What are the best Forex currency pairs to trade online?

So you have covered the very basics of understanding what Forex is. You know how to work the platform, you know which broker you want and you even know how much money you are going to be using for your trading operation. If you haven’t, you should really check out some of our guides and crash courses on those subjects. If you have, you must have been feeling pretty confident. But as you sat down in front of your computer, you realized that you have no idea about the most important part of trading. Namely, what exactly do you intend to be trading for the next few weeks?

Thank god you have Google and thank god you have us. In this guide, we are going to get into the details of what you want to be trading on your Forex platform and why. We are specifically going to talk about what the what is the best currency pair to trade for the purposes of safety or for a quick profit. This guide is here to give you a general framework and a reference, maybe even a nice tip to constructing a trading plan. What happens after is up to you. You get to decide what you are going to start trading with: the best Forex currency pairs out there, or ones you will get to figure out on your own after learning more about potential ones.

The best currency pairs to trade for beginners

Depending on your platform and broker you can have around 40 to 70 different types of currencies available to trade. This is a whole lot of diversity and might be a little intimidating, especially to a beginner who is unaware of what currencies are best to trade, which currency pairs make the best teams and most importantly, how to select which currencies you are going to be trading. Thankfully, the markets have already given you a hint about what the best currency pairs to trade today are. The world of Forex has already given you seven currency pairs to trade with through their sheer popularity to be traded with. These seven are the most popular pairs in the world for a simple reason: they are well known international currencies and they are notoriously stable. This comes as a result of the fact that these currencies belong to some of the biggest economies in the world, granting them the type of stability no small economy currency can truly have.

The seven currency pairs are divided into the major and minor sections, with the for of the most popular currencies being in the majors:

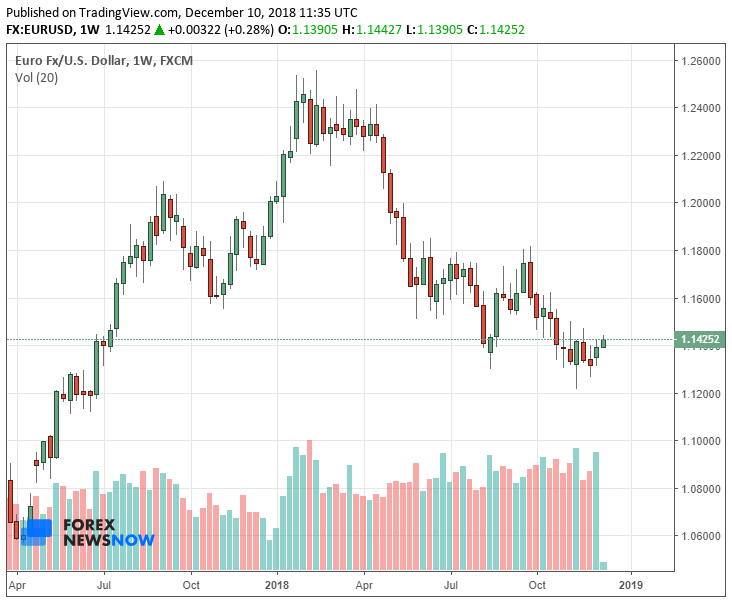

EUR/USD – the Euro and US dollar pair is well known and well trusted around the world. This pair is extremely trustworthy, with a stable relationship dating back decades of Foreign Exchange. These two currencies are two of the biggest and most widespread in the world, which is why it makes sense that this is the most popular exchange pair out there. These also make the easiest currency pair to trade on the market.

This chart showcases the relationship of EUR/USD. The two have had a week of widespread change happening, making them perfect to trade throughout the week.

USD/JPY – this relationship is a little less obvious than the EUR/USD, but one that is nonetheless important. The US dollar and Yen relationship have been a strong one for many years, with the Yen often thought of as the safer bet between the two. The Asian counterpart to the US dollar, many people choose to invest in Yen when they think the USD might be experiencing some trouble in the near future. The prices of the two move very little against each other, which makes them very healthy alternatives to each other and one of the best currency pairings to safely trade with. This is the best currency pair to trade during asian session.

GBP/USD – the Great British Pound to the US dollar relationship is pretty obvious. The GBP has held an important role in the world economy. It is known as one of the most stable currencies in the world, barely ever wavering by wide margins. One of the best currency pairs to trade London session wise.

USD/CHF – a lot of people unaware of money exchange operations happening around the world might not realize how often the US dollar is traded for the Swiss franc, but it happens, a lot. This is one of the best currency pairs to trade New York session wise.

The minor currency pairs are:

AUD/USD – the Australian dollar to the US dollar. What can we say, the two currencies from different sides of the world like each other? This is one of the best currency pairs to trade Sydney session wise.

USD/CAD – the US dollar and the Canadian dollar. The neighbours enjoy working together when they can. This is also one of the best currency pairs to trade during the US market hours.

NZD/USD – the New Zealand dollar to the US dollar.

These pairs are the most popular in the world, right now, for the sake of speculative Foreign Exchange trade. The specific reasoning for this is a little blurry, but we have one general answer: all of these currencies are widely used around the world and come from dominant economies of countries with a very strong financial sector. The countries which actually account for most of the foreign exchange trading happening in the world. Which makes them some of the best currency pairs to trade at night or during the day, when looking for a relatively safe income.

You may also notice that the US dollar appears in these combinations a lot. Many Forex brokers report that it is the most popular trading vehicle in the world currently.

Should you trade the most popular currency pairs in the world?

The answer to that question, especially to any beginner, is yes. For the very same reason that the rest of the world trades with them – because it is so much easier to predict what is going to happen with them than with smaller currencies from obscure countries the inner workings of which you are never sure of. In the Forex market, the most important resource you possess is not the cash that you invest, but the information that is available to you. If you are able to look at markets, political situations and so on, then you might be able to see whether the currency is going to fall or rise, and that gives you an advantage when trading.

The fluctuations in the values of each of the above-mentioned currencies are not only well documented but also easier to observe. The most popular currency pairs are this way because the information on them is so easily available to anyone looking for it. The trade information on the local and international markets is well publicized on a daily and even hourly basis. This means that anyone looking at the US market and seeing it being strong, while to EU market might be suffering for the day, will know that the US dollar will gain a few points on Euro that day, so they might be interested in investing in one or the other. Other than the markets, you are also able to anticipate changes through other means and other information. This makes them the most predictable currency pairs out there.

Security is key

Security is key

Although the most important reason why a beginner should be trading one of the above-mentioned currency pairs is not the easily available information. It is the safety of your funds. You see these currencies never go through extreme fluctuations relative to each other. So if you make a bet and win out, you might not be making a lot of money, but if you are making the wrong bet, you will not be losing a lot of your money either. If you are a beginner you are just coming into the game, so it is important to work with your training wheels first. You might have had a demo account for a while, but the real market works with real money and it is important to get your feet well onto the ground before you get into the more risky stuff.

Basically, what we are trying to say is, these seven are the best currency pairs to trade for beginners to start trading with.

Exotic currency pairs

Of course, the seven of the most popular currency pairs are not the only ones that people are trading. Otherwise, brokers would no offer more than forty currency options on their platforms. With these many currencies, it would be a little self-limiting to stick to just 7 pairs, and very often no so profitable. If you explore enough, you will figure out which currency pair is most profitable in Forex for you with ease. The key to finding your favourite pair is understanding what you are looking for and how currencies work on the market.

Let us say you are out here looking for a currency pair that will make you the most money. What you are looking for, then, is one relatively stable currency on one side and one relatively volatile currency on the other. You start keeping an eye on this relatively volatile currency, learn how to predict its movements and then start buying and selling accordingly. If you make big investments, you will get big returns. But remember, while high volatility might mean big payouts, it also means big losses if you turn out to be not so lucky. So watch out and only make moves when you are at least 90% sure that you are making the right one.

So what are some of the best currency pairs to trade when you are looking to get into the volatile currency market? Good questions. We are all strong believers in the freedom of choice and looking for your answers, but we are also able to give you one example or two.

Popular exotic currency pairs

One of the best currency pairs to trade for volatility purposes is the US dollar to the South African Rand. The ZAR is a notoriously volatile currency which fluctuates pretty often, reaching interesting heights and lows as it does. Learning to predict the changes in the South African Rand is not the most complicated thing, all you have to understand is what the buttons for the changes are. Economic output, political attitudes, upheavals and times of calmness. Except watch out – you cannot always depend on your own predictions to be right, and it only takes one big mistake for you to lose a lot of money on Forex. Make sure you understand how the currency pair of your choice works before you start risking big cash on it.

And just because I am generous, I will give you a list of the most popular and possibly some of the best exotic currency pairs today:

- EUR/TRY – Euro and Turkish Lira

- USD/TRY – US Dollar and Turkish Lira

- USD/SEK – US Dollar and Swedish Krona

- USD/CNY- US Dollar and Chinese Yuan

- USD/DKK – US Dollar and Danish Krone

- USD/HKD – US Dollar and Hong Kong Dollar

- USD/SGD – US Dollar and Singapore Dollar

- USD/THB – US Dollar and Thailand Baht

- USD/MXN – US Dollar and Mexican Peso

The popularity of these pairs should not drive you to trade with them exclusively though. As I said, most Forex Brokers offer more than forty and up to seventy different currencies on their platforms. This means you have the opportunity to create currency pairs that are not necessarily as popular as these and ones that might be a bit more interesting or even more profitable than the ones above. It is up to you to get looking.

What makes an exotic currency pair attractive?

AS I promised, by the end of this guide you should be able to more or less identify some of the best currency pairs to trade on your own. While this could be the subject of a lecture in a masters level finance class or even a PhD, I do not want to get too wordy. Instead, I would like to give you some of the qualities displayed by exotic pairs that can be considered to be the best to trade.

Information

One of the most important qualities is the ease of gathering information on the currency. As we mentioned before, the most popular currency pairs and the safest ones usually have information regarding their markets and political determinants. The ease of availability of information will allow you to make easier predictions as to the nature of the currency and its fluctuations. If an exotic currency does not have information about its determinants available, you should probably avoid it. If you have no way of knowing the GDP of the country using the currency, predictions for it, market activity and health, political situation and other contextualizing information, it is best to avoid the currency.

Volatility

If you want your exotic currency pair to make you a whole bunch of money, then you should definitely make sure it is volatile enough to work well. Wide fluctuations between the pair you have chosen will provide for wide wins (and losses), which will make it into an incredibly profitable and one of the best currency pairs to trade for you. The two qualities above are definitely something you need to look into and make sure are there.

But what else?

Well, you need to consider how risk averse are you and determine whether the exotic pairing you have created adheres to it. Some of the other things you should do are a pair a volatile currency with a strong one. You should also produce a technical analysis of the currencies you are trading, determine the pip value and be confident in your investing. It is always a good idea to consider all of the risks and understand how you might be able to mitigate them through your actions.

Trading strategy and currency pairs

Of course, the general overview of what some of the popular currency pairings are is great, but what about your specific needs?

Every trader has their preferred trading strategy, whether this is day trading, positional trading, carry trading, range trading and so on. The problem with providing specific currency pairings with each strategy is that there are just too many things to consider. The reality of the matter s, I won’t be able to tell you a lot about all of the specific pairings for each strategy. The article would get too long this way. Instead what I am going to do is take one of the more popular strategies and tell you what some of the general features of your currency pairings should be for it. Hopefully, this will assist you in better analyzing your own trading strategy, making you better equipped to tackle the problem and come up with the best currency pairs for range trading, day trading or any one of your strategies.

Best currency pairs for Day Trading

The point of Day Trading is to take advantage of small price movements happening throughout the day to receive the most benefit. If done correctly, traders will be able to see large income from seemingly little, single day lasting effort. But how do you pick the best currency pairing for day trading? The best way to go about it is to really think about what Day Trading is about. You open your position and get income through fluctuations in the currency. This means you want a currency pairing with high enough volatility to pay for to spread while also making money off of it. This means you want a currency pairing that has a combination of a low spread and good enough volatility to cover this spread. USD/EUR works better in this case than USD/TRY simply because the USD/TRY spread can get really high (as of writing this guide) and you run the risk of the currency not being volatile enough to cover the spread.

Simpler thoughts

Some of the things that need to be mentioned seem like very simple ideas and thoughts, and yet it is important to mention them because sometimes the simplest things might seem the least obvious. So here are a couple of things you need to consider when creating your currency pairings.

Currency Correlation

One of the most important things you could consider when picking two currencies to work with is how much they are correlated. This can be done by looking at currency correlation matrixes online. These will provide you with information with high correlation. Why should you consider it? Well, if you have a pairing of highly correlated currencies and you see one going up, you might think you are making money off of it. The reality is, since they are highly correlated, both of them will be going up at the same time, meaning that the profit you will be making off of such a pairing is minimal as compared to a pairing where the correlation level is low. The best currency pairings to trade will have a nice balance of correlation, where they are not too correlated but are not too different either. Highly volatile pairings might be a little dangerous for any investment that you make.

The best Forex currency pairs account for the cost

Never disregard the actual cost of trading, especially when considering your pairings. It is important to consider how much it will cost to open and close your position and whether you will be making any money as a result of that. The best Forex currency pairs to trade at night or during the day, always account for the cost that the trader will be paying. If you have a highly exotic pairing with an incredible payout, but the spread was too high, you might end up not making anything back. Always consider what your options are, what your strategy is and what is best in such a context.

Brokers

One of the easiest and funniest things to forget is that not all brokers offer all currency pairings. So before you start picking or making your own currency exchanges, you need to make sure the platform you are on has it to offer. You might have to adapt to how the brokers do their business, but there should be more than enough options for you to substitute one currency pairing with another, relatively similar one.

Local Expertise

Just in case you didn’t catch this from all of my earlier comments, you need to have a level of local expertise if you want to produce the best Forex currency pairs for you. Local expertise gives you the chance to know ahead of time what is going on within the economy and which way the currency might be moving. So if you pick an exotic currency, you better do it because you know the local events well enough to predict movements of the currencies in relative to your stable currencies.

Final advice

The best way to go about trading on the market is to consider multiple strategies. While it is good to stay safe and within the confines of low-risk investment, this will not produce big winnings. On the other hand, being involved in high-risk trading might produce some great profit margins, but will also bankrupt you pretty quickly. So why not balance the two? Once you have determined what the best currency pairs to trade on the market are, you combine them with safe ones and diversify your trading portfolio. So in case your high-risk investment fails, you still have that low risk one succeeding and providing a steady cash flow. This way you can keep trading for years without much worry about your own financial future being ruined by a single bad trade.

Comments (0 comment(s))