to sustain the rally, instead moving sideways before retreating. The pair then tested the resistance level at 0.871 attempting to turn it into support, but the presence of exhaustive candles showed signs of a strong bearish sentiment.

Prices kept going down to stop at the 23.6% Fibonacci level, but that too was broken, and the pair closed below this level. Today’s candle was unable to resume the recovery, which shows that the EUR/GBP pair may resume the downtrend in the short-term. The target for the downtrend will be the 38.2% Fibonacci level and support at 0.863.

Fundamental analysis of the EUR/GBP pair

Ever since the US elections making Trump president, protectionist politics have hit the Eurozone too. Several other countries have expressed an interest to leave the EU as well, and there are candidates who support this view. If this was to happen, the euro would take a hit and weaken against the pound. Elections in Netherlands were to be the first to set the tone, but the candidate for this sort of protectionism, Geert Wilders, was defeated.

It was a setback for these protectionist views across Europe, and now sights are being set for France where Le Pen is second in the lead. She has stated clearly that she would hold a referendum to exit the EU, an event which would be dubbed Frexit. However, she’s facing stiff competition from Emmanuel Macron and the defeat of Wilders may be a sign the rest of Europe is not willing to go down the UK’s path.

In the UK, Article 50 may be triggered on the 27th of this month, which would cause weakness in the pound. In the meantime, CPI data expected to be released later today will set the tone for the EUR/GBP pair as it will show how the economy is performing. Markets believe inflation will be higher this month, which would increase the strength of the pound. If this happens, we could see the EUR/GBP pair go down to test support at 0.861.

On the 23rd, retail sales data from the UK will also be made public, and this is expected to be high as well in tandem with inflation. This would further continue the downtrend, perhaps down to the 61.8% Fibonacci level or the 0.853 support level. Expectations by many analysts are bearish, but the Bank of England may surprise us all.

Over the long term, though, the uptrend may continue following slightly hawkish statements during the ECB meeting last week. Already, TLTROs have been ceased and the bond buying program may be cut back, with expectations leaning toward a rate hike sometime this year. For long-term traders, long positions would be the safer bet, but short positions will be advisable this week.

Comments (0 comment(s))