Georgian Lari (GEL) predictions and analysis for 2020

Georgian economy has been in a mild stagnation for the last 5 years now. The moderate economic growth, which has hardly ever surpassed the 5% mark, slow pace in industrial production, and even a decline in agriculture and other sectors indicate that there’s something going on with the economic policy.

However, the macroeconomic indicators aren’t the only sectors of the economy that have been stagnating over the recent years. One of the main subjects of public discussion is the country’s currency – Lari, which has seen a major degeneration during a 5-year period.

In this article, we’ll look into the current monetary problem Georgia faces right now, as well as what are its economic, political, and social driving factors. Finally, we’ll make a general prediction of where Lari is headed towards and how will it change over the foreseeable future.

Depreciation of Lari in 2014-2018

Lari has been acting rather sickly over the recent years. According to the Georgian financial website Kapitali.ge the depreciation of the country’s main currency is now among the major problems Georgia is facing right now. Some of the main impacts of Lari inflation are increased import values, heavier credit pressure on the population, as well as the country, etc. And even though some economics experts would suggest that the Lari inflation is actually beneficial to the amount of money received from exports, tourism, and foreign remittances, for a country like Georgia, which is heavily depended on imports, increased prices hit the population the most.

Let’s now discuss the main developments in the monetary field that has affected Lari over the last 5 years.

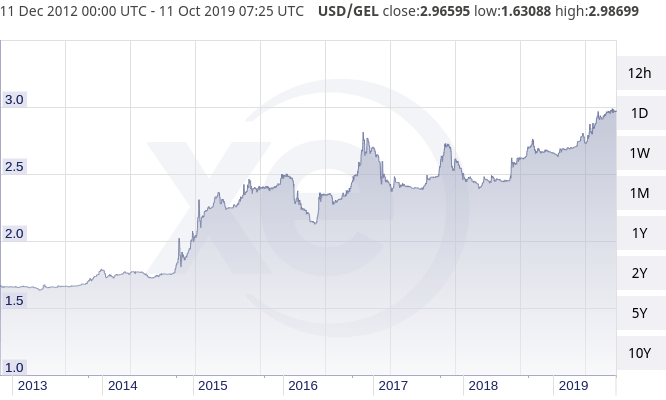

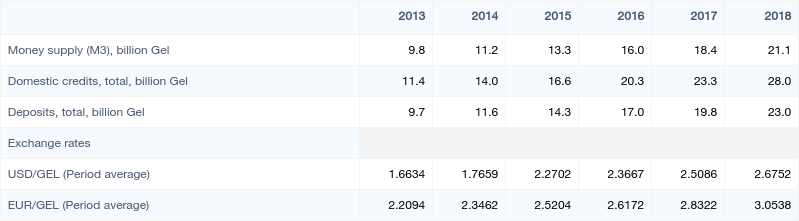

Lari started to dramatically depreciate at the end of 2014. According to the National Statistics Office of Georgia, the average exchange rate between USD/GEL was 1.76 in 2014. The inflation rate between 2013-2014 was somewhat reasonable at 6%, while the next year was the biggest leap in the recent history of the currency. The USD/GEL exchange rate suddenly spiked at 2.27 which is a staggering 29% inflation rate over the previous year.

From this time on, Lari only started getting worse. In 2016, the exchange rate was 2.37 (4% inflation); in 2017, it reached 2.51 (6%); in 2018 – 2.68 (6.8%); Overall, the currency has depreciated by 52% from 2014 till 2018.

There are several contributing factors to the inflation rate. Because Lari is a free-floating currency, which means that there are no actual rules or laws establishing the specific exchange rate, it solely depends on the basic laws of supply and demand on the foreign currency. The supply and demand of foreign currency depend on various economic and political aspects, the most important ones being the foreign remittances, tourism, and foreign investments.

The foreign remittances are probably the least controllable by the government factors that mostly depend on the labor migrants. This indicator remains somewhat stable over the recent years at around $1 billion, thus not really contributing to the radical shifts in inflation rates.

As for tourism-related revenues, the industry has also been generating increasing revenues year by year, with $3.2 billion in 2018 and $1.5 billion in the first half of 2019. So, even this indicator cannot be used to explain what has been going on with Lari over these 5 years.

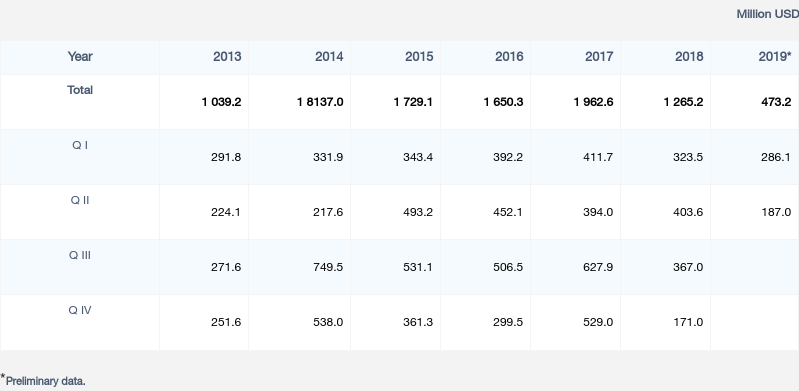

And finally, we’re left with foreign direct investments, which is the main culprit in this situation. According to GeoStat’s annual reports, the FDI in 2014 was $1.84 billion, which was a significant increase over the previous year’s FDI (+77%). However, from 2015, the investments started to slowly die down with $1.73 billion that year, $1.65 in 2016, $1.92 in 2017 (one last sign of life), and $1.26 in 2018.

Lari condition for the last year

As for 2019, one could say that Lari has gone wild. According to the monetary statistics from GeoStat, the money supply M3 has hit its record high with 23.6 billion Lari in August 2019, which is a 12% increase over the previous year. As a result, the USD/GEL exchange rate reached record-breaking 2.98 within the quotes of most of the FX brokers, with an inflation of 11% in October 2019.

There are many things to be said about this situation but the most obvious one is related to the decrease in the FDI. The first half of the year show a miserable $473 million in the foreign investments, and the high hopes of a more lucrative second half are virtually non-existent.

The main reason behind the dramatic fall in FDI is a critical political situation in the country. One prominent example here is the July 20 public uproar when the Russian MP visited the country and even sat in the parliament chairman’s chair. This caused one of the biggest protest movements in the modern history of the country.

The protests reached such scales that not only were the Russian MPs almost ousted from the country, but the government had to comply with the demands of the protestors: the parliament chairman Irakli Kobakhidze resigned and the promise was made for the proportional 2020 parliamentary elections.

This, in turn, severed the relations with Russia, who claimed to impose economic sanctions on Georgian exports of wine, Borjomi, etc. But, in a later statement, Putin disclaimed the sanction proposals.

Nevertheless, the severed political situation in the country resulted in a greater distrust in its economy from the part of foreign investors. From the Economics point of view, this is a logical outcome because no investor wants to spend their money in a country with such instability and foreign threats from one of the greatest military powers in the world.

Another major event in the country’s political arena was related to the biggest bank in Georgia – TBC bank. Its founders – Mamuka Khazaradze and Badri Japaridze – were accused by the general prosecutor’s office in money laundering almost 11 years ago. Many political experts and foreign governments, including the US Embassy in Tbilisi, have openly criticized the prosecutor’s decision and called it ‘politically motivated’.

This and other political and economic events in 2019 have ultimately affected the Lari stability in a major way. And even though, the National Bank of Georgia made some efforts to combat the spiking rates with a hike in refinancing rates, the currency still goes down with incredible speeds.

Main political events of 2014-2019

As we mentioned above, the main indicator that greatly affected the Lari inflation rate was foreign direct investment. Over the previous years, starting from 2014, the FDI has been steadily decreasing. The only exception here is 2017 when the FDI reached $1.96 billion, largest in recent years. Apart from that, the indicator is slowly going back towards the 2013’s $1 billion.

The 2014-2019 period started with the full concentration of the Georgian Dream coalition in the ruling elite. In the 2013 presidential elections, Mikheil Saakashvili was replaced by Giorgi Margvelashvili as president of Georgia. One would say, and rightly so, that yet another centralized governance was on the way.

After all the branches of government were seized, the ruling party started the so-called ‘political prosecution’ of the opposition leaders. In 2014, the leader of the United National Movement (UNM), Georgia’s main opposition party, Gigi Ugulava was detained on the charges of money laundering. The same year, Mikheil Saakashvili was charged in absentia with the organized assault on one of his main political opponents back in 2005.

The next year is a hallmark in terms of political relations with Russia. In 2015, the Russian military forces in ‘South Ossetia’ started moving the so-called state border 1.5km inside Georgian territory. Since then, the border has been slowly creeping in, endangering the main road connecting east and west parts of the country. By the year 2019, you can clearly see the border from that exact road.

In 2016, the Georgian Dream coalition repeatedly wins the parliamentary elections and maintains the centralized branches of governance in tight control.

Another social event taking the main stage of the country was the protest movements related to the night club raids by the government forces.

These protests resulted in a political crisis which, in addition to the other political events mentioned above, greatly affected the economic indicators, among which Lari is the most prominent one.

Main economic developments in 2014-2019

As we’ve discussed above, the economic conditions over the last 5 years have slowly started to worsen. The GDP real growth never really reached a 5% mark, which is a miserable indicator for a country with a total GDP of just $15 billion.

The foreign direct investments have also gotten worse, as you already know. The main political events that we listed above have reduced the trust the foreign investors had in the Georgian economy, while the acute political threats from the northern neighbor intensified this distrust even further.

However, there were some positive developments in the economy over these years as well. In June 2014, Georgia signed the Association Agreement with the EU. This, coupled with closing the Visa-Free Travel agreement with the EU in 2017, are probably the brightest point in the economic sector of Georgia.

Apart from that, we cannot really find any promising developments or indicators that could’ve positively affected the Lari condition.

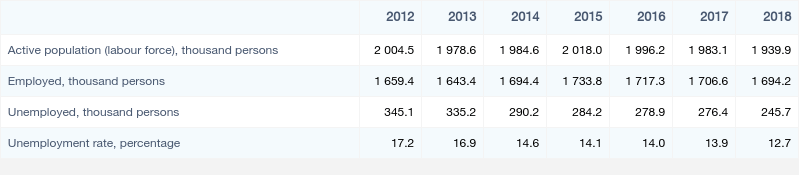

Even though the unemployment rates have slowly reduced from 2014’s 14.6% to 2018’s 12.7%, we have to account for the fact that the migration from the country has also increased and the population growth has also slowed down, sometimes even went to a reverse direction.

Main economic sectors

Now, let’s review some of the major economic sectors individually.

Let’s start with agriculture. The Georgian Dream coalition has been focusing on this sector by introducing subsidies, tariffs on foreign agricultural products, etc. Overall, the government has been spending around $1 billion annually but the outcome has not been what was expected. The percentage of agricultural production in GDP has reduced from 9.3% in 2014 to 7.7% in 2018, while, by the claims of the ruling party, it should have increased dramatically.

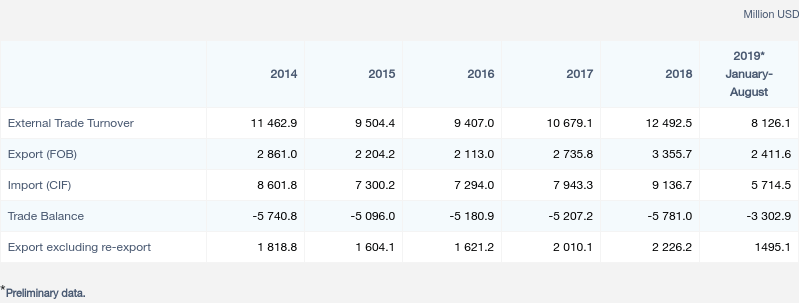

The trade has also been more or less dull. In 2014, external trade turnover was almost $11.5 billion. In the following years, it has decreased and hit its minimum in 2016 at $9.4 billion, while in 2018 the indicator saw some improvement with $12.5 billion in total trade. But, considering there’s only a billion-dollar difference in 5 years, there’s not much to be positive about.

As we’ve already mentioned, the unemployment rate has somewhat reduced down to 12.7%. As for the average salary, the monthly income for the labor sector increased from 2014’s 818 lari to 2018’s 1,068 lari. But with the 52% inflation rate from 2014 to 2018, there’s actually a decrease in the real salaries.

As for the construction sector, the turnout has increased from 4 billion lari in 2014 to 7.2 billion lari in 2018. Again, the high inflation rate majorly dwarfs this increase.

As we can see, the main sectors have more or less grown on the paper, but when compared to the inflation rate and the slow population growth, they actually mean the economic downturn.

Where are we right now?

Georgian economy has been in a dull development for the previous 5 years, to say the least. The slow GDP growth, reduced foreign direct investments, reduced outputs in various sectors of the economy, and finally, the increased political tension internally, as well as externally, have majorly contributed to the dramatic depreciation of Lari.

From 2014 to 2019, the USD/GEL exchange rate has reduced by almost 65% with an annual average drop of 6.6%. The reduced purchasing power of the currency has affected the everyday lives of millions of Georgians, as well as the external debt of the country as a whole.

One of the main reasons why Lari has dropped so dramatically is the reduced foreign direct investments. From 2014 to 2018, the FDI has decreased by over 30%, which has caused the foreign currency reserves to shrink at a rapid rate. With the stable, and even increased demand on the US dollar and its low volumes, Lari has started to depreciate and reach its lowest point so far.

What’s about to happen?

One of the main ways this situation can be amended is by increasing foreign direct investments. The FDI, in turn, depends on the political and economic situation of the country.

In terms of politics, Russia will always be there to hinder the political development of the country and stop it from integrating with the Western structures – at least in a foreseeable future.

There are high hopes with the 2020 parliamentary elections which will be held in October. The reason behind this is that for the first time in many years, the elections will be held with a proportional threshold and the majoritarian system will be removed. This will ensure that the diversity will be at its fullest in the parliament.

If the elections are held properly and without major complaints against the government, the foreign curators may revive their trust in Georgia. This will improve the political stability and enforce the democratic outlook of the country, which then will positively affect the fate of the FDIs.

In terms of the economic factors, one decision has to be made in the top ranks of the government: the economy has to be ‘cleaned’ with excessive regulations and norms that hinder not only small businesses but the big ones and the foreign investors as well from putting their money in Georgian industries. The regulations such as taxis only being white, or taxing the big businesses further, or even oppressing the major players like TBC bank, will undoubtedly slow down the economic growth and cause foreign investors to lose their faith in the country.

As for the future currency rates for USD, EUR, RUB, XAU, and many more, one thing is for certain: it’s going to take a lot of work to increase foreign currency reserves and bring the past exchange rates back. For the immediate future, as the winter is approaching, we have to expect the rise in exchange rates and the further depreciation of Lari.

As we’ve witnessed the current trends with the USD/GEL, as well as other currency pairs’ exchange rates, the increased prices in winter don’t always return to their normal level in the next seasons. That’s why we predict that the next year, USD/GEL might go well over 3.0 and hit 3.5 marks. Many other Forex analysts also predict the same depreciation and suggest their customers invest in this pair, as it will harvest good profits in the near future.

The same goes for other currency pairs. For example, the EUR/GEL exchange rate is currently at 3.26, but the analysts predict that it might go as high as 4.2 in a period of one year. As for the RUB/GEL, from the current rate of 0.046, it might increase to 0.58 next year.

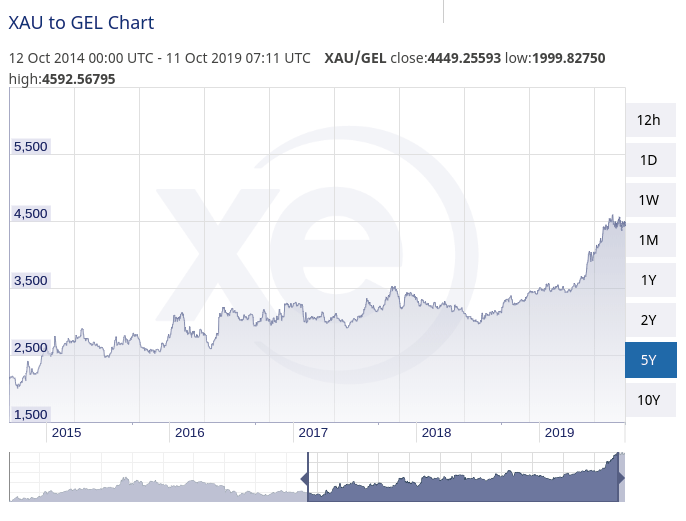

Even the XAU/GEL exchange rates have drastically increased in the recent year, compared to a more streamlined, or rather stable growth over the recent 5-year period. As for today, one ounce of gold costs 4449 Lari and with the future looking more or less dim, we might see it go as high as 5500 Lari per ounce.

Overall, we, as well as many creditworthy UK Forex brokers, are not very optimistic about the immediate future of Lari. Only time will tell if there’s any possible remedy to this crisis.

Comments (0 comment(s))