China’s economic disaster | economic overview and forecast

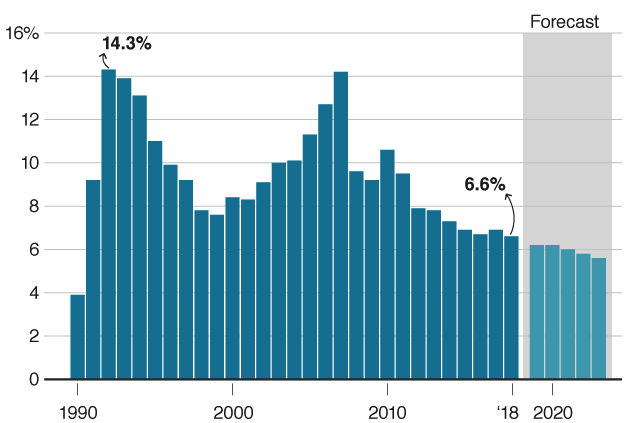

Pretty recently (during the last quarter), China’s economic growth dropped to its level in three decades. The world’s second-largest economy is harmed now because of the trade war with the United States.

During April and May, China’s GDP grew by 6,2%, and over the period from June to early September the growth rate decreased to 6,0%, which is by far the lowest growth rate since 1992.

Chaoping Zhu, JP Morgan Asset Management market strategist, commented: ‘Trade tension with the US is the key factor weighing on business sentiment and investment activities, although domestic stimulus policies are providing some buffer from the downside’.

Those terrific economic figures popped up only one week after the United States and China have reached a certain agreement between each other in order to not damage the world’s two biggest economies even more. Guess they should have done it even earlier to avoid all of that.

Chaoping Zhu also said: ‘Ongoing negotiations may have some positive impact on business sentiments, but despite the potential mini deal, most of the US tariffs on imports from China still remain, hurting Chinese exports’.

The partial trade agreement reached between countries on October 11, 2019, means a halt of the US tariffs that should have been imposed sometime last week. Earlier, the president of the United States Donald Trump pointed out that ‘intellectual property, financial services, and agricultural purchases were also included in the agreement’.

But even after some agreements, two sides could not get to a comprehensive consensus that would sort out all the major issues on the table. Notably, markets experienced a deeper falling after the Chinese data was released. Hong Kong‘s Hang Seng Index (HSI), refloat-adjusted market-capitalization-weighted stock-market index, and China’s Shanghai Composite Index (SHCOMP) that tracks the biggest and most important public companies in China were 0,5% and 1,3% respectively. Before the release of China’s GDP report, those indexes gained as much as 0,5% and 0,3%.

Japan’s and Korea’s stocks have also lost their values. The Nikkei, a stock market index for the Tokyo Stock Exchange (TSE), was about 0,9% before it lost almost all of its gains. Meanwhile, the Kospi index (the Korea Composite Stock Price Index) the index of all common stocks traded on the Stock Market Division of the Korea Exchange, was closed at the rate of 0,8%, after gaining 0,5% earlier this year.

The September recovery

The Chinese data released recently showed that economic activity of the country in September can give some hope for the future dynamics. For instance, the growth rate in industrial production rose up to 4,4% in August and up to 5,5% last month. Meanwhile, the retail sales level increased to 7,8% last month, which is a better indicator that it was like in August. Fixed accelerated asset investment has also shown better results.

However, regardless of a stronger economic position in September, it can still go down significantly in the upcoming months. Senior China economist for Capital Economics, Julian Evans-Pritchard, says: ‘Cooling global demand will continue to weigh on exports, fiscal constraints mean that infrastructure spending will wane in the near-term and the recent boom in property construction looks set to unwind’.

Analysts from Nomura, an Asia-headquartered financial services group, are also sceptical and think that the rebound seen in September is short-lived and will be followed by the economic growth slowing down afterwards.

Future perspectives

The Chinese statistical authority representatives agree on the statement that the economy of the country will continue facing severe external environment. A spokesman for the National Bureau of Statistics, Mao Shengyong, proclaimed that the Chinese government will now start to improve stimulus measures that will enable the economy of the country to stabilize a bit.

Among such measures might be investments in infrastructure, as well as the encouragement of a shift towards consumption and technology that will drive the economy as well.

Notably, consumption in general composed 60,5% of the GDP growth in the first three quarters of the year, while exports and investments contributed about 19,8% and 19,6% respectively.

Another senior economist for HSBC, Julia Wang, is positive that the data above will stimulate the government for more spending. She says: ‘We expect both monetary and fiscal easing to be delivered, in the form of a reserve requirement ratio cut, lending rate cut, and infrastructure investment. But in order to reverse the slowdown trend, the more decisive easing will likely be needed’.

Comments (0 comment(s))