USD/JPY outlook for the coming week

Perhaps the second most traded currency pair, every trader watches the USD/JPY for signs of volatility and possible trading opportunities. To help you trade this pair this week, here’s an analysis of where we stand and what might affect the currency pair over the week.

Current situation

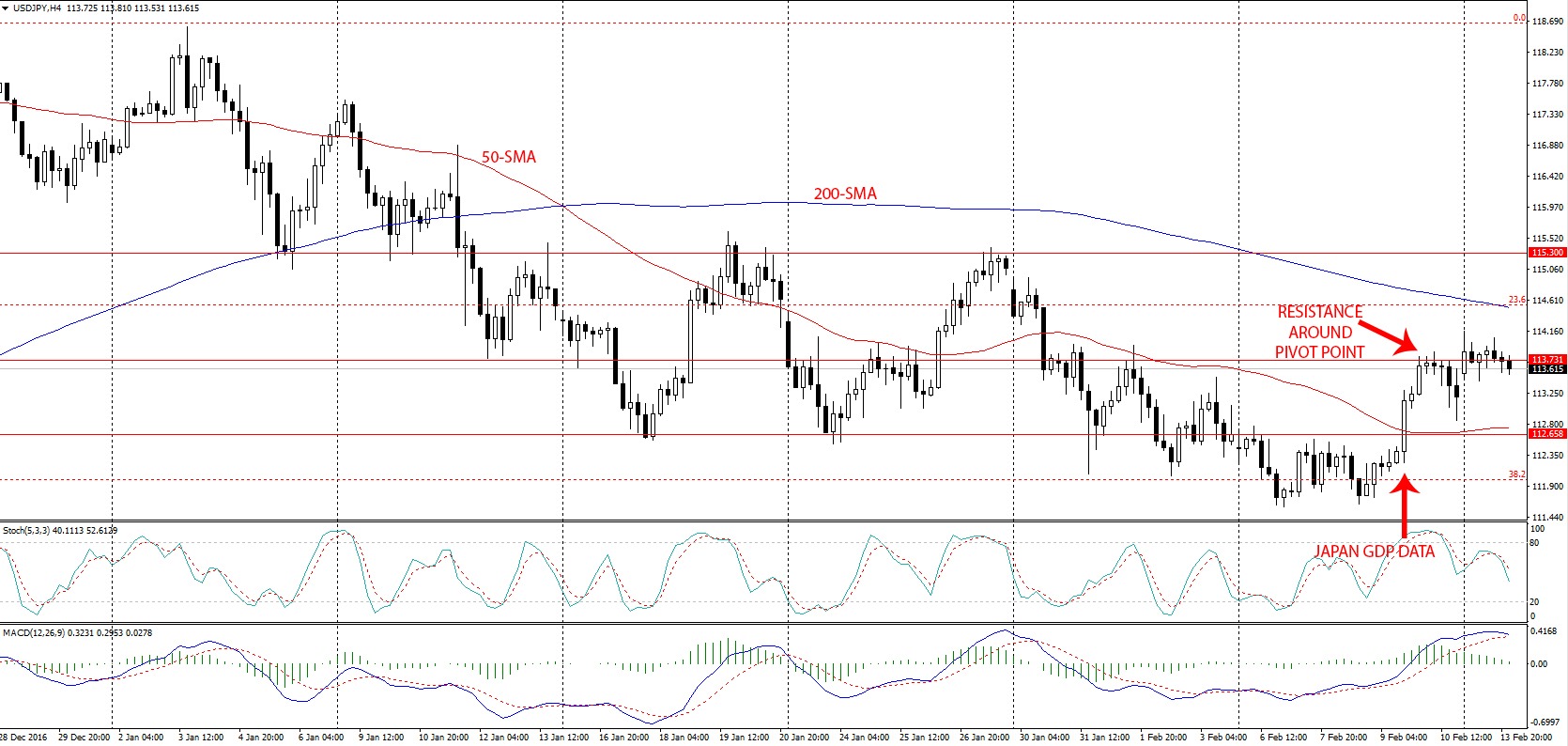

Almost all of last week, the USD/JPY pair traded below the 112.658 support level when it acted as a resistance level. Several comments by US president Trump about tax reform tested this resistance level, but news released on Friday finally broke through this level. The release of Japan’s GDP data for the fourth quarter showed that the Japanese economy slowed, and the USD/JPY soared upon this news. It was however unable to penetrate the 113.73 pivot point where the current week started from. Soon afterwards, the Japanese yen took a hit with the preliminary GDP report showing even slower growth, but the currency recovered after positive inflation reports.

On the 4-hour chart, the pair is still trading below the 200-SMA, showing that it is still in bearish territory, but it is now above the 50-SMA. The dollar has been weak all year, leading to the current downtrend, but recent economic data from Japan show that the economy is not as strong either. So, the currency pair is sort of in limbo, waiting for any push.

What to expect

All the focus will be on data from the US. Today, Janet Yellen, the FED chair is expected to speak to the public and then testify tomorrow in front of congress. In addition, the monetary report by the FOMC is also going to be released tomorrow. All these will finally put to rest the interest rate debate that has been the source of speculation ever since Trump won the elections. On one hand, the president would like to tighten fiscal measures by raising interest rates, but he would also like to keep the US dollar weak enough to maintain a competitive advantage in the export sector. We favor the latter because the US dollar seems to be over-valued and Trump was clearly not impressed by the strength of his currency. Regardless of the direction, the FED will take, this announcement will set the tone for all currency pairs involving the US dollar, including the USD/JPY.

Furthermore, there will be the release of crude oil inventories from the US on Wednesday as well as the consumer price index (CPI), both of which will impact the US dollar. Then, on Thursday will be the unemployment claims, building permits, and manufacturing index reports, all of which impact the US dollar. It’s safe to say, thus, that economic data from the US will be the only significant news to watch this week.

As we’ve mentioned, we expect interest rates to remain right where they are, so this might bring the value of the US dollar down to the 112.66 level where the 50-SMA is at right now. However, we expect that the US dollar will be strengthened by rising oil prices and generally positive data from all the other reports, so it’s possible the pair will rise to the 115.3 level by the end of the week.

Comments (0 comment(s))