All new highs set by bitcoin price yet again

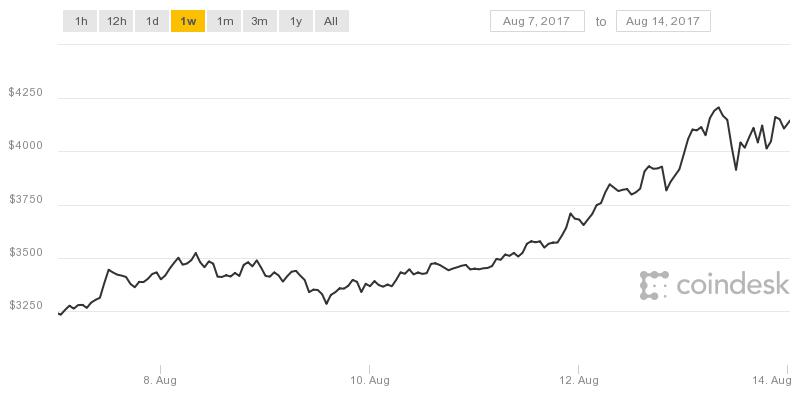

The rise in value of bitcoin is not slowing down in any way, setting a new record above $4,000 this past weekend. Last time we looked at the bitcoin price, it had just surpassed $3,500, which was a record high. Then on this past Sunday, it hit an all-time high of $4,225.40 at Coindesk before retreating to the $4,000 range.

It has been a year of records, not only by bitcoin but also from other cryptocurrencies. Ethereum rose by over 3,000% between January and June while ripple had an even better gains percentage. But, the bitcoin price is most interesting, and it’s got everyone talking.

What gave bitcoin value the most recent boost?

We all know the history of bitcoin price and what boosted its value in the past, but the most recent spike is quite interesting. So far this month, just halfway through, bitcoin value has risen 40%, and quadrupled in value this year alone. Such growth

US-North Korea tension

Ever since North Korea test-launched a nuclear missile on the Day of the Sun holiday, the tension between them and the US have been increasing. At least some of the spike in the price of bitcoin over the weekend can be attributed to the latest news from North Korea. Apparently, North Korea plans to fire four missiles into the waters around Guam as a warning to the US. The statement from the officers at Korean People’s Army claimed this would be around mid-August; right about this time.

Previous tests have shown that their missiles now have the capacity to reach the US, which makes their threats credible. Already, people are being cautioned against how they ought to react in such a case, proving that there may be imminent danger. In such times of tension and uncertainty, investors usually pull out of stocks and invest in commodities like gold. Today, bitcoin is acting as the gold standard, which can explain the recent renewed interest.

Japanese demand

As an ally of the US, a war between North Korea and the US would cause collateral damage on Japan. Already, Japan is bitcoin’s largest consumer, accounting for about a third of the total volume. As you may know, Japan already accepted bitcoin as legal tender, making it very popular. This past weekend, though, that number rose to 46%, showing that there was renewed demand for bitcoin in Japan. It is clear that the Japanese people are using bitcoin as a safe heaven, just in case things get sour.

Institutional interest

Earlier in the year, many institutional investors were wary of bitcoin. In fact, CNBC had contacted some of them, and they had expressed their uncertainty over it. At the time, they believed bitcoin and other cryptocurrencies to be extremely volatile and unstable. This is true, bitcoin and other virtual are indeed highly volatile. Take the incident on the flash crash incident that occurred on the 22nd of June when the value of Ethereum tokens dropped from $319 to 10 seconds in seconds. This was an isolated event, but for a company investing billions of dollars, such a risk is not worth taking.

However, these same institutional investors are changing their tone now that bitcoin does not seem to be going away. Fidelity Investments Inc. will start showing its clients’ holdings of bitcoin through their website. Advisors at Goldman Sachs are also asking other institutional investors to consider cryptocurrencies. In a note distributed last week, the GS advisors said that cryptocurrencies are getting harder to ignore, urging that they be studied more closely.

These are merely statements of interest, but they are enough to increase confidence in bitcoin and other cryptocurrencies. According to the Fidelity, they intend to do this as an experiment on digital currencies – they have not actually started investing in it. Nevertheless, we all know that interest from such big players can be powerful enough to even motivate legalization; perhaps a successful Bitcoin ETF.

What’s the future of bitcoin

When any asset has such a rapid rise in value, we get anxious and wonder if it’s just a bubble about to pop. I don’t think it is, and bitcoin price may still be heading up. So far, experts believe that the value of bitcoin will plateau for a while before heading up once more. Looking at the technical analysis of bitcoin charts show the formation of a double-top, a sign of consolidation. The consensus seems to be, that bitcoin prices remain within the $4,000 range for a while, until something happens in the markets.

Comments (0 comment(s))