Will Scrutiny Of Coinbase Rattle Cryptocurrency Industry?

The U.S. Internal Revenue Service (IRS) has Coinbase, a popular cryptocurrency exchange, in its crosshairs. The tax agency suspects the platform is used as a haven for tax evaders and it is now asking the court to compel Coinbase to turn over client data covering several years. But Coinbase wants to hold on to the data, saying it has not broken any law.

The IRS is interested in identifying U.S. active users of Coinbase. The agency is specifically interested in Coinbase’s client data from 2013 to the end of 2015. The data demand is part of IRS probe into whether users of Coinbase exchange platform failed to disclose income transactions as required for tax purposes.

As per IRS, virtual currencies are a property and U.S. taxpayers who make gains from trading such currencies should report their taxable gains. IRS suspects Coinbase users don’t do that and it wants to know who they are and what they have transacted on the platform. The agency believes laying hands on the multiyear transaction data will help it determine whether Coinbase clients complied with the tax law or avoided taxes on their digital currency gains.

The data that IRS is seeking from Coinbase include account statements and records of payments.

The IRS back in 2014 told taxpayers that they needed to declare gains they made on cryptocurrency transactions. Now the agency is moving to crack the whip.

Examples of tax dodging

The IRS says it has reasonable ground to question transactions on Coinbase. The agency says it has several examples of tax evasion transactions involving digital money. The IRS cites a case of two U.S. taxpayer companies that it says used Bitcoin to book shady tech expenses to lower their tax burden. The agency further said another taxpayer moved money to an overseas tax haven and then wired it back into the country in the form of Bitcoin, a transaction that the IRS contends allowed the taxpayer to dodge taxes.

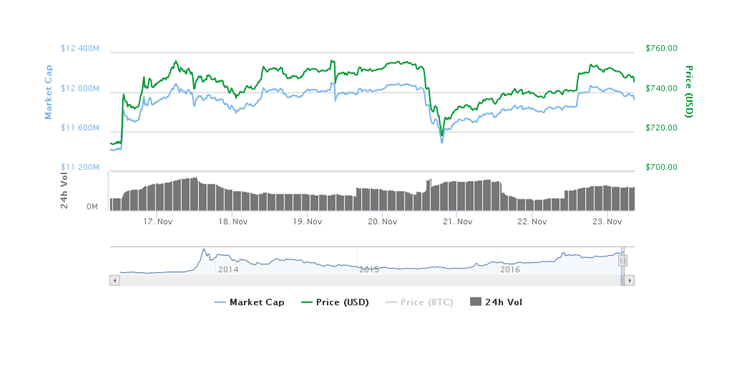

The IRS is targeting Coinbase because it is a popular Bitcoin exchange platform and Bitcoin is the most popular of the cryptocurrency family. Bitcoin price soared in the run-up to and after the U.S. election that resulted in Donald Trump clinching the White House in an upset victory against Hillary Clinton. The digital currency has held on its post-election gains, with BTC/USD trading at $746. Bitcoin has a market cap of $11.9 billion.

Implication of IRS probe on cryptocurrency industry

But the scrutiny of Coinbase could rattle Bitcoin and the cryptocurrency world. If the IRS gets away with its data demand, it could spark a trend where regulators in other jurisdictions where digital currency exchanges operator would also want to scrutinize the trades. That may scare off investors, leading to a plunge in Bitcoin value that could in turn pull down the prices of other cryptocurrencies or altcoins such as Zcash, Litecoin and PeerCoin.

Governments showing interest in cryptocurrency

However, cryptocurrencies, or at least the blockchain technology that they use, seem to have a bright future. Just recently China’s central bank put up a job advertisement calling for experts in blockchain and cryptography in what is seen as Beijing’s effort to develop a national digital currency. The central bank of Sweden has also opened discussions to see if the country is ripe for a government-issued digital currency. That comes at a time when Sweden is recording declining levels of hard cash transactions.

Comments (0 comment(s))