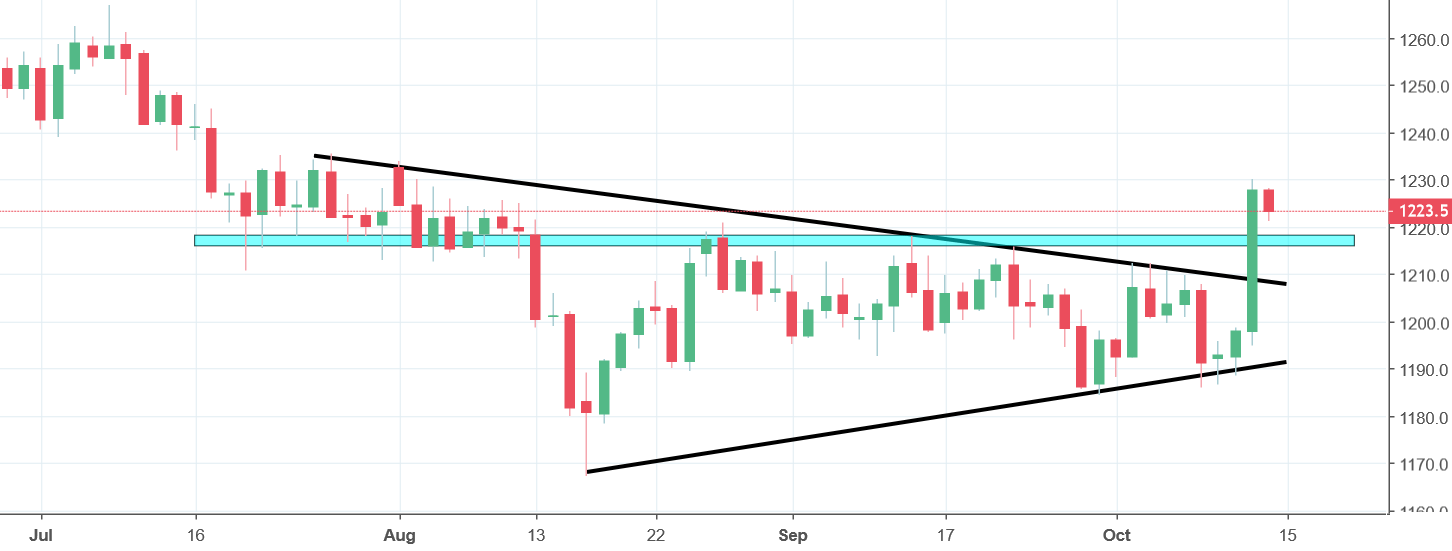

Gold Analysis – A breakout, finally…

Decline on stocks is a fuel for the Gold to climb higher. Precious metal is on the highest levels since the 1st of August and we do have a legitimate buy signal here. Previously, we wrote about the Gold on the 3rd of October and back in that day we were bullish, anticipating a buy signal:

“It may indicate that there is a shift on the market and that the precious metals are entering the bullish trend. Buying now is not the best idea though. We are below the green resistance. Only the price losing above that line will be a proper signal to buy. „

Yes, at the end of the day we were right but before that happened, we had small decline, which tested the lower line of the triangle as a support. Anyway, yesterday, the price broke the upper line of the symmetric triangle pattern and the horizontal resistance on the 1217 USD/oz (blue). That gives us a proper buy signal. As for now, we may experience a small pull-back, which would be typical but in the mid-term, we should see gold much higher than today.

Comments (0 comment(s))