Major currency pairs analysis for Q1 2017

While it may be difficult to determine in the short-term, long-term major currency pairs analysis is much more reliable compared to short-term analysis. In this post, we’re going to focus on 5 of the major currency pairs and the analysis of the fundamental and technical factors in order to establish their performance for the first quarter of 2017.

EUR/USD

This pair will be the focus this year, with major changes in the Eurozone and the US. Forex traders are going to be looking for trading opportunities

Current situation

The EUR/USD pair remained on a constant downtrend throughout 2016 due to the quantitative easing (QE) measures taken by the European Central Bank (ECB). On the 10th of March 2016, the ECB dropped interest rates from 0.05% to 0.00% and this caused the Euro to weaken. All through the year, the ECB did not make any changes to the interest rates, and they have even said they will maintain the current rate until the end of 2017. It has chosen to do so because the European economy has remained well performing despite a few hurdles.

On the other hand, the FED already raised interest rates once on the 14th of December 2016. This year, they have promised to raise the rates even further, even more than once. With the election of Donald Trump, there is no doubting this, and the US dollar is expected to become stronger over the year. The fundamentals clearly point at a strengthening dollar and an uncertain euro, so the market sentiment is largely bearish.

Onto the technical analysis, however, you will notice that the pair has been on the up-and-up since the beginning of 2017. This may seem contrary to the fundamentals but now it has reached a critical resistance level at 1.0710 and has begun going sideways. Several exhaustive candles around this region prove that the bullish sentiment is running out of steam. If there’s going to be any more upward movement, it’s not expected to exceed the 1.10 level. Besides, the 100 SMA (simple moving average) shows a generally bearish trend that the pair has maintained ever since the US presidential elections.

Q1 predictions

Over the rest of the quarter, we expect to see the downtrend resuming. For the short-term, we have to wait and see if there will be any news that pushes the pair above this level or if it will drop back down.

Given the expected political changes in Europe, the euro is going to be facing some tough times. Meanwhile, the US dollar has still not really established its position and traders are mostly cautious about what will happen next. Therefore, the short-term prediction is uncertain, but the pair is expected to be bearish over the next months. We’re expecting a lot of news from Europe with Brexit’s Article 50 and other elections. All these might put a dent on the strength of the euro and it is most experts’ consensus that the pair will acquire a downward trend.

GBP/USD

The situation with the pound is very similar to that of the euro – uncertainty. Article 50 is expected to be triggered by the end of March this year, but this is also not certain. The UK Supreme Court has asked that the bill goes through parliament before it is triggered. This move might delay the execution of the hard Brexit Prime Minister Theresa May is looking for.

What this means for the pound

The June referendum on the Brexit sent the value of the pound spiraling downwards, but not as much as most expected. Besides, economic growth has been reported to be growing faster than ever. The Bank of England’s (BoE) decision to lower interest rates in August 2016 from 0.5% to 0.25% probably helped the economy. On the other hand, inflation was up by December and is expected to keep rising. This might spur the BoE to reconsider QE, but it can’t do so until there is a resolution on Article 50.

For now, all we’re left with is a lot of speculation and uncertainty as everyone waits to see what happens next. In these times of uncertainty, perhaps an analysis of the technical data could be of some help:

The effect of the Brexit vote was inevitable, and soon the pound’s value fell to about 1.28 where it held for several weeks. In October, though, there was a ‘flash crash’ that sent the value spiraling further downward to below 1.2. The value of the GBP/USD pair fell to a 3-decade low not seen since the 1980s. So, it’s difficult to see the value drop too far below its current level, and the prevailing sideways trend it probably all we are going to get.

Predictions for the GBP/USD pair

The short-term prediction is that the uptrend will remain active as the GBP/USD rises to test the 1.28 level. Whether the value breaks through will depend on any news coming from either the BoE or the FED regarding economic policies. The general sentiment remains bearish because unlike in the UK where there is a lot of uncertainty, the US dollar is favored to become stronger in the months to come.

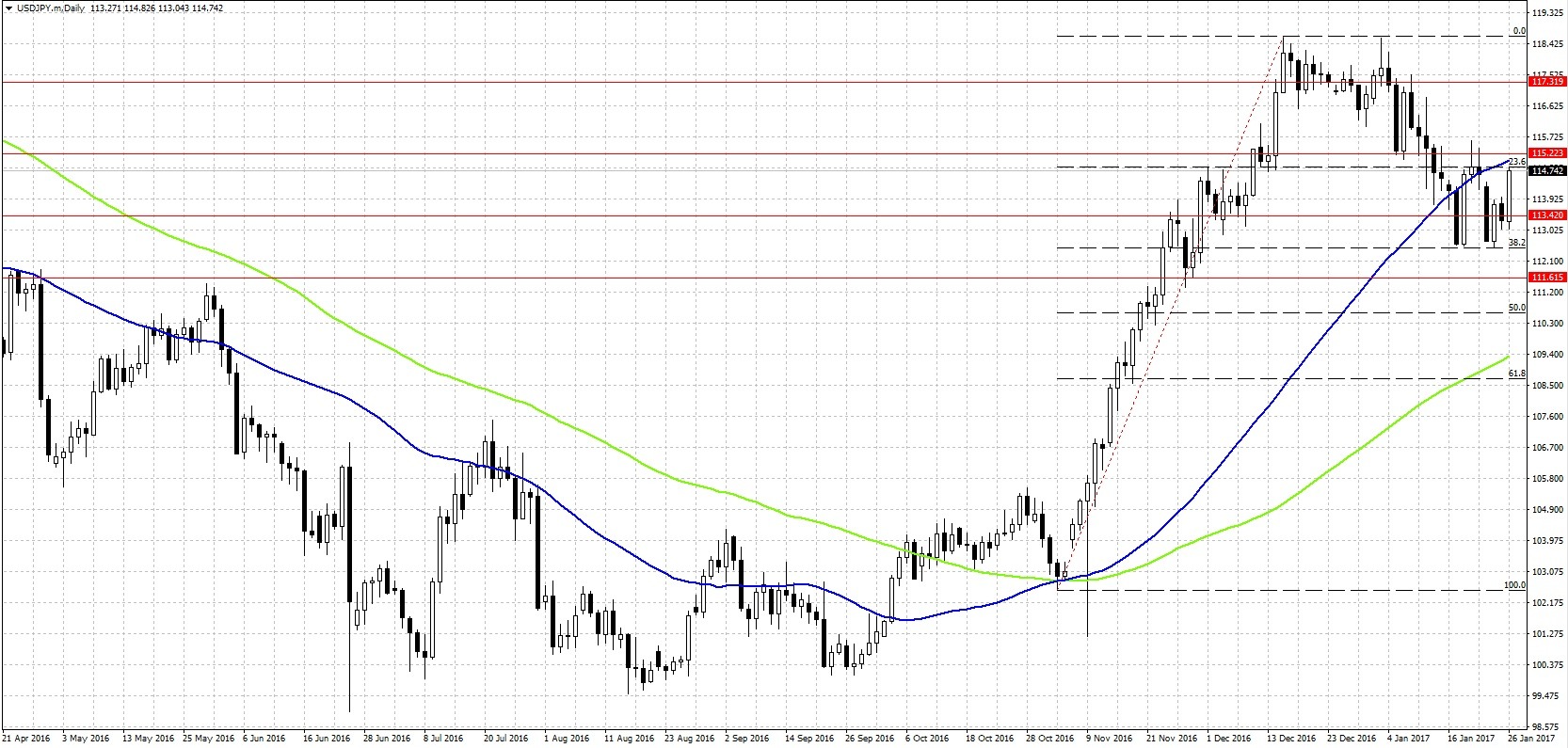

USD/JPY

This is another very heavily traded currency pair in the Forex market, and that’s because there is a lot of demand for the Japanese Yen to enable carry trades. Japan’s low-interest rates make it a favorite funding currency, and investors are always curious to know how the currency is performing.

Current levels

Just like other currency pairs with the US dollar as the base currency, the USD/JPY started to go up after the US elections. This trend was maintained for several weeks until a major resistance level around 117.32 was reached that the pair bounced back down. According to the Fibonacci retracement, the trend fell back down to the 38.2% Fibonacci level and has been ranging between there and the 23.6% levels.

The technical analysis shows a currency pair in range, and there is still no clear signal as to how it will proceed. The main levels to watch are the 115.2 resistance level and the 111.6 support level. These will be the determinant as to whether the pair resumes the uptrend or drops to the 50% Fibonacci level.

There have been some major moves with this pair so far this week following Trump’s statements about the trade. He would like to withdraw from the trans-pacific partnership (TPP) which slightly weakened the dollar. Other reasons for the drop were lower US treasury yields and the president’s belief the US dollar was getting too strong. All these points to the possibility of the US dollar getting even weaker in the coming weeks.

Q1 predictions for the USD/JPY pair

Statements by Trump concerning the soaring strength of the US dollar coupled with a strong Japanese yen point to a bearish sentiment in the short term. For the rest of the months in this quarter, there is still a lot of uncertainty and there is no clear consensus on where this pair might be by April. This is another case of wait and see – wait to see what the FED might do.

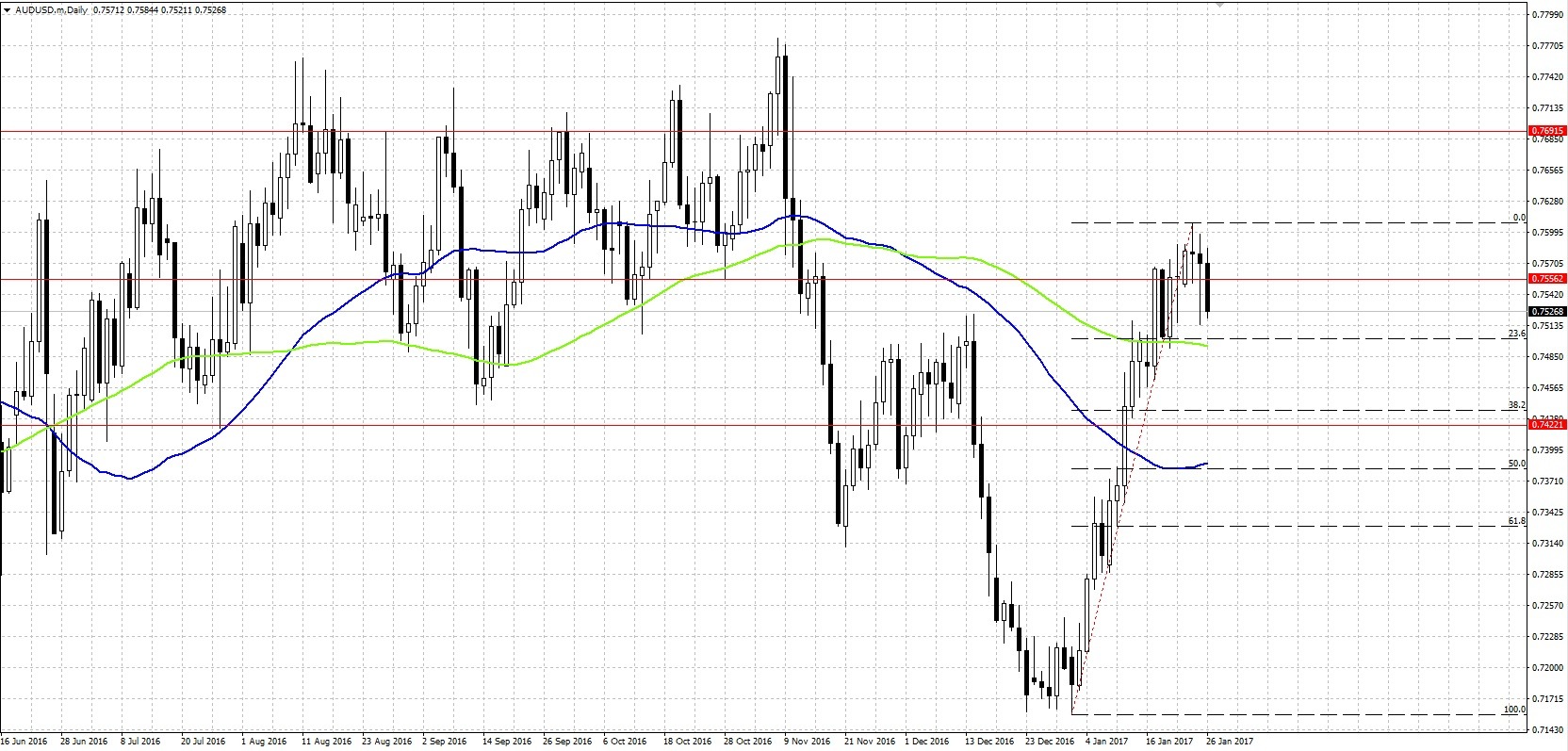

AUD/USD

This pair had been very up-and-down the entire year 2016, but it acquired a consistent uptrend from the beginning of the year. This is because of the rising value of gold this year, which greatly improved Australia’s economy. Australia is one of the biggest gold producers in the world, and increasing demand for it boosts Australia’s economy. In these times of political uncertainty, gold becomes a safe haven for investors, and this explains the recent uptrend.

However, we can begin to see Doji candles as the bullish sentiment for the Aussie starts to lose steam. The value of the Aussie is currently at a significant pivot point around 0.755, and it is expected to remain between resistance level 0.77 and support at 0.742. The Fibonacci retracement could mean that the value drops down to 23.6% or further to 38.2%. However, all eyes will be on next week’s FOMC meeting where we expect the FED to tell us their decision on interest rates.

Predictions for Q1

At this moment, the market sentiment remains mixed, and no one is really sure how this pair will move. The most anticipated announcement will come next week and that will determine how the AUD/USD moves for the rest of the quarter. If interest rates remain unchanged, then you can expect the pair to remain within its support and resistance levels. A further increase in rates will certainly send the AUD/USD hurtling down toward the 0.72 region for the rest of the quarter.

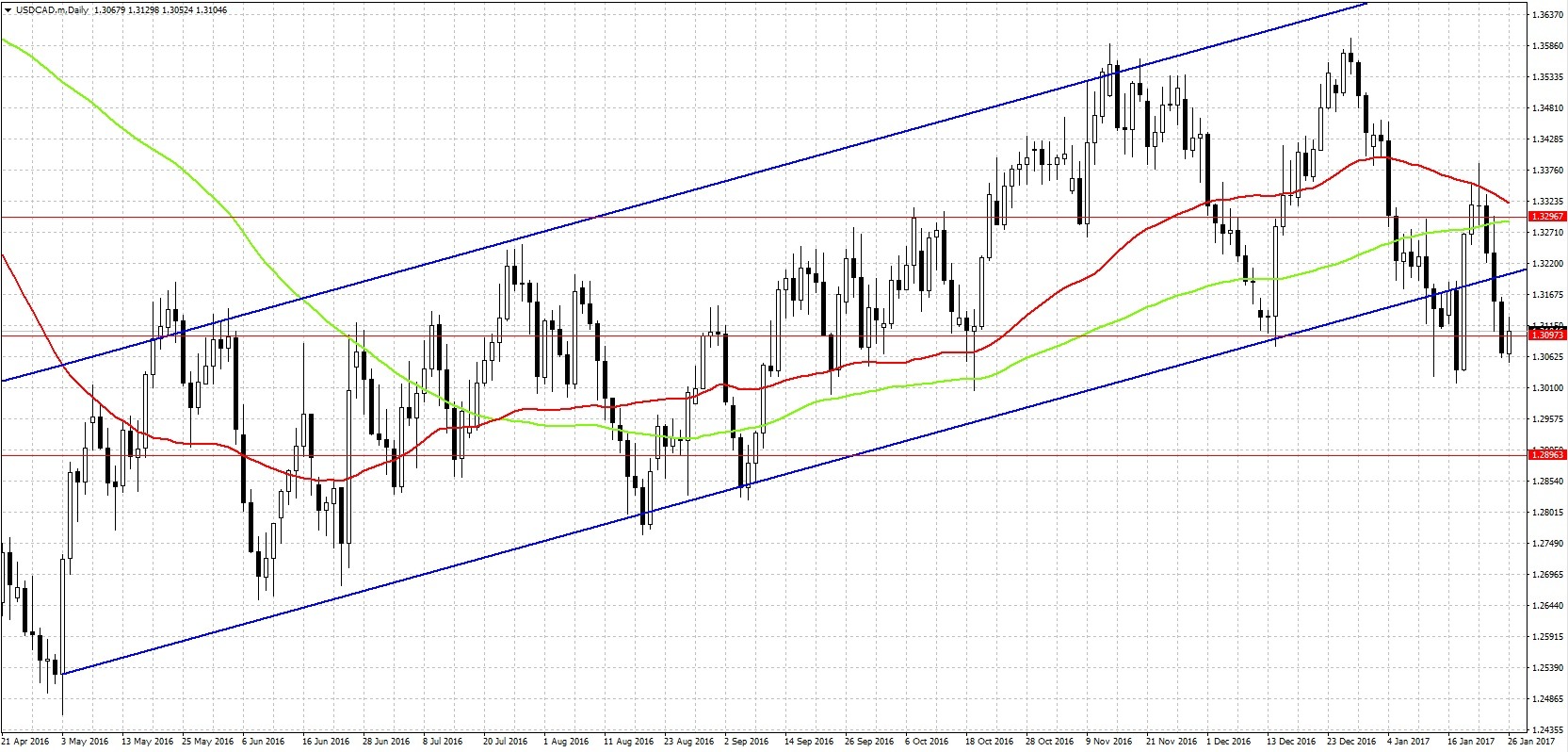

USD/CAD

After maintaining an upward trend for most of 2016, the Canadian dollar fought back following rumors of OPEC nations reducing output. This caused a reversal of the trend that led the USD/CAD to test the 1.31 pivot point several times now.

The 100-day SMA shows that a bullish sentiment is still active and that the uptrend might resume. Again, the focus will be on the FOMC meeting next week to establish a definitive prediction.

Q1 predictions

For now, you can expect the USD/CAD pair to range between 1.28 and 1.32 up until the FED announcement. Should the interest rates remain unchanged, the USD/CAD might fall down to the 1.28 region, but a further interest rate hike could send the pair into 1.35 territory.

Comments (0 comment(s))