Benefits of cTrader Copy Over PAMM

While many people are looking for a passive investment, others are thinking how to make an additional gain from this. Investment programs, such as copy trading and PAMM, provide means to cover these needs. But what is the difference between the two?

Many of you are already familiar with the model of PAMM. Investors allocate their funds in a certain proportion to the selected Money Manager. The Money Manager trades the sum of funds from their own investments and of the Investors’ with an aim to generate profits. The fees are deducted from the pool of assets by the Money Manager for providing their service to Investors. The generated profit is then distributed between Investors and the Money Manager themselves according to the initial funds’ allocation percentage.

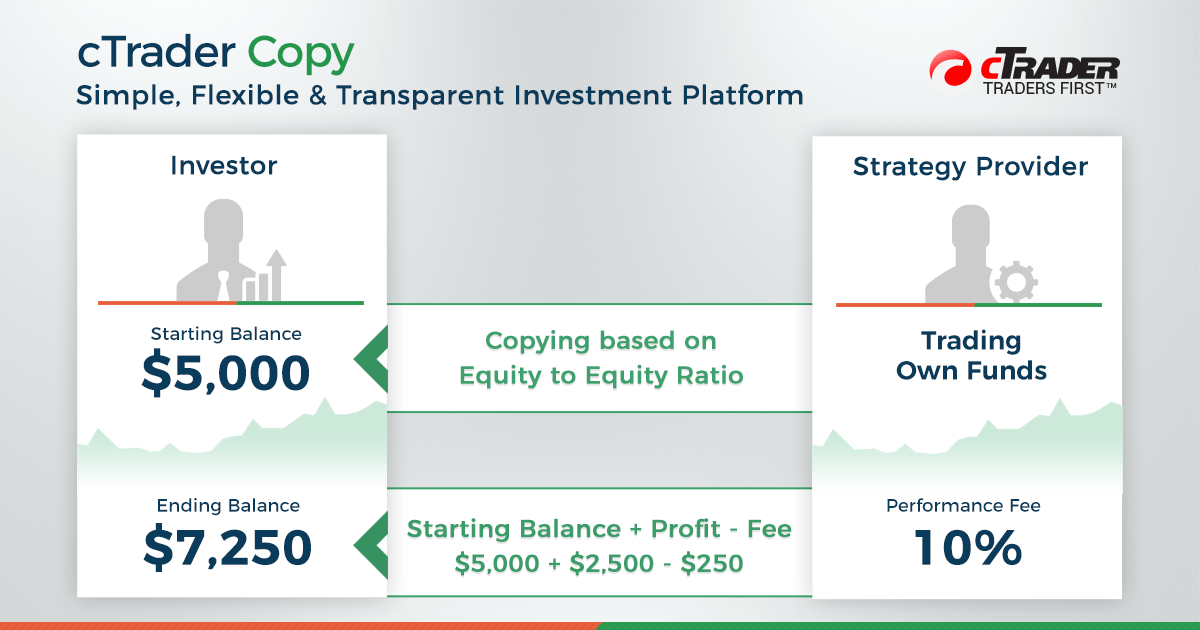

To review the model of Copy Trading, let’s look at cTrader Copy, an easy and transparent Copy Trading service that has recently been added to the popular cTrader FX and CFD trading platform. In cTrader Copy, there is a huge variety of strategies to invest in. They are available from Strategy Providers trading with many different brokers. The Strategy Provider also charges fees for allowing Investors to copy their strategy. However, Strategy Provider only trades their own funds, not the funds of Investors’. The trade volume that will be copied and the gains (or losses) the investor will receive is defined according to the ratio of Investor’s equity to the Strategy Provider’s equity.

cTrader Copy shares the advantages of PAMM, as both models offer Investors the possibility to invest their money and get potential profits while allowing Strategy Providers and Money Managers to receive extra earnings. But it also enhances PAMM and offers additional benefits over it. Let’s look more closely at them.

Accessibility

In PAMM, Investors have to sign an agreement first and Money Managers have to meet certain criteria set by their broker. With cTrader Copy, the process of getting started is much easier. Any trader can become a Strategy Provider or an Investor simply by creating a Copy Trading Account in cTrader. What’s more, they don’t have to be tied up to one broker only (unless the broker has chosen to be isolated), as cTrader Copy is a cross-broker service. Thanks to this, Investors can choose to copy from a variety of different strategies and Strategy Providers can attract more traders to copy their strategies.

Trading Conditions

The cross-broker feature improves liquidity, thus reducing the role of volume in the investment strategy, unlike PAMM where the execution price drops down due to the large amounts of funds traded. Also, when Investors in PAMM decide to exit, the amount of trading funds available for Money Manager is reduced and, hence, his trading conditions change. This doesn’t happen in cTrader Copy, in which Strategy Provider’s funds are not affected by Investor.

Control of Funds

To invest in PAMM, Investors have to transfer their money to PAMM account controlled by the Money Manager, who will then trade the sum of all funds, his own and Investors’. With cTrader Copy, Investors are in full control of their funds. They don’t need to transfer their funds to Strategy Provider, as he trades only his own funds. At any given time, Investors can increase or decrease their equity or funds allocated to the selected strategy. They can also easily withdraw their profits partially or in full. This is in contrast to PAMM, where all funds are kept by the Money Manager with no simple way to withdraw them or make changes to the amounts.

Fees Structure

In both investment programs, Strategy Providers and Money Managers charge fees for providing their services to Investors. In PAMM, however, there are usually only performance fees available to charge, whereas in cTrader Copy, in addition to performance fees, Strategy Providers can choose to charge also management and volume-based fees, along or in any combination. This provides much more flexibility and a possibility to reach their goals.

By providing more transparency, accessibility, flexibility, control over funds, cTrader Copy becomes a truly versatile investment platform that can serve the needs of any kind of Investor, Professional Trader or PAMM manager.

Comments (0 comment(s))