Fed leaves the interest rate unchanged

Fed has always been under scrutiny when it comes to setting the interest rates as these decisions determine the fate of the markets in the immediate future and long-run. This time it was even more so as President Trump has vocally criticized the decision of the independent institution to increase rates. There is a conflict of interest when it comes to setting the benchmark interest rate. Fed is supposed to take into consideration the long-term consequences of the decision. Leaving the rate too low for too long could cause the economy to overheat. On the other hand, the government cares about re-election and approval ratings, which is why the elected officials usually prefer lower rates and more growth in the short-run, even if it comes with dire consequences in the future.

Trump’s criticism of the Fed has been judged by many as an attempt to influence the decisions of the institution which is supposed to act independently of the government. For this reason, the latest meeting which started on Wednesday was bound to be controversial. Some analysts expected a rate hike as that had been foreshadowed by Fed officials and was a logical continuation of the previous path of the institution. Most expected that the Federal Open Market Committee would keep the rates unchanged this time and have a hike in December. That is exactly what happened as the representatives announced that the federal funds rate would be kept in the range of 2% to 2.25%.

Fed discusses the economic conditions, growth and employment

During the announcement, Fed officials also discussed the changes in how they view the economic conditions in the country. One of the topics discussed was the unemployment rate. The Fed noted that the rate had declined since the last meeting which took place in September. Furthermore, the rate, which according to the Labor Department stands at 3.7%, is at the lowest level since 1969. On the other hand, the institution wasn’t as optimistic about the business fixed investment growth, which has slowed down during the year. Although the Fed hasn’t commented on the causes of the decline, some participants believe that the trade war between the US and China has affected the investments negatively.

Other topics discussed by the institution included economic growth. Federal Open Market Committee noted the fast pace of economic growth. For the last three quarters of the year, GDP has grown by 3.3%, which is bound to be maintained for the last quarter as well. Some analysts were surprised by the Fed’s decision to omit housing data and the sharp decline in stock prices from its discussions. “We shouldn’t be surprised by either comment as they are simply a summary of the recent data. Interestingly, there was no mention of the softer housing data. Moreover, there was no mention of the sell-off in the stock market in October which implies that Fed officials were largely willing to shrug it off,” – said Michelle Meyer, U.S. economist at Bank of America Merrill Lynch.

Analysts believe a rate hike to be very likely in the nearest future

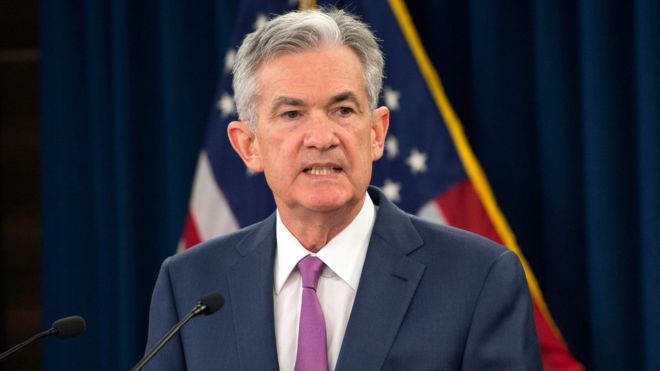

The comments of Fed representatives, including Chairman Jerome Powell, have led many to believe that the Fed is going to keep increasing the rates. “Interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral. We may go past neutral, but we’re a long way from neutral at this point, probably,” – Powell commented during an interview. Since then, the institution has removed the word ‘accommodative’ from the description as it doesn’t see the word fit to describe the current stance of the FOMC.

The gradual increase of the rate stared in December 2015 and since then the benchmark rate has been increased 8 times. Each time there was a 0.25% hike. The rate was lowered to a near-zero level during the financial downturn of 2008 to aid the economy. Now the rate is at the highest level it has been for ten years. It is likely that it will be increased even further in December when the committee will meet next. “A December rate hike appears to be a likely event at this point, but the outlook ahead is very different as the market and the Fed have differing views on how many rate hikes are in the cards for next year,” – commented Charlie Ripley, senior investment strategist at Allianz Investment Management.

There are those who believe that keeping the rates unchanged in December will be detrimental to the stock market. Dick Kovacevich, the CEO of Wells Fargo has commented on the issue expressing his belief that the institution has to increase the rates since it has already hinted about it and if it doesn’t, the market will take it as a sign of the institution yielding to the president’s demands. “The independence of the Federal Reserve is instrumental to any market economy. If that ever comes into question, the market is going to react very negatively,”- Kovacevich said during an interview. “What he doesn’t understand is that the more he tries to influence the Fed by public statements, the less likely he is to influence the Fed, because the Fed has to remain and be perceived as being independent,” – he added.

Comments (0 comment(s))