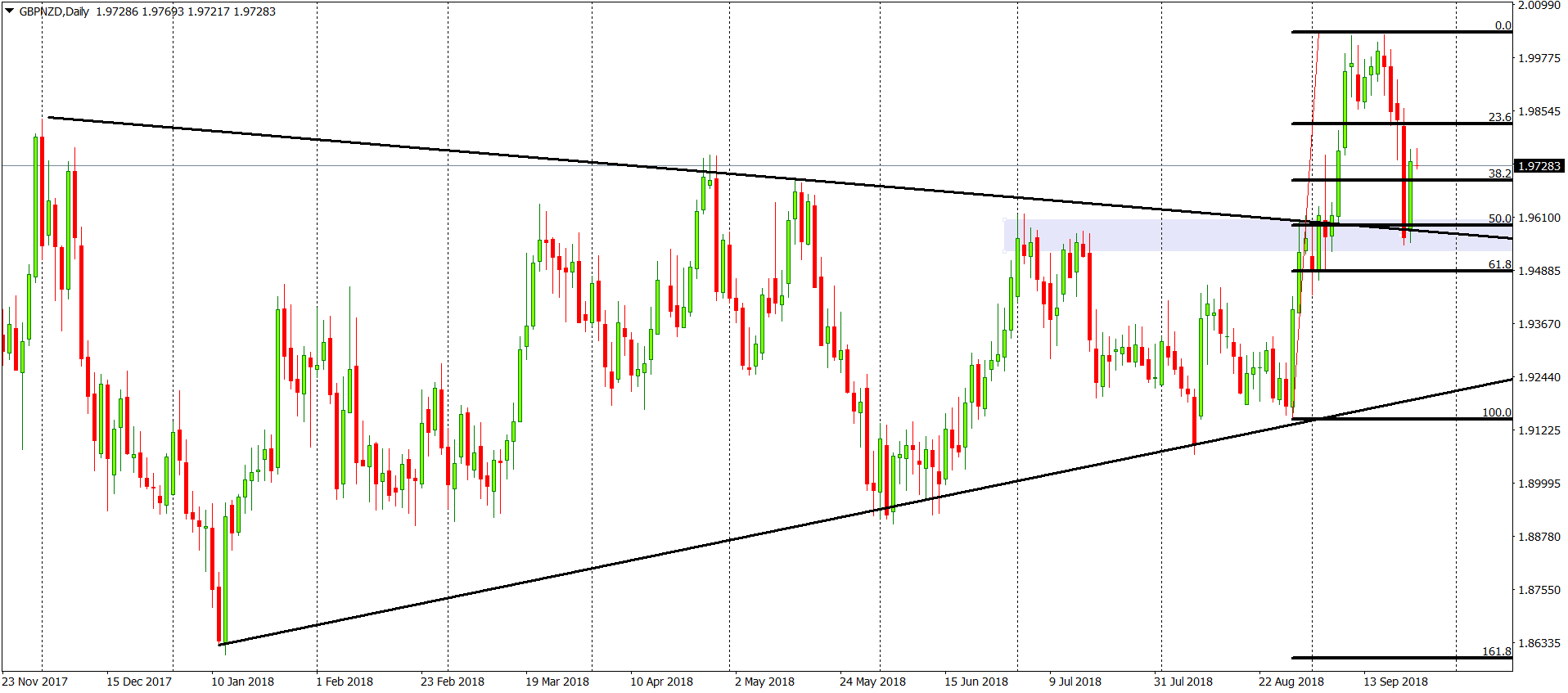

GBPNZD Analysis – Nice boounce but the buy signal is not there yet…

Forex part of today’s analysis starts with the GBPNZD, which was previously mentioned here on the 20th of September. Back in that day, the price was testing a recent resistance as a closest support and we were waiting for a bullish price action to jump in with a long position:

“Why it is great? Because any bullish reversal pattern here will be a great buy signal. Any type of an engulfing or a long tail on the 38,2% Fibo and the support mentioned above will be an excellent occasion to go long and can bring interesting profits. „

The price broke the 38,2% with relative ease but there was a next support there just waiting for an action – 50% Fibo. That line was tested yesterday and brought us a nice bounce! Apart from 50% Fibo, we had there an upper line of the triangle there so that was a combination of two important supports! You have to admit that it was a great place for a reversal! The price indeed bounced but we still have one problem with this setup. Daily candles do not form any bullish pattern. Despite a nice rise, this is still a inside bar, which for me is not a significant signal to go long. At least alone.

I think that we can wait a little bit more. Price closing a day above the close of the yesterday’s candle will be nice signal to buy.

Comments (0 comment(s))