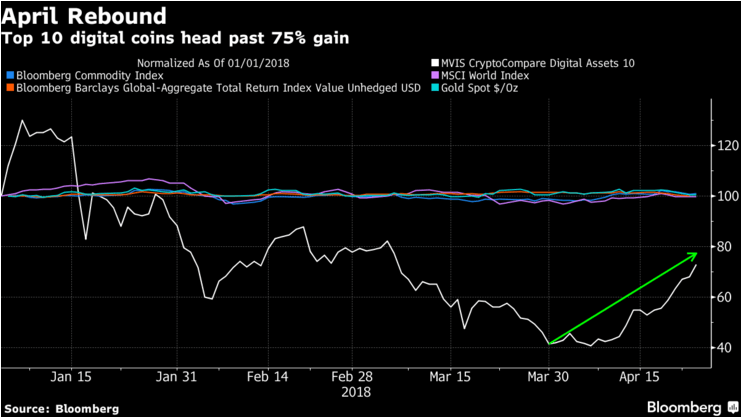

Major Cryptocurrencies gain by over 75% in April

The world’s major cryptocurrencies continued their April rally this week. This is the fourth week that the cryptos have risen which means that for the month of April alone the cryptos have gained by more than 75%.

The major cryptocurrencies which led the advance are Ethereum, Bitcoin Cash, and EOS. Even though Bitcoin dropped by around 6% in the past 24 hours, it has been gaining for the past weeks. In the past 24 hours, the trading volume of Bitcoin has topped $9.7 billion. This is the same upward trend that Alphabet Inc. has been taking this week.

The noise from the regulators has been far less destructive in the past few weeks compared to the end of 2017 and there hasn’t been a major theft from an exchange recently. This has been good for the crypto market. This is an observation from Marc Ostwald, a global strategist who was speaking at ADM Investor Service in London.

Cryptocurrencies performance in April

The recent rally of Bitcoin has taken it back to where it was in early March. In January, there were several things which worked against Bitcoin among them the introduction of tough regulations by several governments, selloffs which were sometimes caused by traders getting spooked by market events or crypto heists. The top ten cryptocurrencies have jumped by 76% in the month of April. However, the cryptos are still down 40% from the January record high.

According to Ostwald, many people who trade Bitcoin do so based on technicals the same way commodity traders of wheat and oil do. For some of them, there is a downtrend broken after a double-bottom, he was quoted by Bloomberg.

The cryptocurrency surge in April has coincided with many of the world’s stock and bond markets which are struggling to forge some direction. Besides the traders in traditional assets having to factor in higher yields and inflation forecast, they also have to factor in the shifting narrative of the U.S and China trade dispute. Also to factor for the traders are the rising tensions between the U.S and Russia.

Crytpo traders are selling in order to pay their taxes

The Bitcoin rebounded in the past few weeks from a low of $6,900 to settle at over $8,700. There has been speculation and some analysis showing that Bitcoin’s huge gain in 2017 created a large tax liability. Because of the tax liability, some traders have been selling their BTCs in the past two weeks to pay taxes.

According to Tom Lee, Fundstrat Global Advisors’ Head of Research, cryptocurrencies increased by $590 billion in 2017 alone. He adds that around 30% of crypto trades were done in the US and this translates to $177 billion. Based on the estimate that on average American households realizes 52% of capital since 1954, the taxable income is $92 billion. And when a 27% tax rate is used, then a total of $25 billion is the tax bill crypto traders in the US are supposed to pay. Lee does not calculate the self-employment taxes which should come from mining.

Comments (0 comment(s))