DAX Analysis – Oh boy that can turn ugly

OK, we all know that the most important even on the market is the decline on stocks. We already mentioned the American indices, so now time for the major index in Europe – DAX. This instrument is declining sharply and has a legitimate sell signal, which is backed by the huge bearish pattern. Was that expected? In our previous analysis, from the 28th of September we were bullish:

“As for now, buyers have slightly bigger chances for success. „

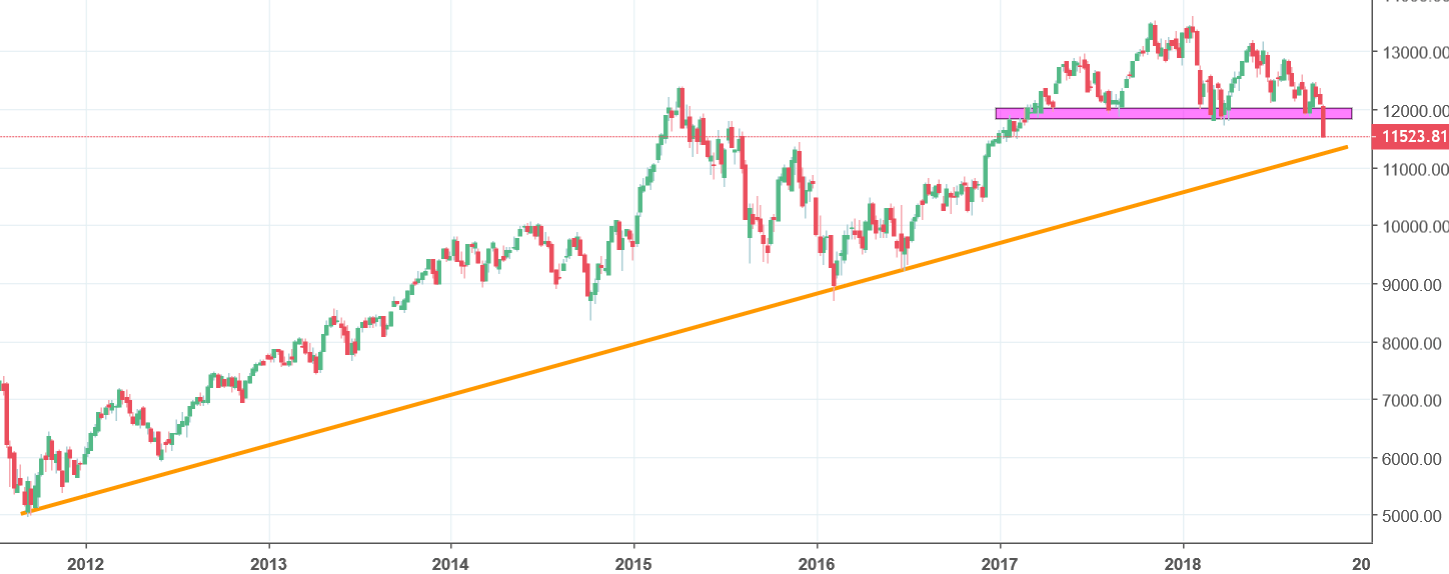

Well, that was not a good call. The price ignored the mid-term situation and decided to play the scenario from the weekly chart, so a giant head and shoulders pattern. Last week, brought us a breakout of the neckline (pink area), which is a trigger to go short. As for the potential target, we do have a long-term up trendline (orange), which connect higher lows since the 2011. That can be the first stop. Breakout of this line can be really catastrophic and from the technical point of view, can indicate a start of the bear market or if you will, a recession. As long as we stay above the orange line, many traders will thing about buying but you need to be aware of the fact that we do not have any bullish signs at the moment.

Comments (0 comment(s))