How much could you bet on bitcoin with?

A mystery investor has been reported to bet on bitcoin with about $1 million. The story was reported by the Wall Street Journal yesterday, but the identity of the investor was not available. The bet was made by purchasing call options set to expire at the end of 2018, hoping that the value of bitcoin will reach $50,000 by then. It is an audacious bet on bitcoin, even despite the recent rally by the coin. If it were you, would you make the same bet?

What are the details of the bet on bitcoin?

The transaction was performed on the LedgerX exchange, a derivatives exchange that deals in, among other things, options. When call options are purchased, they give the buyer the right to purchase a specific asset at an agreed upon time in the future, or even before then. However, the options expire after the date passes and become useless. The opposite type of options are called puts, which give the owner the right to sell an asset at or before a specified date in the future.

Options are used by investors to make sure that they can hedge against risk by ensuring they pay their preferred price. For example, if Apple would like to ensure they pay a particular price for aluminium to be used on their next iphone, they would purchase call options with an aluminium manufacturer. When the date came, they would buy the aluminium at the agreed upon price, even if the market price for aluminium may have changed. In this way, Apple can plan exactly how much they have to spend for materials and not be shocked by changes in market prices.

As for the bet on bitcoin, the investor’s call options give them the right to buy bitcoin at $50,000 on or before the 28th of December 2018. They would have the right to purchase 275 bitcoin for $50,000 each, which would be a transaction of $13.8 million. The deal cost them $1 million for the options, which would not be a bad haul if it all works out. In fact, if bitcoin surpasses $50,000 and goes to, say, $75,000, they would still have the right to buy at $50,000.

On the other hand, if the prices don’t get to the $50,000 mark, they can choose not to buy the options. Remember, call options only give the investor a right, but it’s not mandatory. The only downside is that they would lose the $1 million investment if bitcoin fails to reach $50,000.

Is it possible for bitcoin to reach $50,000 in 2018?

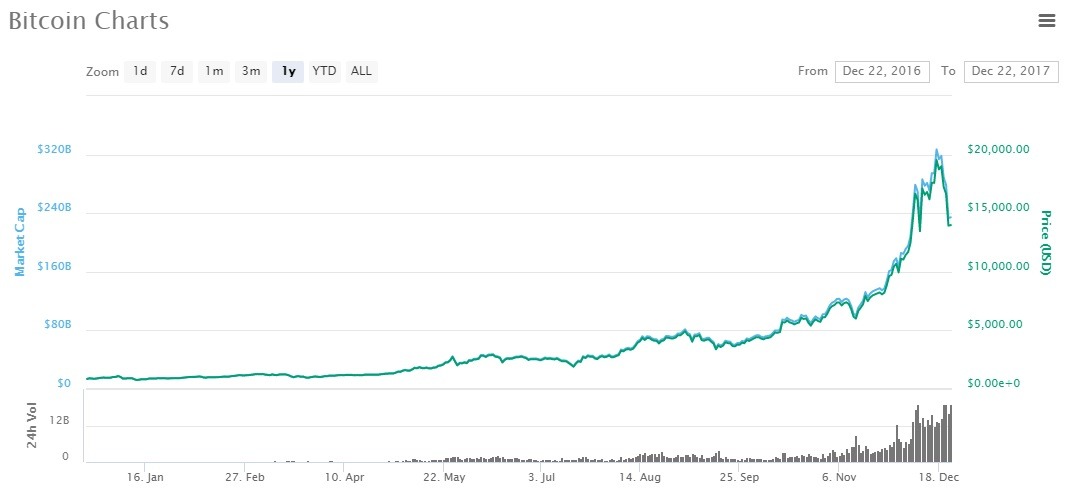

According to many experts, they have predicted a $50,000 forecast for bitcoin in 2018. Some have even forecasted $100,000, although this may be a bit too optimistic. The adoption of bitcoin provides the support for such a prediction. Not only have bitcoin futures become a reality, now even Goldman Sachs are planning to set up a bitcoin trading desk in 2018. If other investment banks follow this trend, they may create enormous liquidity in the markets and push prices to and beyond $50,000.

Comments (0 comment(s))