Soft commodities futures for cocoa and coffee in 2017

Soft commodities futures are an interesting and complicated trading instrument because of the factors affecting them. Unlike currencies and stocks whose prices are determined by internal factors, soft commodities futures will be affected mostly by natural forces. For those who trade commodities, two ideal examples of this market would be cocoa and coffee which have worldwide demand.

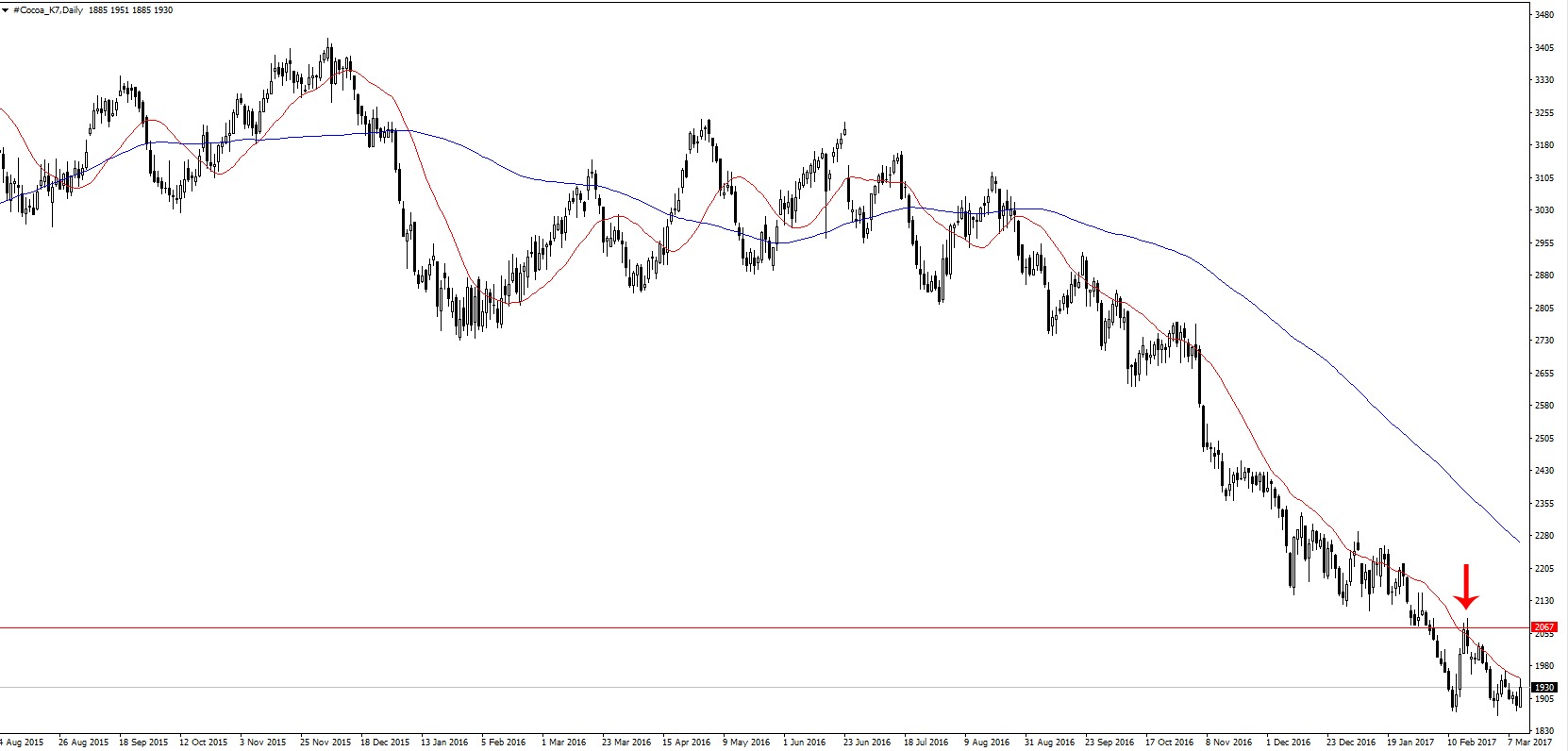

Cocoa futures analysis for 2017

The price of cocoa is currently below 4-year lows, with cocoa futures closing at $1,930 per metric tonne on the Intercontinental Exchange (ICE). Prices have been dropping since the third quarter of 2016 due to abundant supply from Ivory Coast and Ghana. These West African countries export more than half of the world’s supply of cocoa, with Nigeria and Cameroon taking the total to 70%. As a result, the increased exports have caused a supply glut for cocoa, and prices have been falling for months.

The increased quantity of cocoa exports can be attributed to good weather conditions which have decreased the extent of damage to cocoa crops. An opposite effect can be seen in 2014 and 2015 when there were weather problems in the same West African countries and other cocoa exporting countries.

The El Niño event that spread around the world had caused droughts in Africa, causing cocoa supply to drop and prices to rise. By the beginning of 2016, cocoa futures had risen to 3-and-a-half year highs to trade above $3,400 per metric tonne. Then when weather conditions stabilized, the decline began and prices tumbled to the current market price.

In February this year, prices reached a critical support level around $2,067 where it seemed the prices would bounce off. Experts also believed prices would not go lower than that following cocoa exporters in Ivory Coast suspending their exportation. Instead, Le Conseil du Cafe-Cacao (CCC), the cocoa authority in the country, sped up exports to reduce backlog. This caused cocoa prices to break through this critical support level for the first time in many years and hit $1,900. The price then rose sharply but bounced back down off the $2,067 support, enforcing it as a resistance level.

Besides the increased quantity of exports, some analysts believe the dwindling prices may also be motivated by decreased demand. Analysts at Euromonitor stated that while chocolate is still in demand, consumers are opting for higher quality brands with less cocoa and sugar.

For the rest of the year, there is hope that cocoa prices may rise again as demand increases following increasing belief in the benefits of cocoa. Technically, cocoa prices have acquired a sideways pattern as you can see in the chart above. This could be a signal that prices may have bottomed-out showing hope of a comeback. However, prices are still below the 20-day SMA, and you should not be in a hurry to buy cocoa futures just yet. We may continue to see a further downtrend in the short term, and buyers should wait until prices break above the 20-day SMA before opening long positions.

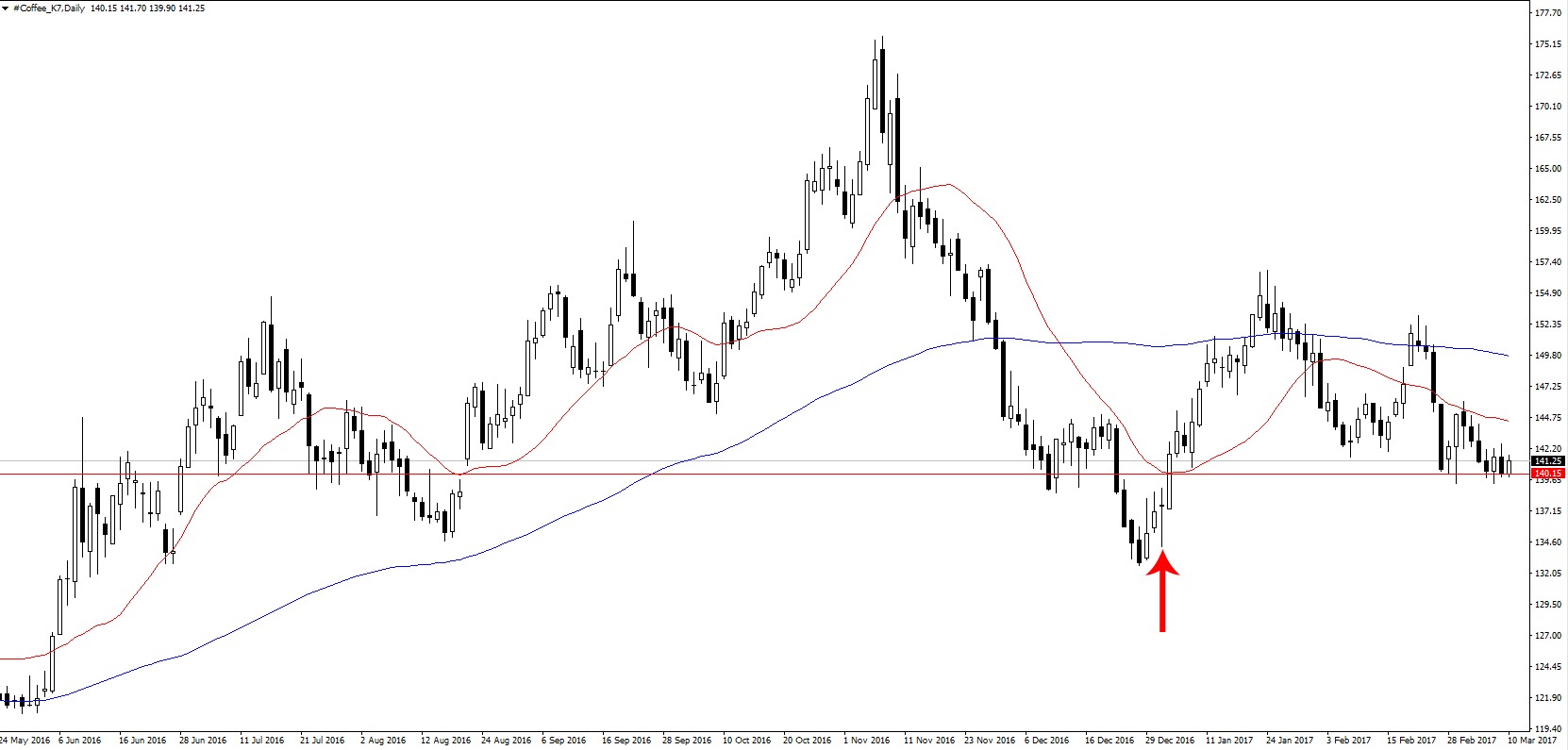

Coffee futures analysis for 2017

Unlike cocoa, the coffee market has a lot more volatility and there are more factors that affect the price. To understand this commodity, though, you just have to look at the major exporters – Brazil, Vietnam, Columbia and Indonesia.

Coffee futures for the May contract have been moving in an oscillating pattern so far this year due to mixed opinions. Exportation of coffee has been varied from the main exporters, and there is also a difference in demand for either the robusta or Arabica brands. These differences have created increased volatility, making the coffee market even more difficult to participate in.

2017 started off strong due to rumours that Brazil would produce less coffee than the previous year. These rumours arose from the droughts experienced in Brazil, and they caused coffee prices to rise. The bounce was strong enough to break through the 20-day SMA and even break above the 100-day SMA for a while.

The actual export figures were released a month later in February by CECAFE, confirming the rumours. In February 2016, there were 2.62 million bags of 60kg coffee exported from Brazil, but the number dropped to 2.23 million 60kg bags in February 2017. That is a difference of about 400,000 60kg bags! Weather patterns also remain grim as weather forecasts predict continued dry weather over most parts of Brazil in the coming weeks.

However, despite the largest exporter’s troubles, increased exports from smaller exporters were enough to keep prices below the 200-day SMA. Exports from Colombia and Vietnam have remained high. Given the increased demand for robusta coffee, this would explain why coffee prices declined after the initial jump at the beginning of 2017. Nevertheless, Brazil remains to be the main coffee exporter in the world, and their export quantities have the most impact on global coffee prices.

To try and cover the deficit in coffee exports, Brazil is planning to import coffee from other Central and Latin American nations. The total imported coffee volume would be around 1 million 60kg bags to keep the optimal supply from Brazil.

Prices have still remained below the 100-day SMA al through 2017, which may indicate that the current downtrend may still be on. However, the recent sideways movement for most of the previous week and several exhaustive candles may indicate oversold conditions. Price is now around a strong support level around $140, and failure to break through this level could cause prices to shoot up to the $150 level of the 100-day SMA.

Comments (0 comment(s))