2019 – That can be the year of the Gold (at least the beginning)

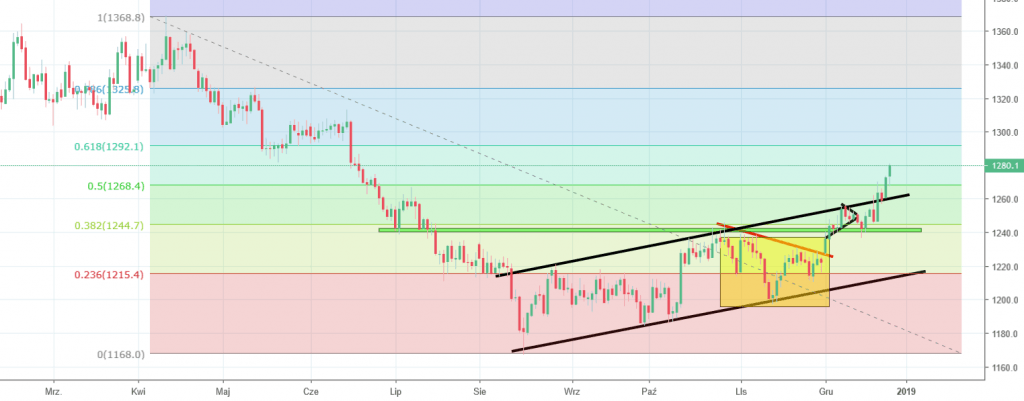

Time to mention one of my favorite instrument, so Gold. The main two reasons why we will talk about the Gold now is that: 1) the previous metal is surging 2) we were right in our previous piece. About that, let me show You how we concluded the last analysis about the XAUUSD:

“That does not change the mid-term sentiment though as this one is driven mostly by the green line. As long as we are above, the buy signal is ON and we do have bigger chances for a further rise. „

So what happened here is that the green horizontal support got defended and that was crucial in the whole situation as price bouncing from the 38,2% to the upside is always a positive sign. Obviously all fundamentals helped here. Decline on stocks, reversal on USD and all that can be considered as a positive factor for the XAUUSD. We need to emphasize one thing here: Fibonacci. After bouncing from the 38,2%, price went to 50% bounced and then broke this level. Now, the aim is on the 61.8% and chances that we will get there are very high. Once again, look at the previous price movements from May, June and July. Those levels where the Fibos are, were carefully respected during those three months. That increases their value and put them on front in the list of the key technical players. My view on Gold is definitely bullish.

Comments (0 comment(s))