The results of the last 30 days: the world at the brink of a depression

Let’s go back to February 17, 2020. The novel coronavirus outbreak in Wuhan, China, does not seem to bother the rest of the world much. At that moment, fewer than 1,000 people were infected outside of the country. So why bother, right? Plus, everything seemed to be normal and the Dow Jones Industrial Average was standing just shy of 30,000 points, driven by the longest US economic expansion in history.

But what people, and mainly investors, did not know is that over the span of just 30 days, the virus will burst out of quarantine in China and cause major outbreaks in South Korea and Italy, then Spain, France, Germany, the United Kingdom and the United States.

It is no doubt that in just about two months, the coronavirus stopped businesses all over the world, sent stock markets into a meltdown and forced central banks to take emergency actions that were no taken ever since the 2008 global financial crisis.

It is fascinating that back in summer 2008, a psychic who claimed she started receiving premonitions at age 5 predicted:

“In around 2020, a severe pneumonia-like illness will spread throughout the globe, attacking the lungs and the bronchial tubes and resisting all known treatments. Almost more baffling than the illness itself will be the fact that it will suddenly vanish as quickly as it arrived, attack again ten years later, and then disappear completely.”

The predictions faded and the book of this psychic, Sylvia Browne, was left without any attention after the author’s death in 2013. But now, of course, after the outbreak of this virus, the book caught an eye of curious ones who try to understand how the virus can evolve in the future and what effects it will have on the economy and humanity in general.

Now, going back to reality – a global recession. Something our generation was not even thinking to be possible is a foregone conclusion now. Moreover, many experts and convinced that this is not over and the outbreak will drag the economy into a depression.

Central banks and governments are trying their best to keep economies floating and cutting interest rates, providing loan guarantees and new spending, tapping emergency powers to reassure investors, preserving the foundations of a functioning economy for the future.

The Trump administration in the United States has already required Congress to approve a rescue bill that would inject $1 trillion into the economy. By doing that, they hope to prevent mass layoffs as the airlines, hotels and restaurants run out of cash. Meanwhile, in the United Kingdom, the government guaranteed to pay 80% of the wages of anyone at risk of losing their job because of the pandemic.

But many believe that it is too late.

According to Goldman Sachs, 2.25 million Americans filed for unemployment benefits this week. This is the greatest number in history. What is more, the number of coronavirus cases around the globe keeps rising and now there are already 270,000 people infected and more than 11,000 people killed. Many countries, including Spain, Italy, France and the United Kingdom are under partial or complete lockdowns.

Only in California, there are 40 million people who were directed to sit at home. David Kostin, a chief US equity strategist at Goldman Sachs, said this week:

“The coronavirus has created unprecedented financial and societal disruption.”

Most affected by the outbreak are businesses and individuals operating in transport, the energy industry and hospitality. Moody’s Investor Services commented:

“In the worst case, entire industries could be destroyed.”

While the pandemic is still far from being anywhere close to its ending, economic analysts are already trying to predict how it will change the world. The majority of them agree that we should expect a shift in supply chains and patterns of global trade. ‘The merits of capitalism, democratic systems of government and globalization are likely to come under intense scrutiny.’

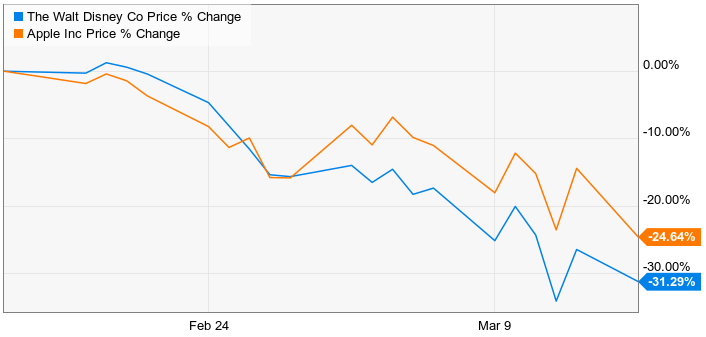

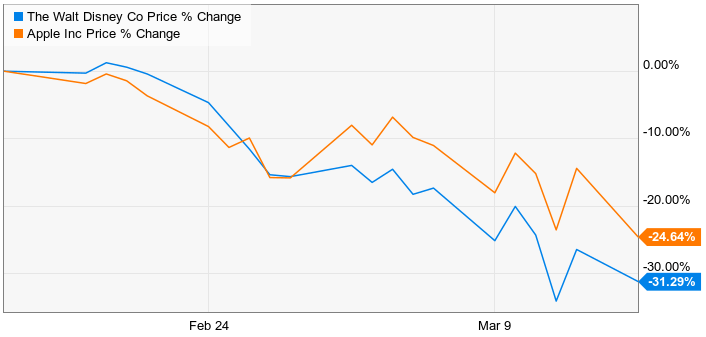

Apple knew it all

On February 17, 2020, the stock markets were closed as it was a big holiday in the United States. But Apple already sounded the alarm and warned that the company wouldn’t meet its revenue goals for the first three months of the year because the coronavirus had reduced iPhone manufacturing capacity in China. Moreover, with the Apple stores closed all over China, the company lost a big share of buyers. The next day, when US markets reopened, investors pushed the company’s stock down by 2.6%.

Even though this first hit to Apple stock was modest, Apple still projected that a coronavirus will become a huge burden on the big companies’ shoulders. Also, Apple explained first that the pandemic is affecting both supply and demand. That is the primary reason why this outbreak is much more damaging than many other “black swan” events.

The World Bank said in a report from 2013:

“A severe pandemic would resemble a global war in its sudden, profound, and widespread impact.”

As we see now, it is a complete truth.

After one month from Apple’s warning, thousands of companies were hit by the outbreak. Car manufacturers shuttered factories in Europe and then the United States. Airlines canceled international flights to China, and then just about everywhere else. In this light, CAPA Centre for Aviation is convinced that most carriers will be bankrupt by the end of May unless governments bail them out.

Eswar Prasad, a professor of trade policy at Cornell University, explained:

“The free flow of goods, capital, and people has generated enormous benefits but also created channels for rapid worldwide contagion from financial shocks, geopolitical conflicts, and epidemics.”

There are many opinions on what exactly countries should do in order to protect itself from being massively hit by the next pandemic (which, as many claims, is unavoidable). One of such is to start producing goods like medical supplies at home and prevent possible shortages. That would also ensure that the country is independent and does not fully rely on China, which would, in turn, mark a rollback of globalization exemplified by the trade war between the United States and China.

However, William Reinsch, a senior adviser at the Center for Strategic and International Studies, says it is impossible to undo the technological advances that have dramatically boosted global trade over the past 50 years.

“The larger question is whether those tools will be used in the same way and to the same degree as they have been…The coronavirus crisis has taught them that supply chains are a lot more fragile than they thought, that supplies can be suddenly interrupted for unexpected reasons, and that a prudent manager will not only have a Plan B, but a Plan C and Plan D as well.”

Since February 18, 2020, US stocks were showing a stunning freefall that wiped away roughly a third of their value. The Dow has fallen nearly 35% since Apple issued its coronavirus warning.

Markets all over Europe and Asia also experienced serious damage (and still are). Namely, Europe’s Stoxx 600 has lost roughly a third of its value since February 18. Hong Kong’s Hang Seng Index has dropped 18% over the same time period of time. And $27 trillion has been wiped off global stocks since the end of January, according to data released by Bank of America.

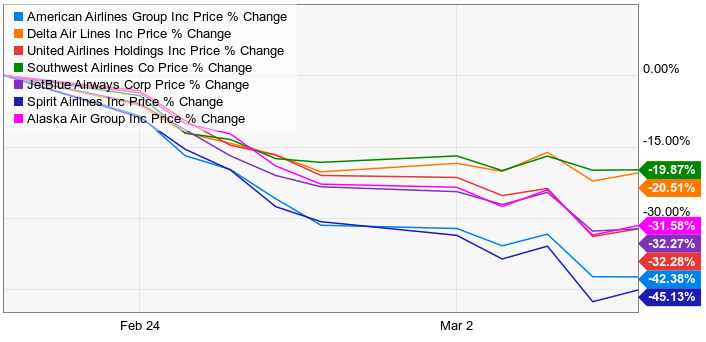

Companies that were the most exposed to the damage from the outbreak of COVID-19 have also shown a decrease in their stocks. United Airlines’ (UAL) shares are down roughly 70%. French carmaker Renault (RNLSY) has plummeted 62%. Moving forward, Marriott International’s (MAR) stock is down 50%. Of course, the list goes on and on and the numbers keep rising higher and becoming more frightening.

Neil Shearing, the chief economist at Capital Economics, believes that there is a certain limit to what banks can now do.

“History suggests that equity markets are only likely to bottom out when it becomes clear that the flow of new cases of the virus has peaked. Until this happens, we should expect stock markets to remain under pressure.”

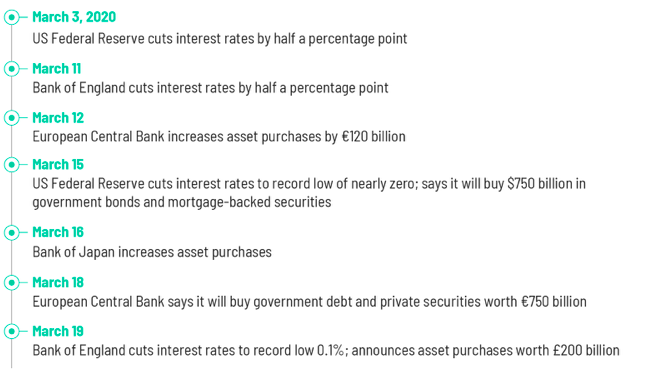

Central banks worldwide were trying to stabilize the situation by slashing interest rates to support growth and keep the economy from seizing up. On the meeting that took place on March 3 and March 15, the US Federal Reserve made a decision to cut interest rates to a record low. Also, it stimulated a $750 billion input into the economy to buy government bonds and other securities.

However, despite the Fed’s rescue efforts, the US stocks still fell this week. After Senate Democrats made a decision to block a coronavirus economic stimulus bill from advancing, the US stocks sank sharply this afternoon (23 March, 2020). The Dow, which was already moderately lower earlier in the day, fell 700 points, or 3.7%. The S&P 500 fell 3.6% and the Nasdaq was down 1.5%.

At the same time, the Bank of England also cut interest rates twice, on March 11 and March 19. In Europe and Japan, central banks have joined the Fed in announcing hundreds of billions of dollars worth of asset purchases. And that regardless of the fact that interest rates there have been in negative territory for a very long time. Measures and actions made by different central banks you can see on the photo below (source: CNN.com):

Governments made a promise to inject a huge amount of money into their economies to support them. It is now known that spending commitments from the United States, Europe, Japan, the United Kingdom and China add up to at least $1.7 trillion. Also, a much bigger sum of money was promised to be given out in the form of credit guarantees.

Morgan Stanley chief economist Chetan Ahya told:

“While the initial response from developed economies was slow, over the last few days — as economic and financial market disruptions persist — we have started to see strong commitments from policy makers, indicating a sizable fiscal expansion plan is in the offing.”

Predictions: what happens next?

Goldman Sachs warned that it is likely that US GDP will plummet at an annual rate of 24% during the second quarter. And the unemployment rate will reach 9% later this year. It is expected that later of there might be a “sudden surge in layoffs and a collapse in spending, both historic in size and speed.”

The detail that needs an additional mention here is that the economic collapse predicted by Goldman will be by far more serious than the sharpest contraction during the Great Recession when GDP dropped by a rate of 8.4%. The future recession is also expected to surpass the previous post-World-War-II record of 10% set in early 1958.

The picture is quite depressive and not only in the United States but everywhere around the world. Regardless of the economic structure and the presence of the manufacturing industry in the country. According to Deutsche Bank, if the situation won’t change for good drastically in the United Kingdom any time soon, we can expect the economy of the country to shrink 6% this year. That, in turn, will put it into the worst recession in a century.

Drawing a bottom line here, the majority of experts agree that this coronavirus outbreak is very likely to spark a repeat of the Great Depression that began in 1929 and lasted for years.

Kevin Hassett, one of the economists that claim so, commented:

“We’re going to have to either have a Great Depression, or figure out a way to send people back to work even though that’s risky. Because at some point, we can’t not have an economy, right?”

All in all, the only thing we might recommend here is to try and take action together – try to flatten the curve. Even though this already became a mantra we keep hearing from politicians, doctors, nurses and members of the public. But the reality is that this is the only thing that might move us closer to the end of the pandemic. This can be done through social distancing which is imposed pretty much everywhere around the globe trough massive public lockdowns.

Prof Jodie McVernon, a director of Doherty Epidemiology, says:

“To deal with that, whole of society behaviour change is needed to reduce the spread of infection. That’s what the social distancing recommendations are about. We need to be realistic that whatever changes are in place are likely to be needed for at least six months, so they have to be sustainable.”

Comments (0 comment(s))