How France elections affect the euro

When the markets opened this week on the 24th of March 0100HRS (GMT+3), the euro had almost reached 1.092 against the US dollar. These are levels we had not seen since November last year, and the cause was the results of the French presidential elections. These elections were held on Sunday the 23rd of April and the results announced the same day. What happened to the euro was a sign of how France elections affect the euro value and the Forex market in general.

Why do France elections affect the euro?

Within the EU, Germany is the largest economy, followed by France. This second position used to be occupied by the UK, but their decision to leave the EU has left France in second place. The statistics show that France contributes as much as 15% of the total annual EU GDP. Germany contributes around 20%.

Moreover, it’s not just about the economy, France also has political pull in the EU. Of 751 positions in the European Parliament, 74 are filled by the French, making up about 10% of the total. Remember that the European Parliament has to approve the heads of the European Central Bank. This give France a bit of sway into EU financial decisions considering that there are 28 member states in the EU. In the Council of the EU, France provides 29 out of 352 votes in the EU council of ministers, again providing France with added political leverage.

In short, you could to say that France is a major player in the EU, and you would expect France elections affect the euro.

The candidates’ effect on euro value

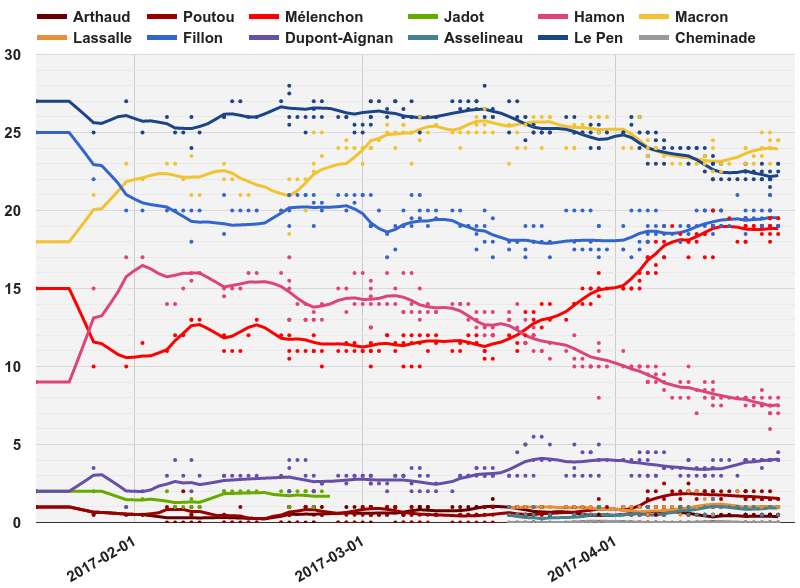

There were 11 contenders for France’s presidency during this year’s elections, but there were really only 3 horses in the race – François Fillon, Marine Le Pen and Emmanuel Macron. Toward the election day, opinion polls showed only Macron and Le Pen as the top contenders as the others lost support. The chart below shows how opinion polls shifted in the first 3 months of 2017:

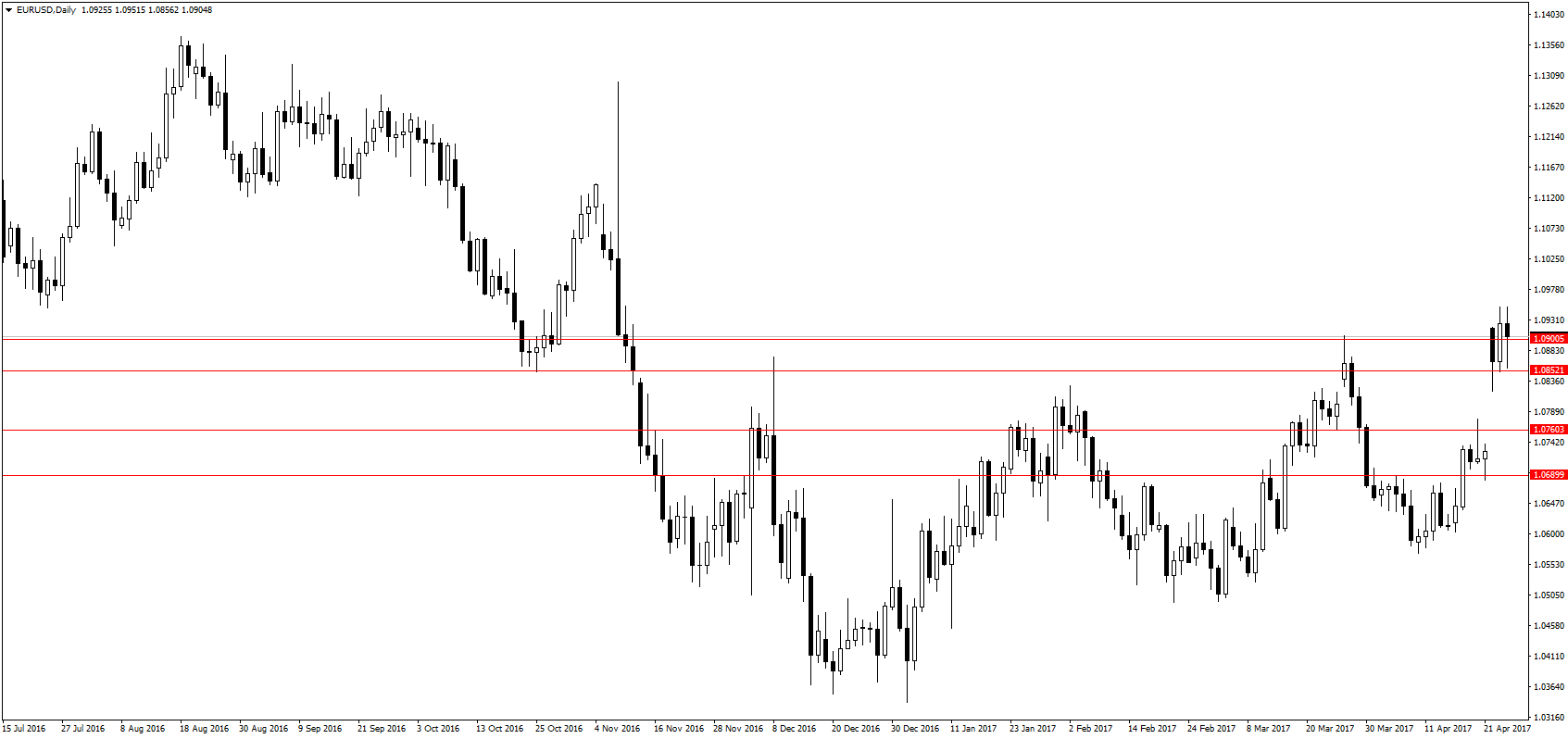

For most of 2017, Le Pen had enjoyed popularity and the opinion polls suggested she would win the elections. Consequently, the value of the euro took a dive every time the polls showed increasing favor toward Le Pen. The chart below shows how the euro measured up to the US dollar for the past year or so:

Following the US elections, the euro fell below the support level at around 1.09. It only temporarily broke above this level on the 27th of March following strong PMI data from France and Germany the week before. In fact, the only thing that kept the euro from falling deeper was the strong economic growth in Europe, particularly driven by Germany.

Le Pen popularity was a downer for the euro because she had promised to bring a referendum on EU membership within 6 months of her victory. Her popularity signaled a dissatisfaction among the French of being in the EU, perhaps signifying such a referendum would lead to a Frexit. Given the position of France in the EU economy, such a move would hurt the euro, and this is why the currency always took a dive when the opinion polls showed her increasing popularity.

However, in the final week before the election weekend, favor shifted toward Macron, who is more for reform rather than complete abandonment of the EU. This is why the euro picked up on the final 2 trading days before the election weekend.

After the elections

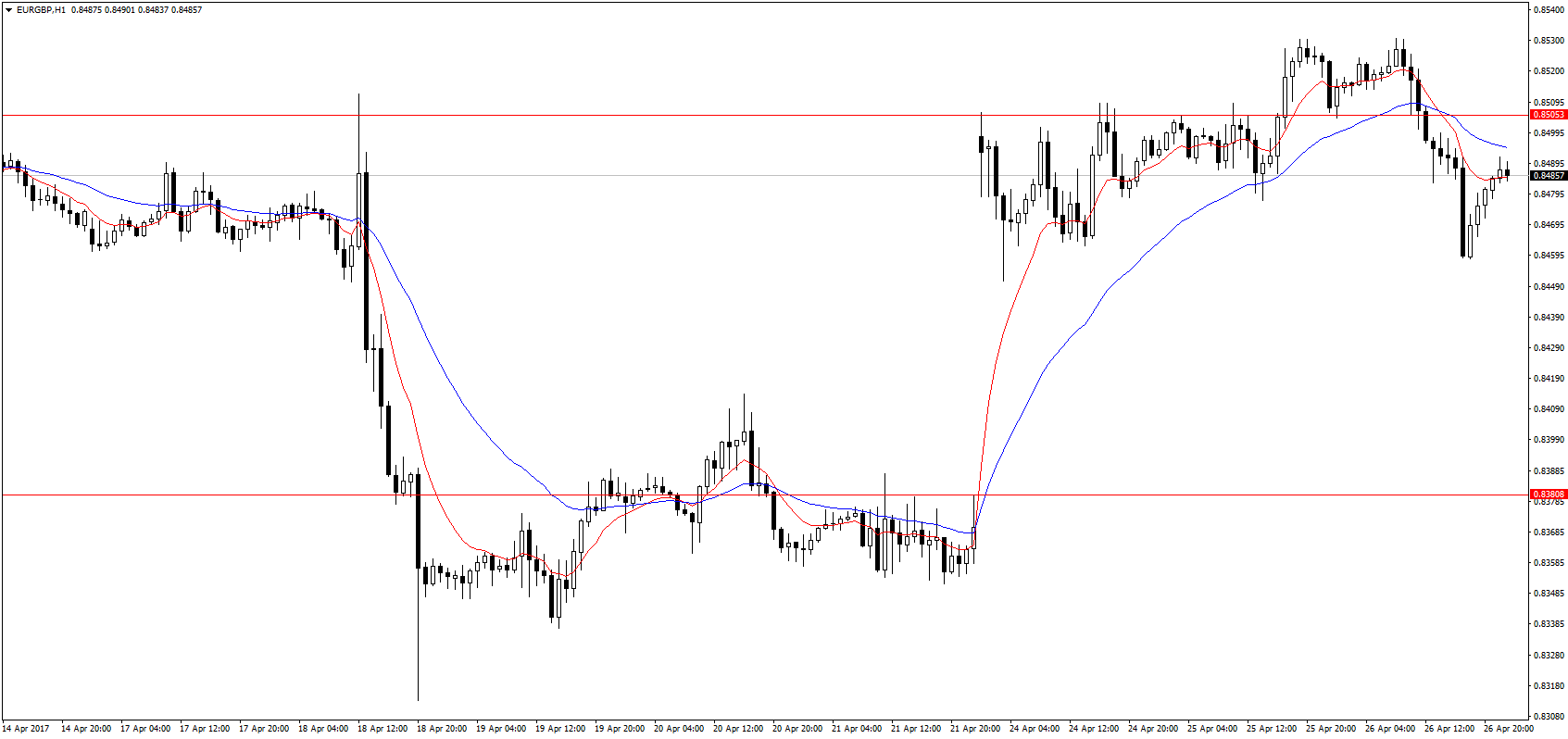

With so many candidates and 3 leading horses, it was always clear there would be a run-off election. A winner needs more than 50% support. There was good news for the euro as Macron took the lead with 23.7% of the vote over Le Pen’s 21.7%.

When the Forex markets opened, the euro was trading 2% higher at $1.09395 from the previous close of 1.0723. Analysts at major investment banks had forecasted that the euro would drop by as much as 10% to the US dollar on the back of a Le Pen victory. In addition, the Euro also rose against the sterling pound by about 1.5%.

The victory by Macron over Le Pen was welcome news as the euro has a hope of stability once again. Now, the latest opinion polls still show Macron above Le Pen by a huge margin, and this is keeping the euro strong. If Macron finally gets a win on the 7th of May, we might see the euro go even higher toward the $1.10 or $1.11 area. Otherwise, its value will break below $1.09 again, this time into unknown territory.

What’s clear from all this is that French elections affect the euro a lot, and any trader should be well aware of French politics if they want to make wise choices regarding the euro.

Comments (0 comment(s))