Latin American economies and currencies to watch in 2017

Many countries in Latin America are considered to be emerging economies, and some may even show greater economic growth in the decades to come. The following are the Latin American economies to watch in 2017 according to the countries in which they are based

Venezuela

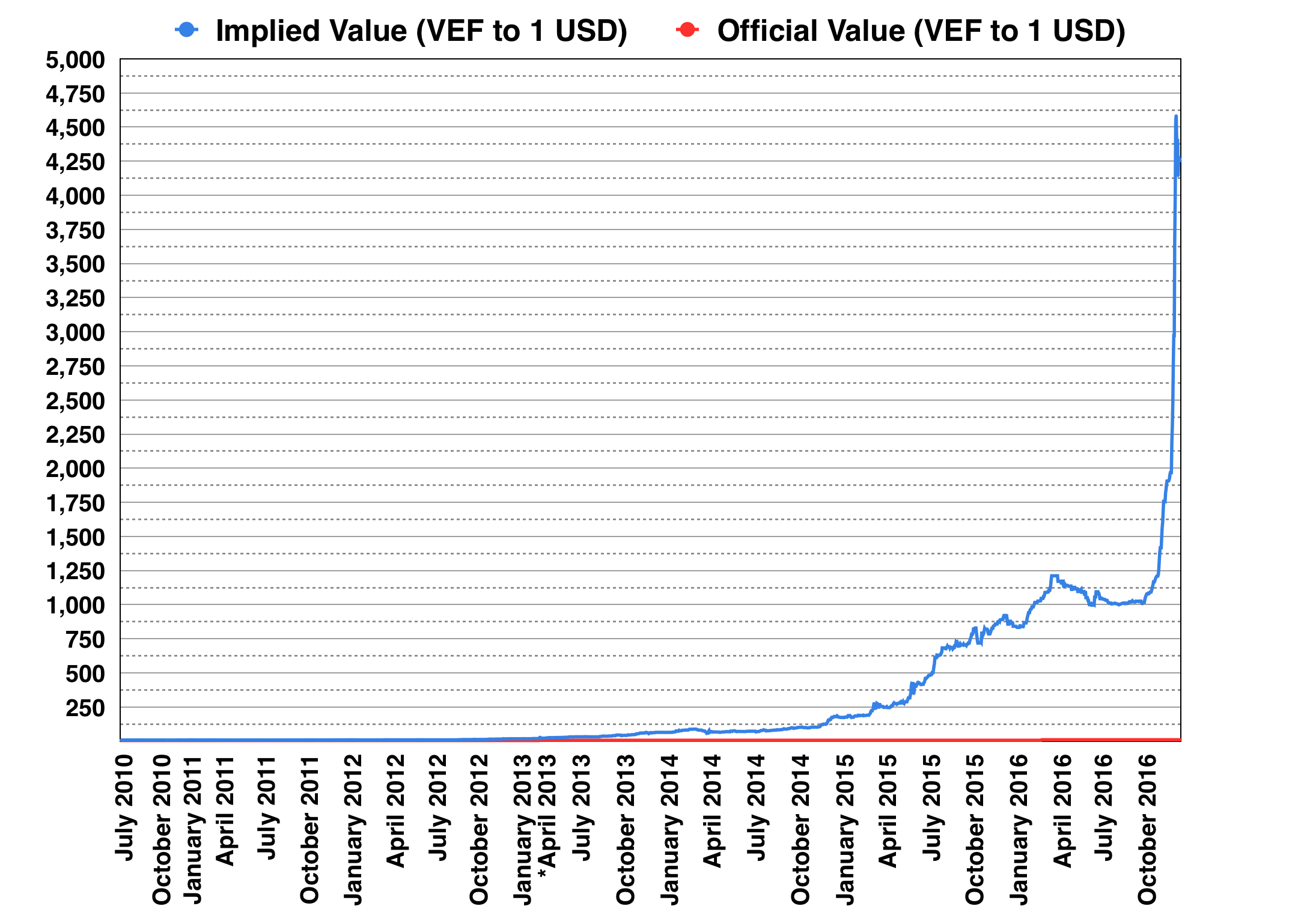

This is the worst performing economy in Latin America at the moment and it is very close to the brink of disaster. It actually started very slowly from back in 2010 when the currency was devalued to 2.60 VEF/USD from the previous 2.15 VEF/USD. Actually, the stronger bolivar in this case had been revalued in 2007 after it had depreciated to more than 1,000 bolivars to one US dollar. Then it was renamed bolivar fuerte (Bs.F) which translates to stronger bolivar to replace the previous bolivar. In 2011, this new bolivar was further devalued to 4.30 VEF/USD, then 6.3 VEF/USD in 2013. In 2016, it was devalued even more to 10 VEF/USD.

All these devaluations were made while maintaining a fixed exchange rate, but that did not stop the parallel market from responding to the actual situation. To date, the official exchange rate is still 10 VEF/USD, but the implied value in the parallel market is way much higher. In 2013, while the official rate was 6.3 VEF/USD, the parallel market rate was around 63 VEF/USD and depreciated to 100 VEF/USD in 2014. By the 3rd of February 2016, the rate reached 1,000Bs.F for every US dollar and ended the year 2016 above 4,000Bs.F per dollar.

Why did inflation spiral out of control?

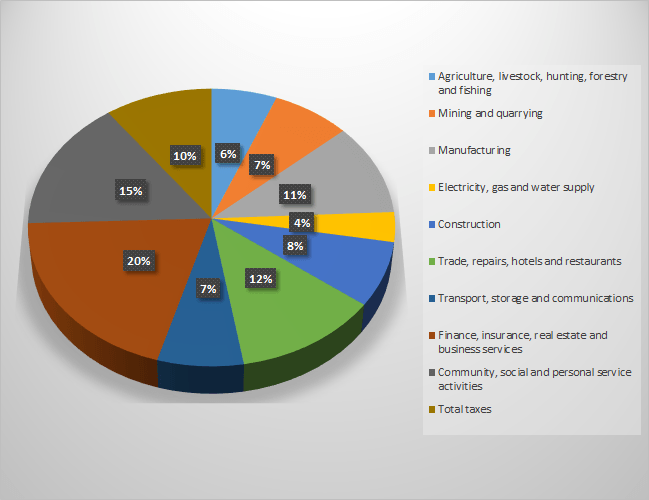

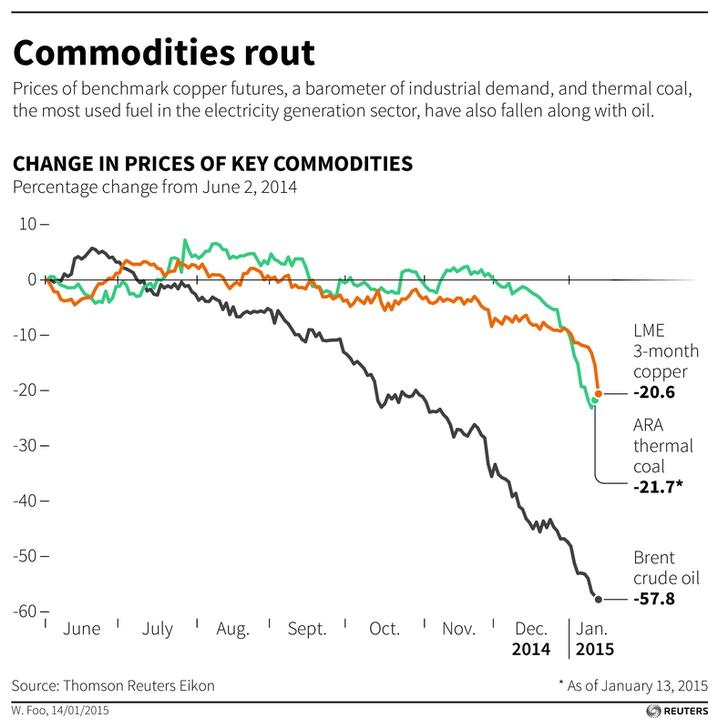

The reason behind the constant devaluation by the Venezuelan government was to stimulate the economy that was suffering from dwindling oil prices. You see, the Venezuelan economy relies almost wholly on the exportation of oil, and the low prices were putting a strain on government revenue.

Many other oil exporters faced a similar situation, such as Nigeria who also imposed a fixed exchange rate between 196 and 199 Naira for every dollar. Inflation in Nigeria, too, went high, but in Venezuela they just went too far. Besides the currency controls, minimum wages were raised 40% and reduced the cash requirements for banks. These quantitative easing actions flooded the country with money, pushing inflation even higher.

On the other side, Venezuela imports about two thirds of its food, mainly from the US. With the strengthening of the US dollar and weakening of the bolivar fuerte, Venezuela’s trade deficit became increasingly large. The country was forced to make more money just to be able to sustain themselves, but in the process devalued their currency severely.

Why is Venezuela interesting to watch?

It might seem unfair to put Venezuela on this list of economies to watch in Latin America, but it is an interesting case of poor economic policy. Besides, Venezuela is an oil-rich country whose oil reserves surpass even those of Saudi Arabia, 297 billion barrels compared to 265. Any topic to do with oil is a topic of discussion given the importance of oil in the world. The devalued bolivar Fuertes has made oil exportation from Venezuela troublesome.

You might think that everyone would rush to buy from the country with the weakest currency, but no one does. The problem is that the currency is losing value fast, and no one wants to own a currency that is going to be worthless in a month. In the 10 months between February and November 2016, the value of the currency dropped from 1,000 to 4,300 VEF/USD which is more than a 400% decline. As a result, the Venezuelan oil industry has suffered from decreased exports and subsequently, revenues.

The reprieve may come in 2018 when the general elections will be conducted, but it may be sooner if the protests get out of control. Right now, there’s no sign of improvement, but we still have to watch Venezuela, for better or worse.

Colombia

In 2014, the economic growth in Colombia was second only to China, showing that the economy was growing very fast. Since then, Colombia suffered just like other oil exporters in the world, because oil exports make up 45% of the country’s exports. Revenues dropped significantly and the GDP growth rate fell to all-time lows by the end of 2016.

Instead of using currency manipulation like other Latin American countries, Colombia sought to expand its economy. Cultural exports are one way the Colombian government diversified their economy, by increasing the number of tourists by 12% every year. The country is also a major manufacturer of electronics, which is mainly used locally, but they expanded the industry to increase exports to other Latin American countries and even the US. Many other sectors were also improved such that exports grew by 32.7% in the month of December 2016 alone which was higher than the 12.6% growth in November 2016.

Now that OPEC members have agreed to an output freeze, oil prices are about to start rising again. Increased revenue from the oil industry coupled with all other improvements in the economy are bound to make the Colombia economy thrive all through 2017 back to its glory. Economic growth is expected to be 2.4% in 2017 and increase to 3.1% in 2017. As for their currency, Colombia remains a major trade partner with the US, and their currency is likely to become only stronger as the US increases its dependency on Colombia instead of China.

Mexico

There will be a lot of focus on Mexico this year both because of its oil exportation industry as well as its relationship with the US. It’s clear that President Trump is not a fan of Mexico as he reiterated, again and again, all through his campaign. This is why many brokers raised leverage for currency pairs with the Mexican Peso and it sure did lose almost 8% in value when Trump won the elections. One of the main talking points regarding Mexico involves NAFTA which created a trading bloc between Canada, the US, and Mexico.

The US president now says he is ready to renegotiate the trade deal because he believes Mexico is taking advantage of the deal. The deal enabled American automobile manufacturers to set up companies in Mexico and import the vehicles into the US. Now, a border tax of 20% is being considered for goods being imported from Mexico. In response, car manufacturers like General Motors, Ford and even Toyota are thinking about withdrawing their bases from Mexico.

Despite these actions that could hurt the Mexican economy, the peso seems to be stronger than the US dollar at the moment. This is due to increasing oil prices, a confused dollar and the expected interest rate hike by Banxico by 0.50%.

Regardless, we can expect to see a lot of action in the Mexican economy and the peso all through this year and the coming 3 years while Trump is still in office.

Guyana

This small country is one of the poorest in Latin America, but recent developments may put it on the map. The economy of Guyana is largely dependent on agriculture and some natural resources. Some main exports in agriculture include sugar and rice, while mineral resources such as gold and bauxite are also crucial.

Reliance on such products for most of their GDP caused Guyana to be blown by the winds of changing commodity prices and weather. For example, the price of gold fell since 2012 to 2015 due to a stronger dollar and lucrative US economy. Also, commodity prices fell from 2014 to 2016 globally, further increasing Guyana’s troubles.

Now, the country has a new source of revenue, oil. The discovery of oil reserves in Guyana may just be the boos the country needs to stand on its feet once again.

A deep water exploration well has already been drilled at a site called Liza. Research showed that there could be up to 1.4 billion barrels of oil and natural gas in the site. Throughout the country, there’s an estimated 4 billion barrels of the same, which could bring more than $200 billion in revenue at today’s market price of oil.

Challenges to Guyana’s oil exportation

To completely set up the oil industry in Guyana will not be a small task, and several challenges await. One is the country’s poor infrastructure. Guyana, is very undeveloped and the infrastructure in the country is dismal. Facilities like roads and ports are either poor or undeveloped, and all these will have to be set up if oil exports are to become a reality.

Then there’s the tension between Guyana and Venezuela. There has been a border dispute where Venezuela claims almost 40% of Guyana should be part of Venezuela. Signs of tension can be observed back in 2013 when oil exploration companies were forced out of the coast by Venezuelan navy ships. Following that, Guyana stopped importing oil from Venezuela, and Venezuela stopped importing rice from Guyana.

This showed increasing hostility. Now Venezuelan president Maduro may make oil exploration more difficult for the companies, which could put a stop to the entire project.

Finally, there’s the severe corruption among Guyana government officials. While this may not affect the exploration directly, it may limit the potential benefits stood to be gained from the industry. Proper management of revenues from the oil exportation will be needed if Guyana is to climb out of the hole it’s in right now.

On the bright side…

Despite the challenges above, Exxon Mobil and Hess have already invested heavily with Hess alone investing $475 million. Keep in mind that only 2 out of a possible 20 oil fields have been explored, so there is still a lot of potential for even more oil reserves to be found. The 2 sites explored are offshore, which is probably because of Guyana’s infrastructure.

The Guyana government has now stated it’s willing to spend up to $500 million in the construction of an oil processing plant. This signals a commitment by the government in providing support to the industry. If all goes well, Guyana will receive an influx of revenue in the coming years starting from 2017.

Comments (0 comment(s))