European currencies and forecasts for Euro adoption

Euro is one of the most popular currencies in Forex, with EUR/USD pair being the traders’ favorite. Indeed, the euro is traded with many other currencies too. Therefore, the EUR traders undoubtedly have lots of different opportunities to cash in on the Eurozone economic strength.

Needless to say that the euro plays a big role in the European financial system. In the EU, already 19 members use the euro and the rest (except for Denmark and the UK) will have to adopt it.

Although the euro seems to be a nice invention, some hesitation surrounds it. The reason is simple – the non-EUR countries, which are expected to adopt the euro, are afraid of the Eurozone instability that came out in the form of the European Debt Crisis. Additionally, in some cases the EU skeptic political agenda also contributes to the delays in the adoption.

Nevertheless, the ECB president, Mario Draghi is still confident about the future of the single currency and his administration will do whatever it takes to preserve it. “The euro is irreversible” – he once said.

In case you feel about the euro like Mr. Draghi does, you may be interested in having some stylish merchandise to express it. Check out the “Euro is Irreversible T-Shirt”.

It is fair to say that the enlargement of the Eurozone is under a big question mark. Yet, let’s try using the crystal ball and also do some research to make some predictions about the future euro adoption. Besides that, we suggest deepening our knowledge about some of the current users of the euro while also mark the European countries that have little to no probability to adopt the single currency at all.

How does a country join the Eurozone?

Before we dig into some analysis, it is important to point out the way that the EU member states should follow to join the Euro area. Specifically for this purpose, the EU officials crafted the ERM II framework. The two-year long exchange stability program, ERM II is an obligatory step in the euro adoption process. The idea behind this is to peg the non-euro currency to the euro at ±2.25%, allowing the fluctuations only within the set limits. Additionally, participation in ERM II encompasses several criteria, including the acceptable levels of HICP inflation, budget deficit, exchange rate, long-term interest and compatibility of legislation. In fact, the only participant of ERM II is Denmark.

Sooner or later, adopting euro is a must for 7 non-euro EU members states, with an exception of Denmark because of an opt-out and the UK (we all know why).

At the moment of this writing, the current euro refinancing rate (main interest rate in Eurozone) is kept at 0%. On the flip side, the inflation rate in the Euro area is slightly above the target level – 2.1%.

Known Dates of EUR adoption

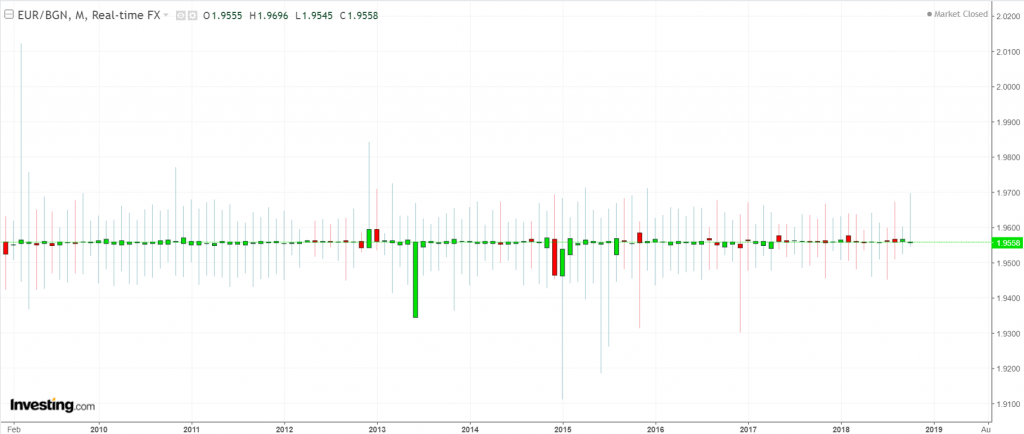

Bulgaria

Perhaps, one of the states closest to adopting the Euro is Bulgaria. The country joined EU in 2007, while its currency, the Bulgarian Lev (BGN), has been pegged to the Euro since the single currency inception in 1999. The exchange rate of EUR/BGN is 1.96. As for the interest rate and the inflation rate, both of them are kept at the level of 1.4%, which meets ERM criteria.

Recently, Bulgaria expressed its willingness to adopt the euro and the European Union backed the initiative. Furthermore, Bulgarian finance minister Vladislav Goranov and the central bank’s governor Dimitar Radev announced that they anticipate July 2019 to be the date of ERM II participation, while also joining the banking union. It will take 2 years onwards from July 2019 until the full adoption of the euro, i.e. in July 2021.

Estimated Dates of EUR adoption

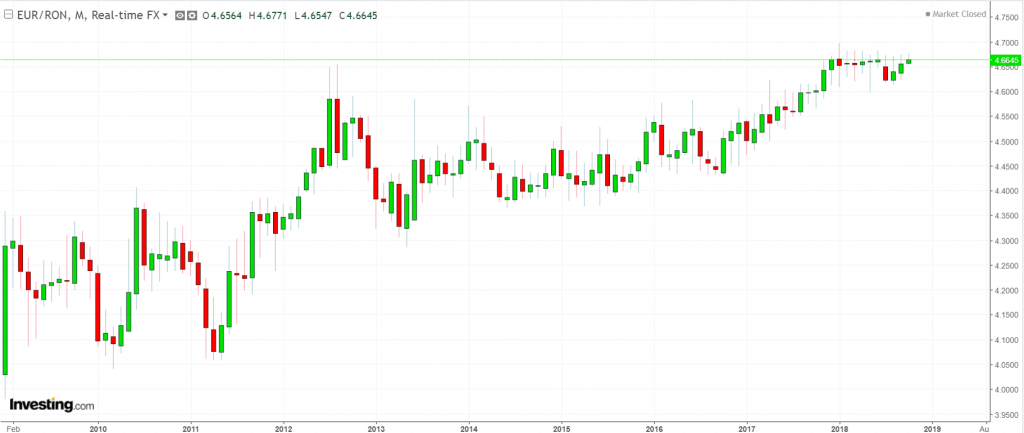

Romania

As for Romania, the state is positive about possible euro adoption, once the country is able to meet the necessary criteria. Yet before this important milestone is achieved, Romania will stick to its national currency – Romanian Leu (RON). Unlike the lev, the leu is not pegged to euro, and the exchange rate of EUR/RON is 4.67. The current inflation rate in Romania is 5%, while the interest rate was set at 2.5%.

Since Romania is eager to join the Eurozone, it is only a matter of time. Assessing the state of meeting ERM II criteria, the ruling Romanian Party of Social Democrats announced that the plausible date of euro adoption is 2024.

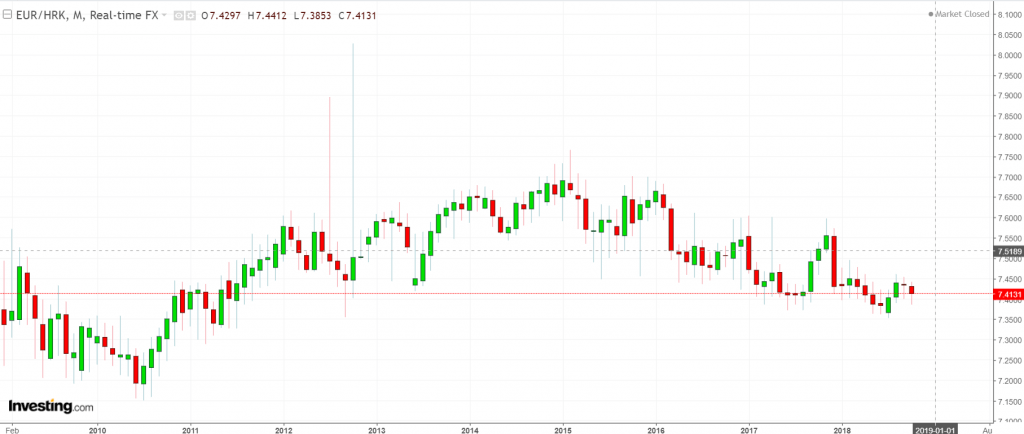

Croatia

The latest country that joined the European Union is Croatia, which entered the bloc in 2013. Although the state is not using euro at the moment, it has intentions to do so in the future. Moreover, Croatian national currency Kuna (HRK) has been closely following euro, as envisioned by Croatian National Bank policy. The exchange rate of EUR/HRK is 7.42, while inflation and interest rates are 2.1% and 2.5% respectively.

The Croatian government has been considering the euro adoption upon 2-3 years after joining the EU. Yet the economic situation within the country did not really position Croatia towards entirely meeting the ERM II criteria. However, according to Croatian PM Andrej Plenkovic, the country seeks to join the eurozone in 2023-2025.

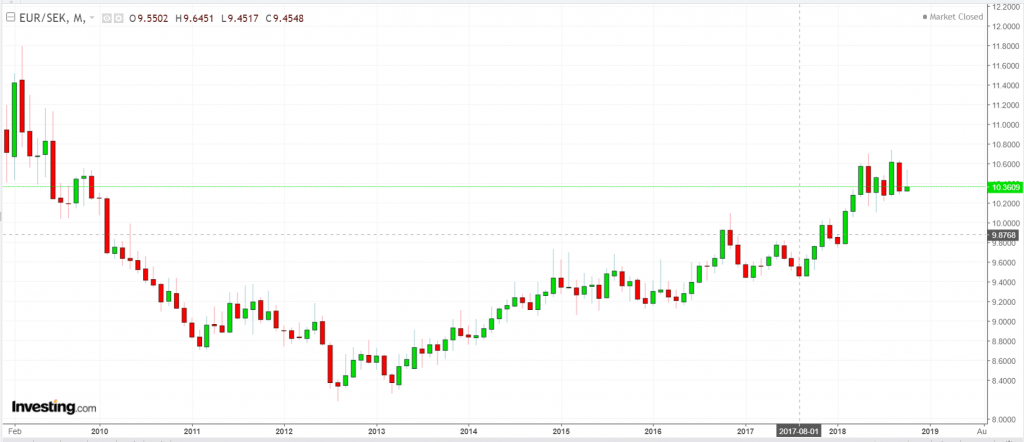

Sweden

Sweden is a non-euro country on our list that uses the Swedish krona (SEK) as its currency. Despite the fact that Sweden meets the main convergence criteria of ERM II, it is not part of the framework and has no plans to join in the nearest future. Swedish officials note that the decision to adopt euro is left up to the national referendum. Yet it is unknown when such a referendum will be called upon. On a side note, the EU accepted the non-EUR status of Sweden for the time being.

However, according to Frankfurter Allgemeine info, the EU has the plan to complete the “Euro area cooperation” by 2025, which may be seen as the deadline for Sweden to proceed with the decision regarding the euro adoption. In case no opt-out is negotiated, we suppose that Sweden will have to adopt the euro by no later than 2027.

Swedish krona floats freely alongside other currencies and it is not pegged to euro. The current exchange rate of EUR/SEK is 10.37. As for the interest rate, it is kept at the record-low and negative value -0.5%, while the inflation rate is 2.3% now.

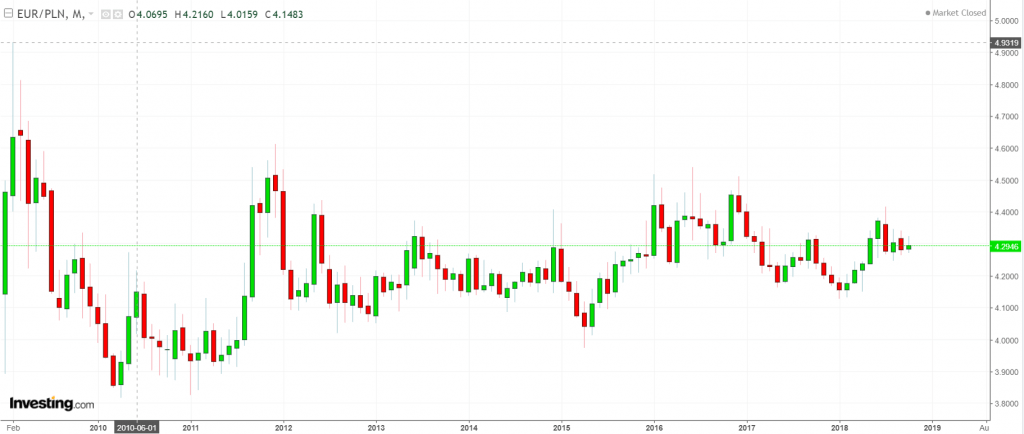

Poland

Poland is a country that is not using euro as its currency and is not the participant of ERM II, but since joining EU in 2004 it has a direct obligation to change this. Currently, the state’s currency is Polish zloty (PLN), that has a floating exchange rate, not pegged to euro. The exchange rate of EUR/PLN is 4.30 at the moment of this writing. In terms of interest rates, they are kept as low as 1.5%, whereas inflation in the country is 1.8%.

According to some of the Polish officials, the steps for euro adoption may start not earlier than 2020. Such a decision would require at least ⅔ of Sejm members’ votes in order to be implemented. However, the ruling party Law and Justice strongly opposes the participation of Poland in the euro area. Therefore, it is also up to political vector in the country that may determine the fate of the single currency adoption within the region. In 2019, Poland will have parliamentary elections.

It is fair to admit that the Polish economy is strong enough to proceed with the replacement of PLN with euro. In case the stars align for the single currency in Poland, we think that the country may adopt the euro in 2025-2028.

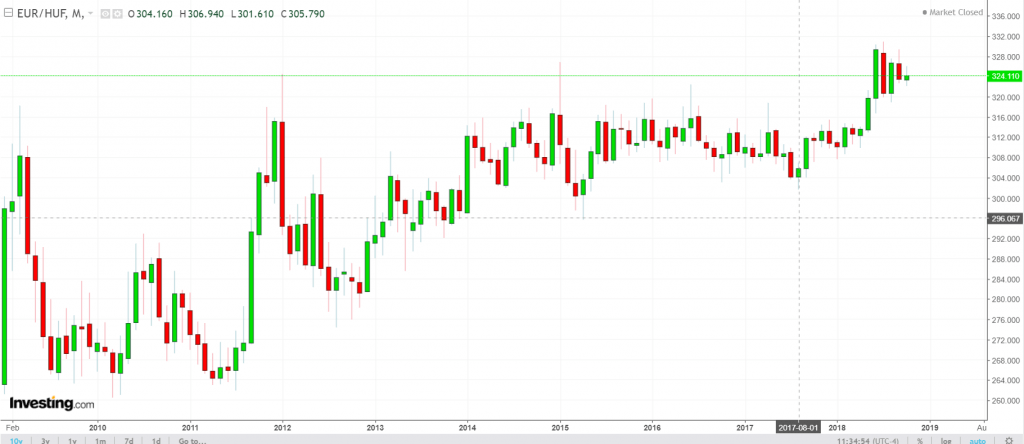

Hungary

Another next candidate for Euro adoption in Hungary. At the moment, Hungary is using forint (HUF) as its currency. Like Poland and Sweden, Hungarian forint is not pegged to euro and is floating freely – the current exchange rate of EUR/HUF is 324.67. The inflation rate is 3.6% as for September 2018, which is higher than required under ERM II. The opposite situation is with the interest rate which constitutes 0.9%.

Initially, Hungary was willing to replace forint (HUF) with the euro in 2010, but it could not meet the necessary convergence criteria for ERM II, with high public debt, inflation, and budget deficit. Thus, the target date for euro adoption was postponed indefinitely. On top of that, the conservative government with the prime minister Viktor Orban at the lead are somewhat reluctant towards adopting the euro at the current state of things, both from economic and political perspectives. Moreover, the Hungarian government previously stressed that forint may be kept as the state’s currency for the next decades.

Yet if the political agenda in Hungary changes, possibly due to the next parliamentary elections in 2022, it may signal positive news for the subsequent euro adoption. Until then, we envision 2027 to be the date when Hungary may replace forint with euro.

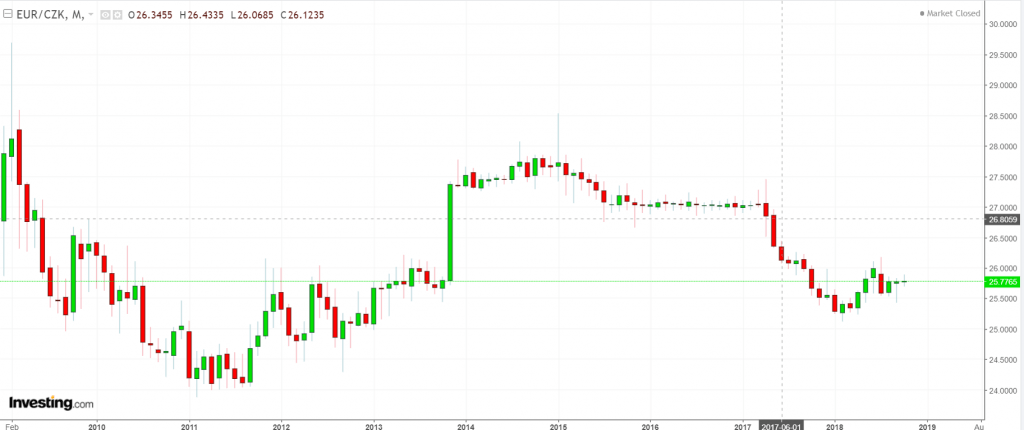

Czech Republic

Similar to other states previously mentioned, Czech Republic is using its national currency Czech koruna (CZK), not pegged to the euro. Likewise, the country is not a member of ERM II and does not plan to join the framework any time soon. The current exchange rate of EUR/CZK is 25.81. The inflation rate is 2.3% at the moment of writing, while the interest rate is kept at 1.5% level. One can see that the Czech Republic is well-positioned for euro adoption, so why it has not happened yet?

Both the government and people are not in favor of replacing koruna with euro, which can be traced to the European debt crisis as the reference to eurozone instability. Newly elected Czech government with the prime minister Andrej Babis in 2017 emphasized that they have no intentions to proceed with adopting euro nor joining ERM II. Hence, until the end of the term, namely 2021, any chances of euro adoption are excluded. That being said, joining the Euro area remains the country’s obligation, which it probably may fulfill by the year 2025.

Countries that adopted EUR recently

In order to provide the additional view into the euro adoption process, we suggest looking into the Baltic EU member states, as those are the latest examples of the Eurozone expansion. Namely, we are going to examine Estonia, Latvia, and Lithuania.

Estonia

Right after becoming the EU member state in 2004, Estonian kroon joined ERM II with the aspirations to adopt the euro in 2007. Yet the country postponed its decision until January 1, 2011, when it finally entered the Eurozone after satisfying the required criteria. The kroon was pegged to the euro at the exchange rate 15.6466 krooni for €1.

What’s also noteworthy about Estonia is that it became the first post-Soviet and Baltic country to adopt the euro.

Latvia

The second Baltic country that made it to the Eurozone is Latvia. As we know, Latvia joined the EU in 2004 along with other 9 states. Latvia initiated the euro adoption process in May 2004, and since 2005 it pegged the Lats to the euro at the rate of 0.702804 lats for €1. The same year, Latvia joined the ERM II framework. Yet it was only the year 2014 when Latvia finally put the euro into the circulation, replacing the lats.

Lithuania

The most recent member of the Eurozone is Lithuania. Like other Baltic countries, Lithuania entered the ERM II in 2004. Its previous currency, the Lithuanian litas was pegged to the euro at the exchange rate of 3.45289 litai for €1. In 2006, Lithuania failed the convergence criteria check, as the inflation slightly exceeded the EU requirement.

However, 8 years later the EU officials eventually approved Lithuania as the candidate for the Eurozone. Hence, it was decided that Lithuania would adopt the euro. The country did so on January 1, 2015.

Countries that use Euro unilaterally

Montenegro

Ironically, Montenegro is the country does not have the currency of its own. Before using the euro, Montenegro used the Deutsche Mark as its currency. The country adopted the Euro in 2002, although that violates EU regulations. Nevertheless, the EU officials did not try to prevent Montenegro from doing it. The inflation in the country is 1.9%, while the precise information about the interest rate as of 2018.

Montenegro is not part of the European Union and the unilateral use of Euro definitely decreases the chances of accession.

Kosovo

Even before declaring its independence in 2008, Kosovo adopted Euro in 2002 unilaterally. It did cooperate with ECB on the matter but is not the member of the eurozone. While the inflation rate in Kosovo is reportedly 1.5%, there is no accessible information about the interest rates in the country. Similarly to Montenegro, violation of the euro adoption rules creates additional odds on the road to the EU membership.

Countries that are unlikely to adopt Euro at all

Denmark

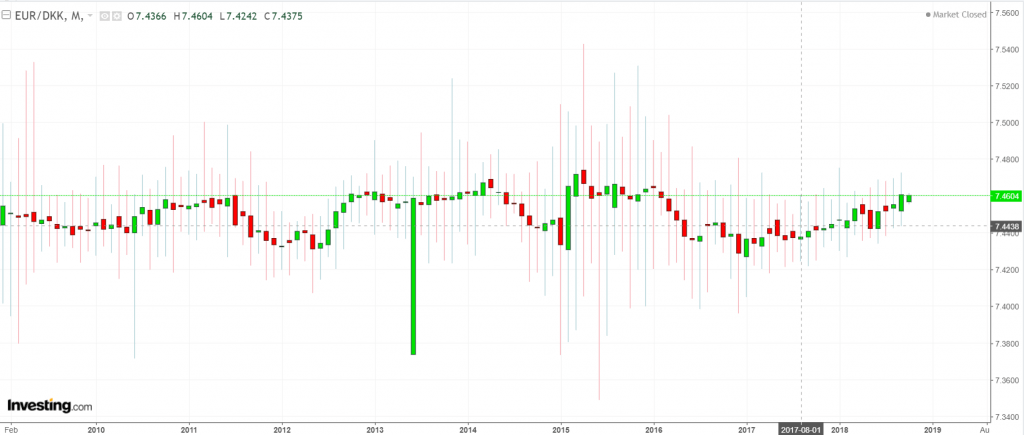

As we previously mentioned, Denmark is the sole participant of ERM II but is unlikely to ever adopt the euro as its currency. Instead, Denmark sticks to the Danish krone (DKK), which in turn is pegged to euro at 2.25% as defined by ERM II participation. The exchange rate of EUR/DKK is 7.47. In addition, the inflation rate is 0.6%, while the interest rate is -0.65%.

In 1992, Denmark negotiated the opt-out from the eurozone. What’s more, the Danish government held the nationwide referendum in 2000 to determine whether the country should adopt the euro. Eventually, the initiative was defeated with 53.2% of people voting against the proposal.

The United Kingdom

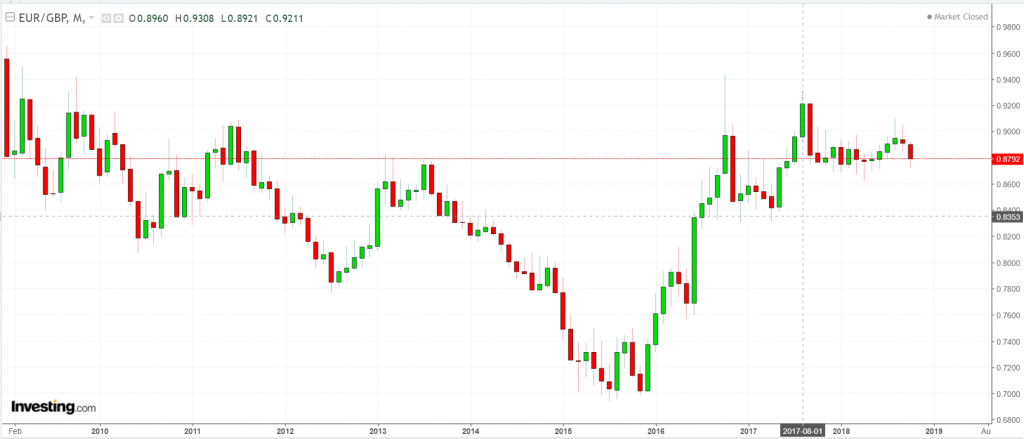

Just like Denmark, the United Kingdom secured the opt-out from the euro upon adoption of the Maastricht Treaty in 1992. The country never expected to adopt the euro and now any chances of that are buried due to Brexit. For this reason, the United Kingdom will continue using the Pound Sterling (GBP) for the indefinite time. Despite that, the euro is still used in the British overseas territories like Gibraltar and the Cypriot areas of Akrotiri and Dhekelia.

GBP is a free-floating currency and the EUR/GBP exchange rate is 0.88 at the moment of writing. In terms of interest rate, the Bank of England keeps it at 0.75% level, while the inflation rate is 2.5%.

Switzerland

Switzerland is not a member of the EU but is a part of EEA. Nonetheless, Switzerland is using its own currency the Swiss Franc (CHF). The franc used to be pegged to the euro at 1.2 from 2011 until the peg was scrapped by the Swiss National Bank in 2015. The event became known as Black Thursday that was in many ways detrimental to Forex traders that traded EUR/CHF pair. Now the EUR/CHF exchange rate is 1.15.

Additionally, Switzerland keeps the interest rates at -0.75%, while the inflation rate in the country is only 1%.

Norway

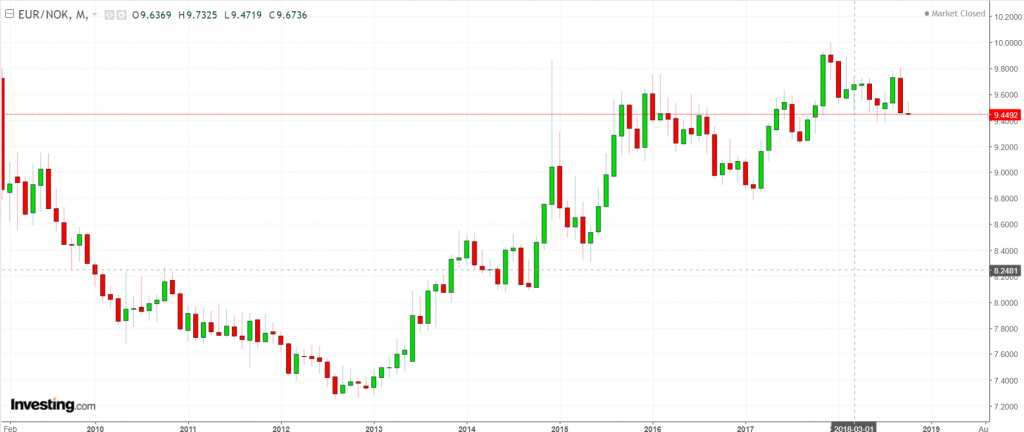

Similarly to Switzerland, Norway is also not part of the European Union, although it is a member of EEA. Hence, it does not use the euro nor does it peg Norwegian krone (NOK) to the single currency. The exchange rate of EUR/NOK is 9.46. As for the inflation rate in Norway, it is at 3.4% level at the moment of writing, while the interest rate is 0.75%.

Iceland

The last European currency to mention is Icelandic krona (ISK), the national currency of Iceland. Like NOK, ISK has never been pegged to euro and is unlikely to ever use the single currency as it is not a member of the EU. The exchange rate of EUR/ISK is 134.58.

The Central Bank of Iceland has set the interest rates in the country at the level of 4.25%, whilst the inflation rate is 2.7%.

The Bottom Line

The idea of the single currency in Europe is somewhat controversial within the EU. Sure, more than the half of EU member states replaced their currencies with euro, while ERM II candidates are cautious about introducing the currency. In some states, like Sweden, Poland, Hungary, and the Czech Republic, the euro adoption diverges from the political and economic interests of the countries. And yes, it would be a mistake not to factor in the Eurozone crisis that discouraged the states to accelerate euro adoption.

However, what about EEA states like Norway or Switzerland? Well, the countries seem to enjoy their independent position and it is unlikely to change in the future.

As for Montenegro and Kosovo, the unilateral use of the euro puts the countries into the stalemate. Although ECB does not intend to prevent the euro circulation there, any ambitions of the states to join the EU will most likely meet serious objections.

Comments (0 comment(s))