What’s the better investment choice in 2017, GBP or USD?

If you choose to invest in currencies, there’s no better investment choice as the US dollar and the sterling pound. These currencies represent some of the world’s largest economies. Besides that, the US and UK economies have shown consistent growth over the past few years, making them the ideal investment candidates. However, you can’t invest in both, and you would have to pick one horse, and that’s where the better investment choice becomes more complicated.

The US dollar

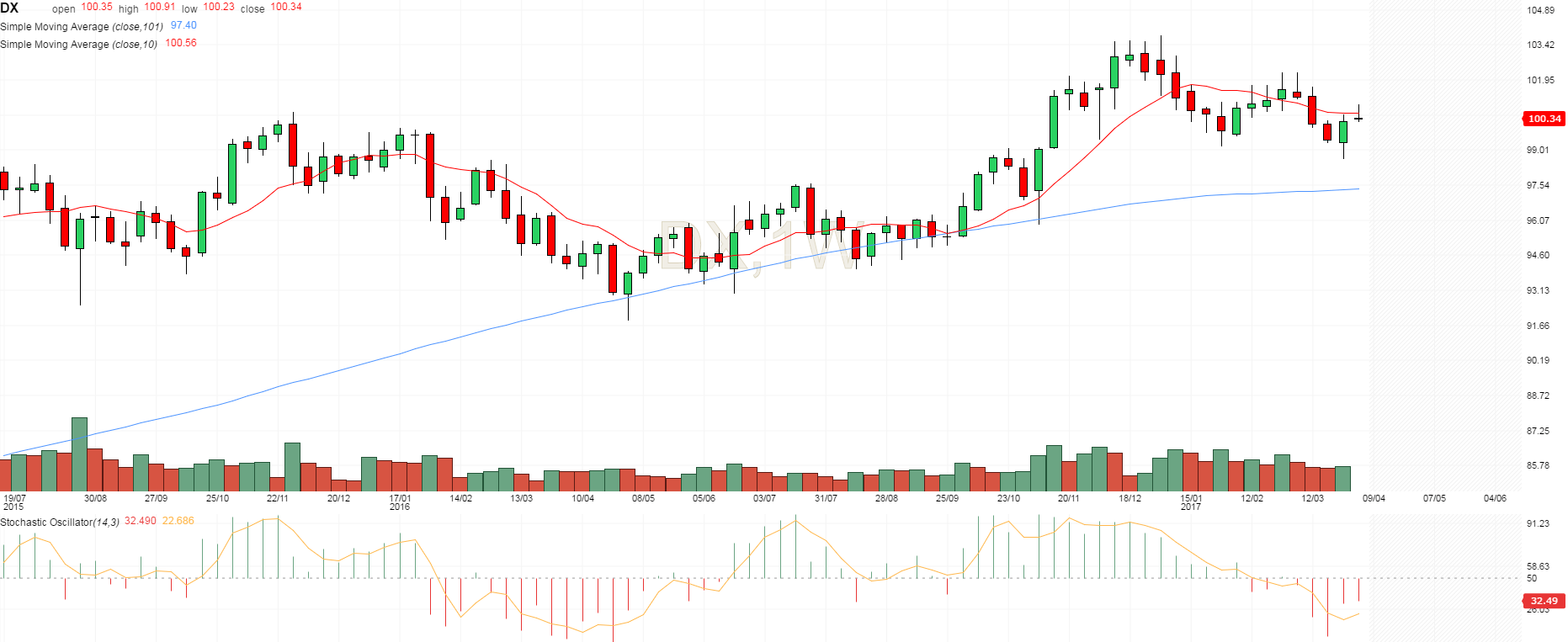

The US economy doesn’t seem to be letting up anytime soon because the uptrend on US indices is still holding. The Dow, S&P 500 and NASDAQ have all gained so far this week to make it a consecutive 4-month bull run. The FOMC minutes were released today, and they showed a consensus on more rate hikes this year. This information boosted the US dollar even more and US stocks as well. The US dollar index (DXY) alone jumped even higher to reach 100.91 after the release of the FOMC March minutes.

President Trump has also promised a stimulus package, which may boost the American economy. It is not known when this stimulus package will come into effect, but most experts believe we may see it come into effect next year, 2018.

All indications show that the US dollar is still going strong, even beside the fundamentals. As you can see from the chart above, the US dollar index is trading above the 100 SMA, which indicates a bullish momentum. Furthermore, the stochastic indicator shows the value of the DXY is in oversold territory – another sign to buy.

The sterling pound

The sterling pound has always been a reliable currency to invest in, after all, it’s the most heavily traded currency in the world. The UK is also known for implementing effective monetary policies, which further contribute to the pound’s reliability. However, there have been some changes recently that may make this currency suddenly unattractive.

First of all, the pound roller coaster is just beginning ever since the UK officially triggered Article 50 last week. Surprisingly, the currency grew stronger despite what the Brexit process meant for the UK. The boost for the UK came from appealing economic data from a strong PMI report, although the manufacturing and construction PMI data weren’t as good. So far, the pound is putting up a fight despite the uncertainties of Brexit, but it may only be short-lived.

In only a week, the negotiations have already taken a hard stance with the EU demanding terms and even a £50 billion charge. A hard Brexit is looking more and more likely from the negotiations, and this may hurt the pound.

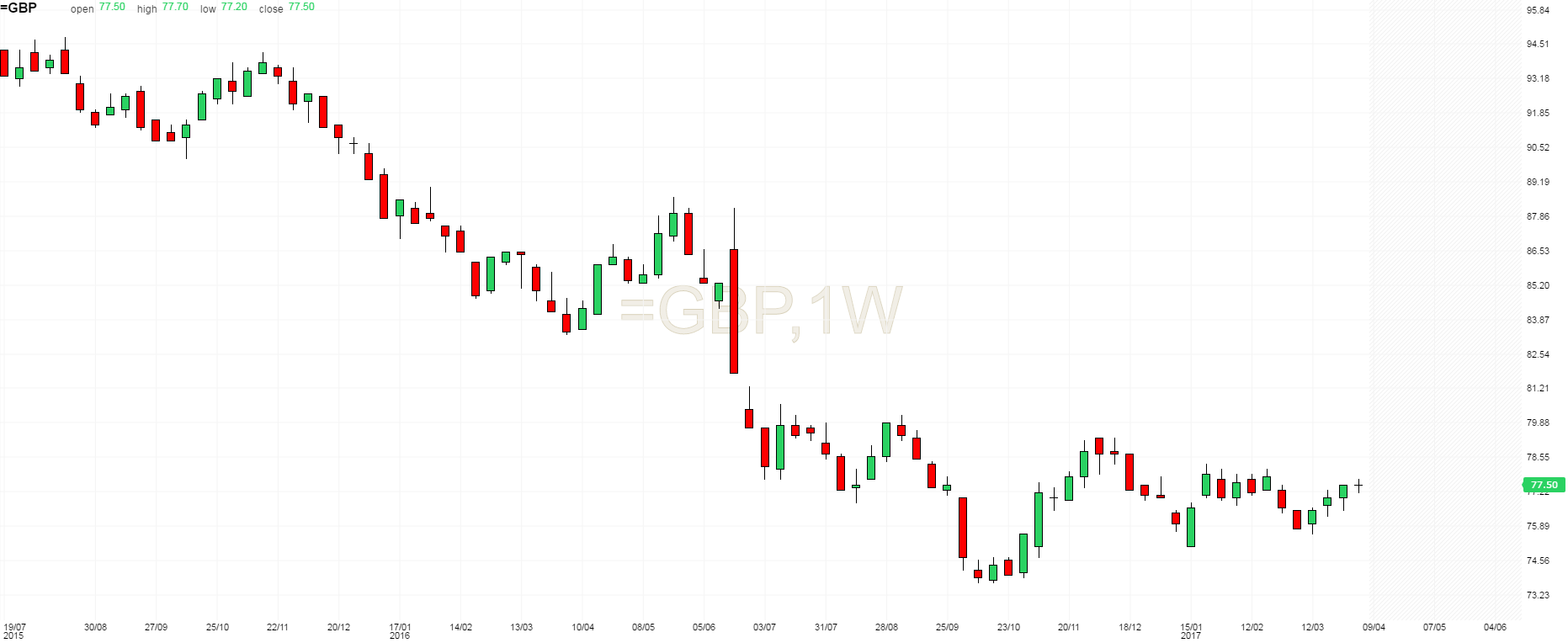

On the technical side, the formation of an exhaustive candle on the UK pound sterling index may indicate that there’s diminishing confidence in the currency. Short-term sentiment is still bullish due to good economic performance, but Brexit woes may push the pound lower as the year goes by.

Which is the better investment choice?

Between the US dollar and sterling pound, the US dollar is certainly a better investment choice. Sure, there is a lot of uncertainty on both sides, but the pound is heading into uncharted territory. While investing, it’s best to avoid uncertainty, and the US dollar is more predictable.

Comments (0 comment(s))