The most successful and promising IPOs of 2019

IPOs have been around for a while now. And over the years, they’ve gained big corporations’ trust when it comes to gaining money and expanding the capital of the company. But IPOs are not popular anywhere in the world, they are mostly concentrated in a particular part of it. That is what we’ll discuss today.

The year has been especially successful for fintech-related IPOs launched all over the world. However, if we would look precisely at the data, we would see that IPOs, in general, have not been as profitable as it was the previous year.

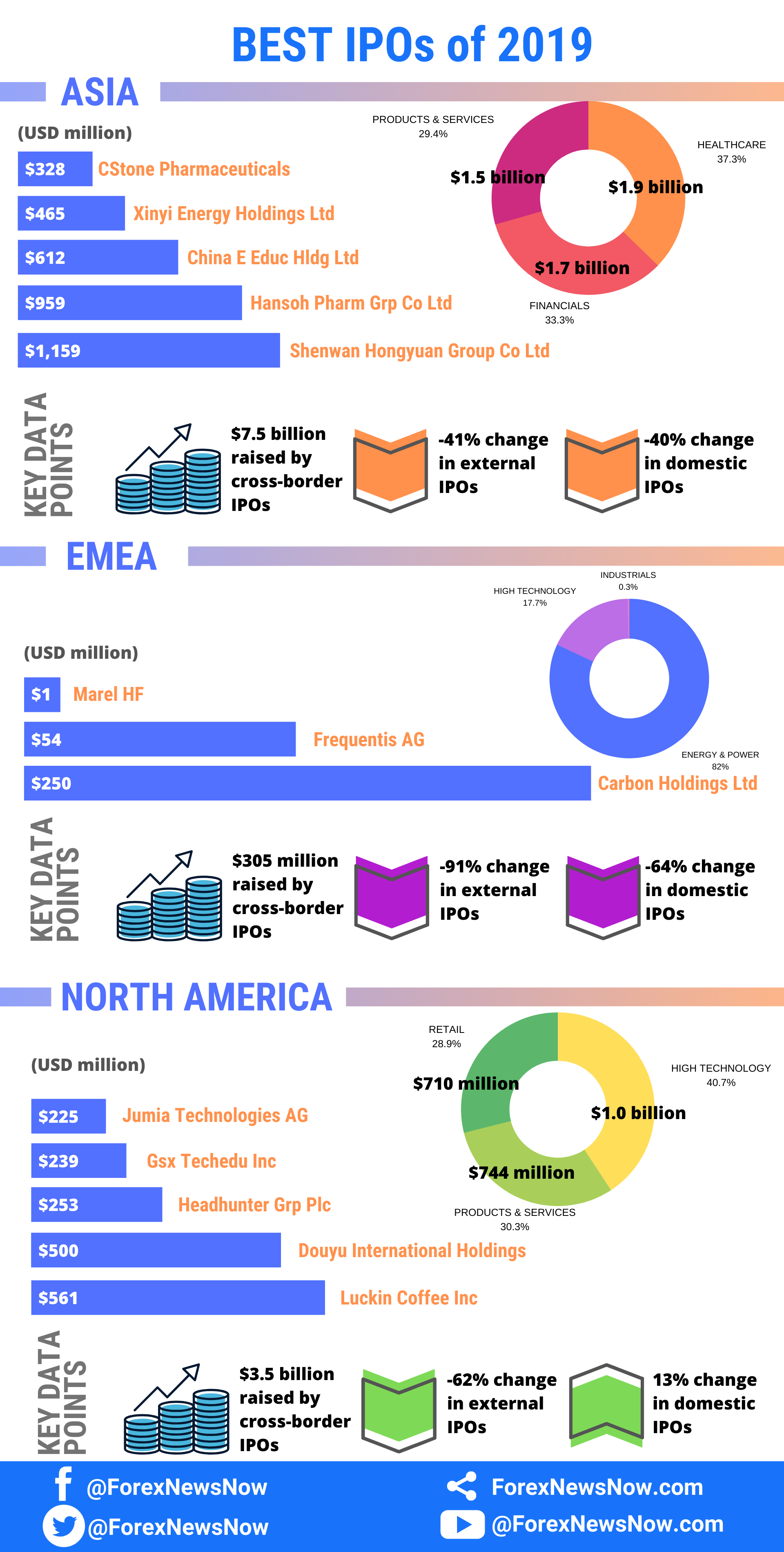

Asia-Pacific has, notably, been the luckiest one in terms of profits gained through multiple IPOs (as cross-border, so as domestic ones). There are 5 main IPO issuers worth mentioning here, as they contributed the most. Those include:

- Shenwan Hongyuan Group Co Ltd (China – HKSE) is an investment holding company operating mainly in the securities business. They raised a total of $1,159 million through IPOs.

- Hansoh Pharm Grp Co Ltd (China – HKSE) is a pharmaceutical company that raised a total of $959 million through IPOs.

- China E Educ Hldg Ltd (China – HKSE) in turn, managed to raise $612 million through IPOs.

- Xinyi Energy Holdings Ltd (China – HKSE) is a renewable energy company that has gained $465 million through IPOs during 2019.

- CStone Pharmaceuticals (China – HKSE) is a biopharmaceutical company that is producing various innovative drugs. They raised a total of $328 million through IPOs.

There are three main sectors of IPOs in Asia-Pacific nowadays. Those include:

- healthcare

- financials

- customer products and services

Now, moving to EMES countries, which involves countries of Continental Europe (Poland, Germany, France, Denmark, Turkey, Russian Federation, UK, The Netherlands, Switzerland, Ireland, Spain, Italy, Czech Republic, Luxemburg, Sweden, Austria, Portugal), Middle East (Israel, United Arab Emirates) and Africa (South Africa).

Adam Farlow, EMEA Chair, mentioned in one of his interviews:

“Europe’s market and economy continues to struggle under the weight of political volatility and a lack of clarity around Brexit, but all eyes look to October for more transparency and direction. We are hopeful that the market will subsequently settle and activity in London will recover. The demand is still there for access to the liquidity and exposure that comes with the London Stock Exchange.”

Among the main IPO cross-border sectors, we might mention

- energy and power

- high technology

- industrials

So, according to that data, we might conclude that IPOs in those countries are rather coming from one huge area of economical flow and daily life.

Moreover, just like in Asia, the EMEA market has been experiencing decreases in as external, so as domestic (or internal) IPOs. But in the case of the EMEA counties, the downward trend is even more prominent and severe than in Asia-Pacific.

And, finally, the North American market is, in fact, is on its rise at the moment. However, that does not mean that it is exceeding Asia’s or the EMEA’s gains from IPOs.

The profits gained by the top-5 (mainly technology-oriented companies) are by far the smallest among all three regions mentioned today. The highest profit is generated by Luckin Coffee Inc and equals $561 million in 2019.

Chris Bartoli, North America Chair, commented:

“The US federal government shutdown may have stifled activity in the first few months of the year, but this is by no means a reflection of appetite. While geopolitical and pricing concerns have impacted markets globally, the US is set to experience a burst of activity running right into the start of 2020. What we can expect to see though, is more conservative pricing among issuers in an attempt to safeguard IPO performances.”

Generally speaking, there is a -55% change in capital raised by cross-border IPOs worldwide and a -32% change in capital raised by domestic IPOs.

Koen Vanhaerents, Global Chain of Capital Markets, admitted:

“The global IPO market experienced quite a slow start to the year as significant political issues stifled activity, along with a change in investor sentiment towards risk – particularly among pre-revenue companies. While global activity experienced sharp declines, this is perhaps skewed slightly when compared to the stellar performance seen in the same period in 2018. With a strong pipeline, H2 2019 looks set to deliver a much more prosperous performance overall.”

In case of sharing the content, please, source ForexNewsNow.com.

Comments (0 comment(s))