Best agricultural commodities to invest in 2018

A lot of focus has been placed on cryptocurrencies and the US stock market that we have forgot about agricultural commodities. These too can be very interesting to trade, and they are worth considering too.

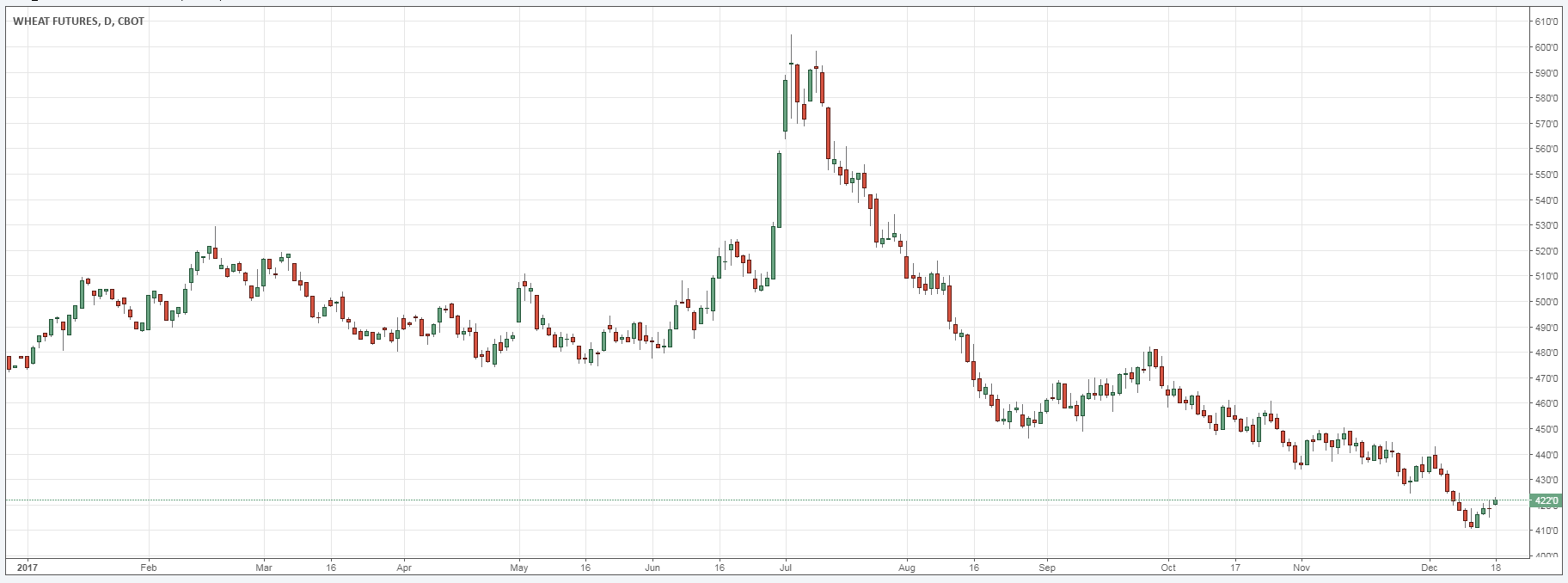

Wheat

The wheat futures market is in a state of limbo, with chances of price going either up or down. Wheat futures are currently at a level of support after a continuous downtrend for most of the year. This downtrend has been fuelled by increasing supply of wheat that has raised stocks both in the US and worldwide. When the US Department of Agriculture released their report on the 12th of December, it showed that wheat stocks in the US had actually risen by 25 million bushels. The story was the same in most places around the world. production in the EU and Canada had risen so much that it compensated for the decline in Yemen, South Africa and Brazil.

However, the technical analysis supports an uptrend, if only in the short-term. The RSI is still trending at oversold areas, which could mean there is potentially some uptrend to come. Furthermore, even the fundamentals support a bit of an uptrend. In the US, most of the spring wheat growing areas , 51%, are experiencing a drought. Besides, even with the increasing supply, it can still be considered to have declined compared to 2016 stocks. Therefore, there is a chance wheat might recover in 2018 and go on a strong uptrend. Even if it doesn’t, the uncertainty created is enough to keep the wheat market volatile next year.

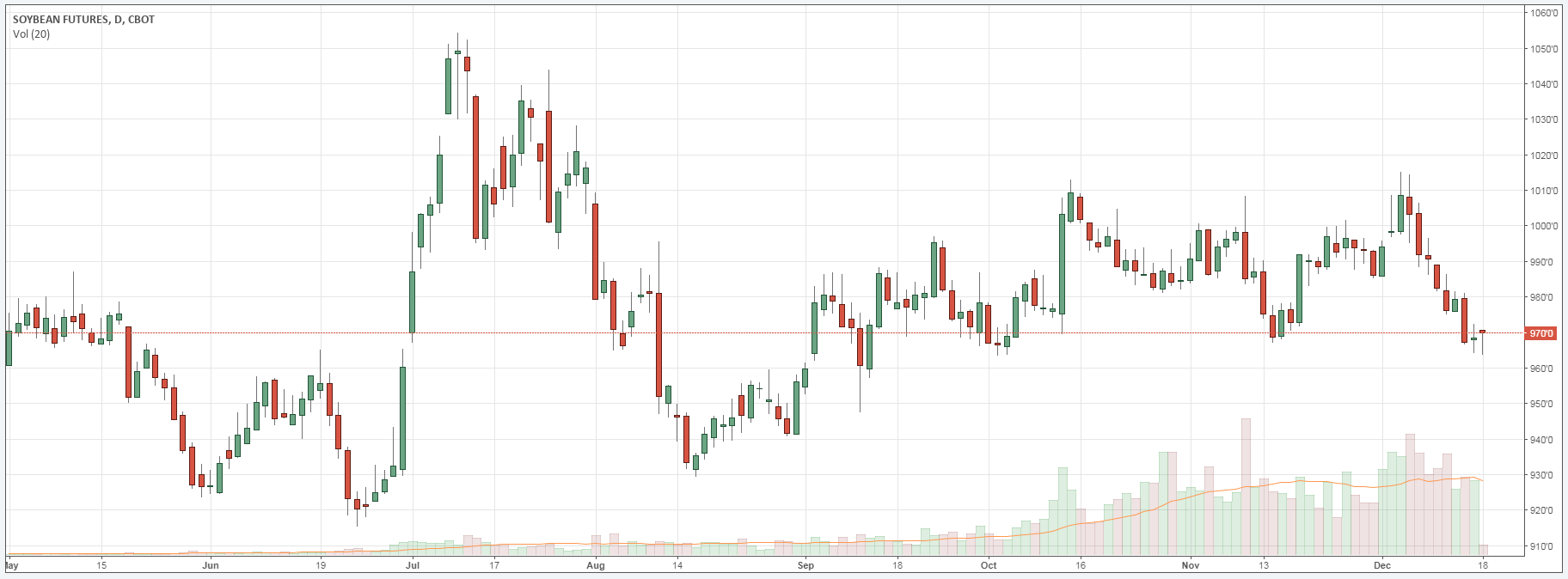

Soybeans

A look at the charts of soybean futures for both January and March show that the value of the agricultural commodities may be gearing up for a rally. The formation of a doji candle is representative of the current market sentiment. The La Nina phenomena has been creating cooler weather that has led to decreased yields in Argentina. However, when the higher yields from Brazil are accounted for, the decrease in supply is complemented, leaving stocks unchanged.

The analysis shows that the current downtrend may either continue until January due to the high supply. Afterwards, we may start to see the charts forming an uptrend as increasing demand from China props up the value of the agricultural commodities.

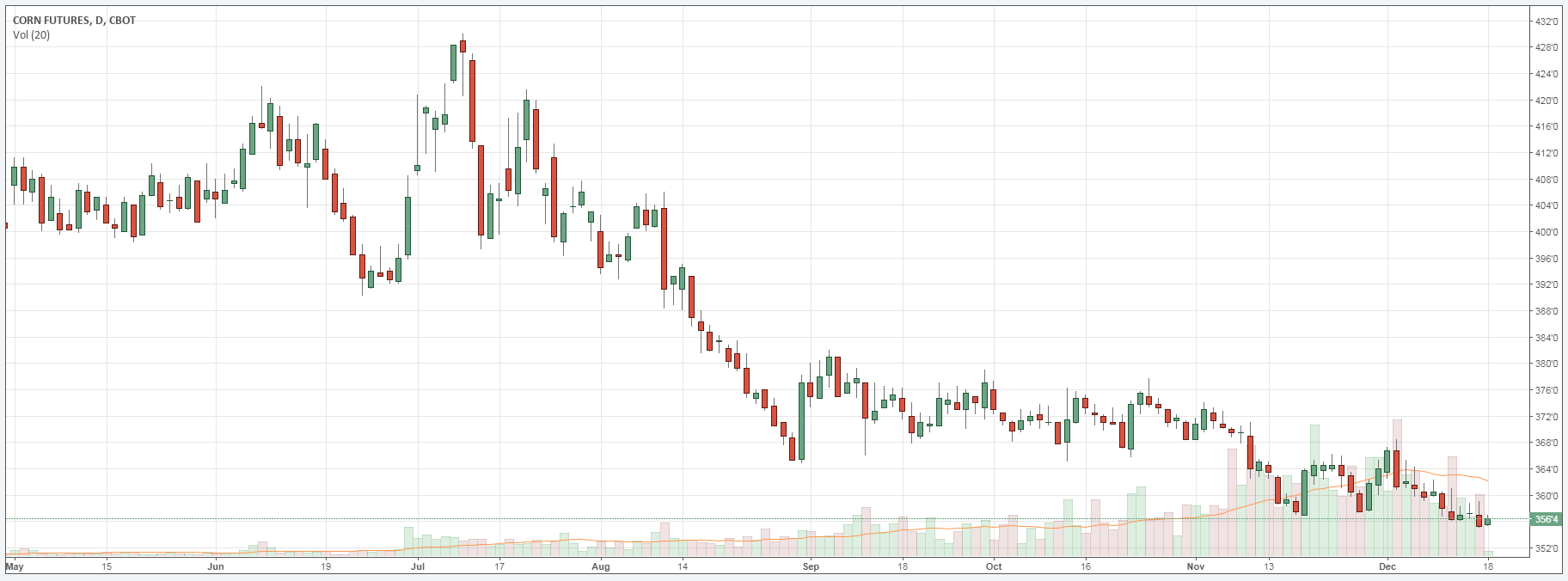

Corn

The corn agricultural commodities market is one of the more volatile in the futures market, and it is always interesting to trade. A look at the charts for corn March futures shows there has been heavy selling since mid-2017. Hedge funds have been selling heavily during this time thanks to large supply and stocks from all over the world. Corn may be gearing up for an uptrend though due to increased demand for the production of ethanol. Lower production of sorghum led to the increased use of corn recently.

The increasing demand for corn may deplete some of the excess stock, while La Nina decreases yield in South America. For now, corn futures will still remain at their current level until the USDA releases their 12th January report for the entire 2017. If that report shows lower stocks then, expect corn to rally quickly to an average of $3.20.

Comments (0 comment(s))